Crash Course on QoE

June 30, 2024

by a professional in Janesville, WI, USA

I get on calls with business buyers all the time who have heard of a quality of earnings analysis but don't fully understand it.

Here is a crash course on what actually goes into a QoE. ⏬⏬⏬

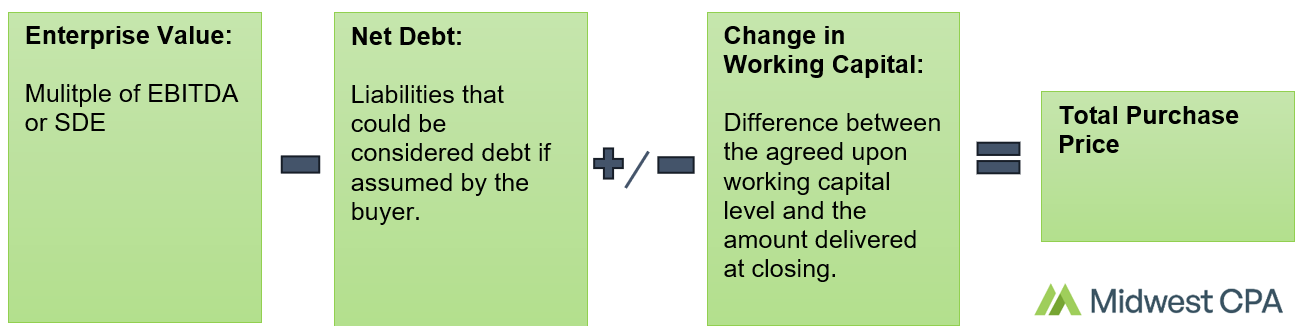

➡Impact on Purchase Price: The reason a buyer has a QoE done in the first place is because the results directly impact purchase price.

A QoE will address each of the above items which helps the buyer determine if the amount they are paying for the business is reasonable.

Let's take them one by one.

➡What is EBITDA? The most talked about aspect of a QoE is the normalization of EBITDA (or other similar measure like SDE).

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization.

The problem with EBITDA is that the way it is calculated and what it means is different depending on your audience.

In a QoE the goal is to get to EBITDA that most accurately represents the economic picture of a company that can be used to model future performance.

There inherently is going to be a business focus to the analysis that goes beyond the rigidity of GAAP and therefore EBITDA on a GAAP basis will not equal the Economic EBITDA calculated in the QoE.

This is a common misconception for people who confuse a QoE with an audit. They are very different things.

➡Adjusting EBITDA The first step here is to reconcile the reported EBITDA to a reliable source of information.

In larger deals this is typically audited financial statements while in smaller deals it is often the tax returns as audited financials don't usually exist.

The second step is to analyze the seller's proposed adjustments to EBITDA for reasonableness.

The final step is to identify further adjustments that could effect company value.

These adjustments can be broken down into 3 major categories.

- Non-recurring transactions

- Corrections of errors/timing

- Pro-forma

*Comment below if you'd like be to do a breakdown on each of these categories with real examples.

➡Net Debt: Net debt is the calculation of items that are "debt-like" while not actually meeting the standard definition of debt.

These debt-like items will lead to non-operating cash outflows that will be the buyer's responsibility post-closing.

There are a variety of items that could fall into this category and I've listed a few below as examples.

- Transaction related costs like deal bonuses for employees

- Deferred capex

- Prepayment penalties

- Deferred revenue

- Litigation claims

➡Net working capital analysis: If a buyer closes on a business with a less than normal level of working capital, additional cash may be required in order to finance operations.

A QoE will help a buyer do 3 things.

- Establish a working capital "peg" for use in the purchase agreement

- Understand the temporary financing needs of the business.

- Understand when the revolving line of credit may need to be drawn on.

This is done by analyzing:

- Historic working capital swings and seasonality

- Identifying periods of time where working capital demands are higher

- Remove non-working capital items from current assets and liabilities

- Make adjustments where needed when adjustments are made to EBITDA

- Calculate and analyze the cash conversion cycle

One final note on NWC...

If your seller and their counsel does not understand working capital (like is common in smaller deals)... you'll save yourself many headaches by including no WC in the deal, adjusting purchase price accordingly and borrowing what you need.

If you found this useful I'd appreciate it if you'd share it with others!

from New York University in Newport Beach, CA, USA

from Texas A&M University in Dallas, TX, USA