Thought piece: Proprietary sourcing methods that delivered 2 acquisitions

August 29, 2024

by a searcher from University College London, University of London in London, UK

The LOI for my first acquisition got signed within 4 months of Day 0 of my (self-funded) search, at 2.7x EBITDA, from proprietary deal flow. Completion happened 3 months later. The same sourcing methods produced my 2nd acquisition 12 months later. This is a long-form post to share with the community details of those sourcing methods :)

Proprietary vs Intermediaries

According to Search Investment Group, 25% of closed Search deals in 2023 were proprietary, vs 54% through an intermediary. My (perhaps subjective) view is that if over 2x of deals happen through an intermediary, it’s because it’s easier, not necessarily because it’s better.

Proprietary sourcing can seem like quite a pain given the upfront time and money cost and lack of certainty that any of the businesses approached are actually for sale. Especially versus what feels like something of a window-shopping experience when you browse eg BizBuySell listings. But over the acquisition cycle, my experience has been that proprietary deal sourcing can bring better value in terms of both minimizing the time it takes to close a deal and securing the best terms. Why?

Because with proprietary sourcing, you have a chance to catch owners just at the right time in their thought process. The best prospects have been thinking about selling up or retiring for a while but have not gone to market. Your outreach to them becomes the tipping point that makes them finally take action - and you have the opportunity to have an exclusive dialogue with them. In turn this gives you (some) control over the timeline and deal terms.

When an owner has already put their business for sale with a broker on the other hand, they're already getting offers from other parties, there's competitive tension, and in many cases the brokers have already anchored their valuation expectations by putting a lofty figure in the owner’s mind (typically as part of their own sales process to the owner). Although you’ll get to see CIMs quickly - and the best brokers / corporate finance firms can facilitate deals that work for both sides - my view is that overall these factors reduce the chances of securing a deal on attractive terms.

To fully cover a sector, it’s advisable to explore intermediaries too. But putting the right effort into proprietary sourcing can yield very favourable long term results.

Cold outreach funnel stats: 1,000 contacts to 1 acquisition (but could have been 4/5).

- Initial list: 1,294 targets (see below for how I built this list)

- All replies: ###-###-#### %)

- Want to know more and held discussion: ###-###-#### %)

- Fit acquisition criteria: ###-###-#### %)

- Realistic valuation / deal terms expectations: 5 (0.4%)

- Signed LOI: 1

- Completed: 1

So there were 5 companies in total with whom I could potentially have signed an LOI, but I chose (rightly or wrongly) to focus just on 1. I maybe got lucky as it did go through to completion on deal terms that I found attractive (10% consideration on Day 1, 2-year deferral on the remainder, 2.7x EBITDA).

Total time from Day 0 to completion: c. 7 months. This included building my overall acquisition thesis, figuring out the sector, constructing presence & collateral, building a deal team, and then outreach / discussions.

The key to proprietary sourcing: building high-quality contact lists.

Maximising quantity x quality of lists = maximising dealflow. I do this in three ways:

1. Paid Lists.

Not all paid list providers are born equal. I had to try a few and got lumbered with data that was both out-of-date (wrong contact details) and/or irrelevant (companies only loosely related to the sector specified). But once you've got a reliable source, paid lists become a very quick, powerful way to build outreach contact lists. A good paid list should include:

Precise sector definitions (beyond the limitations of SIC codes),

Company name, # employees, revenue bracket

Owner name, address, email, date of birth and (sometimes if you’re lucky) Linkedin url

They won’t cover every single company in your sector. But it’s a great way to get discussions going rapidly. I’ve also found them very useful at sector research stage, as you can get a basic sector structure for a fraction of the cost of more formal market research, ie number of companies broken down by # employee bracket or revenue bracket.

2. Official Companies Register (Companies House in UK, state-level databases in US).

Now you’re really covering every corner of your chosen sector(s). First for UK: Companies House provides an API that lets you segment and download their database of companies in CSV format, by SIC code. In the US it’s a bit more tricky but doable. By registering for the relevant Secretary of State databases, or paying for an online service that has access to these databases, you can access extensive lists.

There is still some work to be done once you get these lists though. You’ll need to feed that data into a contact-fetching service such as RocketReach to get owner email addresses and Linkedin profiles and/or do some manual research. UK Companies House provides correspondence addresses for the owners.

It's difficult to filter by revenue bracket as below a (fairly high) threshold this is not disclosed. I got round that by blasting outreach to everyone on these lists, but including in the correspondence “We are looking for businesses making over x in revenues”.

3. Scraping Google Search Results

For very specific targets (eg a sub-sub-sector that is very relevant to you), to which you can send (semi)-customised outreach, Google search is a good shout. I had a custom script written to enter the first X results for a particular search phrase automatically into a Google Sheet. But it can be done manually by a reliable VA too.

4. Bonus - Other scraping tools

There are tailor-made scraping tools built to scrape local listing sites like Yelp, Kompass, Yell.co.uk etc. I’ve used them less recently. But again if you find you’re drying up, or see a classification on one of those sites that seems very relevant to you, it’s a possible avenue. To find the relevant tools, Google ‘[local listings platform name] scraper’ (they seem to be often changing). Else Octoparse is quite a customisable one that you can use for any website, if you find you’re doing a lot of scraping on various sites.

Overall I have found that 1. Paid lists and 2. Company registers have been the most effective in terms of cost / effort / reward. In terms of outreach methods, I used the following.

Multi-prongued Outreach is the way to go

1. Start with postal mail.

Good old snail mail has value in this game. People don't receive letters, unless it’s bad news, or something from the taxman (sometimes both!). So people get all curious and excited when they receive a personal-looking letter. And perhaps nostalgic if they happen to be a baby boomer business owner. Which in turn means this channel is increasingly likely to cut through much of the noise and all-to-short attention span associated with digital communication methods. I have had various owners tell me my letter has been sitting on their desk for X amount of time and that looking at it has finally prompted them to pick up the phone and call me.

Btw I haven’t tried branded goodies yet (eg a nice-ish pen) - has anyone?

The letter and envelope themselves need to look as personal and non-bulk as possible. No franking if possible. A wet-ink signature goes a long way. As does a customised line about why you like their business. The rest of the letter can be the same for all recipients (or recipients within a certain segmentation you have set), except of course name, company name etc. I’ve used Google docs (for almost everything actually) + a good mail-merge add-on to produce the letters to go to print in an efficient way. There are mailing houses to whom you can send your consolidated Google Doc who then take care of part or all of the physical stuffing and sending process.

2. Email

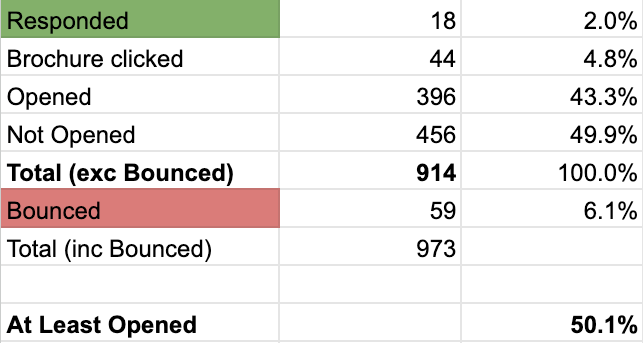

The above notwithstanding, you should still definitely follow up with an email maybe a week or so after the physical letter has landed. I’m seeing email reply rates of anything from 2-4% currently. Again this maximises the chance that the owner actually sees your communication to them.

My second acquisition came about as a result of an email blast. You don’t want to overdo it. But an email blast every couple of months or so (hopefully with some new stuff to mention), perhaps with a follow-up, to a target list you maintain I feel is a key part of your deal sourcing strategy. Especially if you are doing a roll-up.

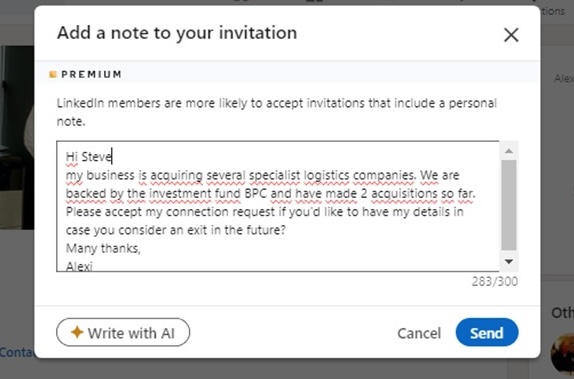

3. LinkedIn

Sending Linkedin invites from a high quality profile with a semi-customised message has also generated a steady stream of leads. If you pay $50/month for a premium account you can send a large number of daily connection requests with a 300 character limit on the personalised message. About 1 in 4/5 are accepting my connection requests currently, after which I’m following up with more detailed information like a digital brochure. One discussion with a $1.5m EBITDA business which is fairly close to LOI at the moment came about from a Linkedin outreach.

I haven’t tried Sales Navigator-generated InMails yet but plan to give this a shot soon to see any improvement in reply rates.

What’s the cost of all this?

It depends on your Search plans, where you’re based, what you’re looking at etc. I’ve found that the main cost items were the paid lists, postage, and obviously your time in doing all this. Minor costs include subscriptions to the various online services like LinkedIn, RocketReach, and the mail merge programs etc.

Wrapping up

I don’t feel it’s either Proprietary OR Intermediaries. Proprietary takes longer to get the first discussion and requires more upfront cost and time. And some deals will only be available through intermediaries. But to date I feel I’ve had more joy with proprietary dealflow - in terms of overall cycle time in closing deals, closing deals at all, and the seller’s financial expectations for a deal.

Hopefully some of this is of help to those of us in the search phase. I’d love to hear other searchers’ experiences and hacks with proprietary deal flow. And I’m always happy to share my experiences - feel free to reach out.

from Arizona State University in Salt Lake City, UT, USA

from Duke University in New York, NY, USA