The Genius of Search Funds

April 09, 2018

by an investor from Stanford University - Graduate School of Business in Seattle, Washington, USA

Two young Stanford GSB alumni raised $6 million to buy a small business called Roadside Rescue, with backing from professors at Stanford and a small group of investors who specialized in what are called search funds.

Three years after buying the business, they realized that their roadside assistance product was essentially an insurance contract and decided to expand into cellphone warranties. That insight — and the growth of the cellphone warranty business — would turn this small deal into a massive moneymaker for search fund investors. In 2015, Asurion earned around $6 billion in revenue, and the investors in the original deal have made well over 100x their money.Asurion is the shining star, but the broader reference class of search funds has performed extraordinarily well. A 2016 Stanford GSB study found that the asset class had achieved a pre-tax internal rate of return of 36.7% and an aggregate pre-tax multiple of 8.4x. In this note, we’ll tell you what’s driving the exceptional returns of this niche investment strategy, and the lessons we’ve learned from studying the asset class.

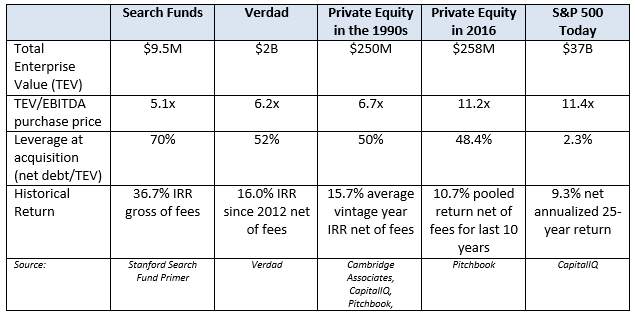

Search funds are dedicated pools of capital raised to support the efforts of an entrepreneur (typically a recent business school graduate) in acquiring a privately-held company. Essentially, these are micro private equity deals where the investor takes over as CEO. Given our quantitative bent, we wanted to start by providing a snapshot of how search fund investments compare with private equity investments, the broader public markets, and Verdad’s portfolio.

Figure 1: Quantitative Characteristics of Search Fund Investments in Context

When you stare at these numbers, we hope that you see the same pattern we do: the lower the purchase price and the higher the leverage levels, the better the returns. We think private equity worked so well in the 1980s and 1990s — and the reason search funds are working so well today —because of these quantitative differences.

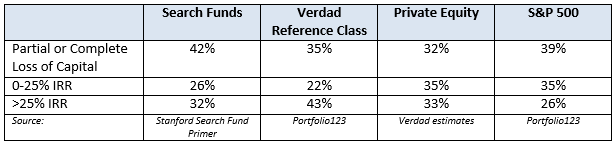

We also wanted to compare the distribution of outcomes, so you can see that what drives the differential returns is the steepness of the payout distribution.

Figure 2: Returns Distribution for Search Funds in Context

The difference in the return distributions is mostly that there are a higher percentage of big winners (>25% IRR investments). Investing is a hit driven industry, where stochastic positive outcomes drive the majority of excess returns. The 75th percentile of IRRs would be 35% for search funds, 38% for private equity, 50% for Verdad’s reference class, and only 26% for the S&P500.

Our reference class appears as such here primarily because we have devoted years of research to defining the exact quantitative parameters that are most likely to predict the optimal distribution of outcomes. To avoid loss of capital, we avidly track short interest, financial health metrics, and bond pricing. To maximize big winners, we are only investing in the cheapest quartile of the market and the most leveraged portion of that cheapest quartile. Our process is like Moneyball applied to private equity.

The search fund data is yet more evidence that buying cheap, highly leveraged investments creates a more skewed distribution of outcomes that creates the possibility for extremely positive outcomes. There’s a clear theme in what works in equity investing…

from University of West Florida in Pensacola, FL, USA

from Columbia University in Alberta, Canada