Searchfunder Analysis: Acquisitions by Graduate Business School

December 13, 2019

by an admin from Stanford University - Graduate School of Business in Honolulu, HI, USA

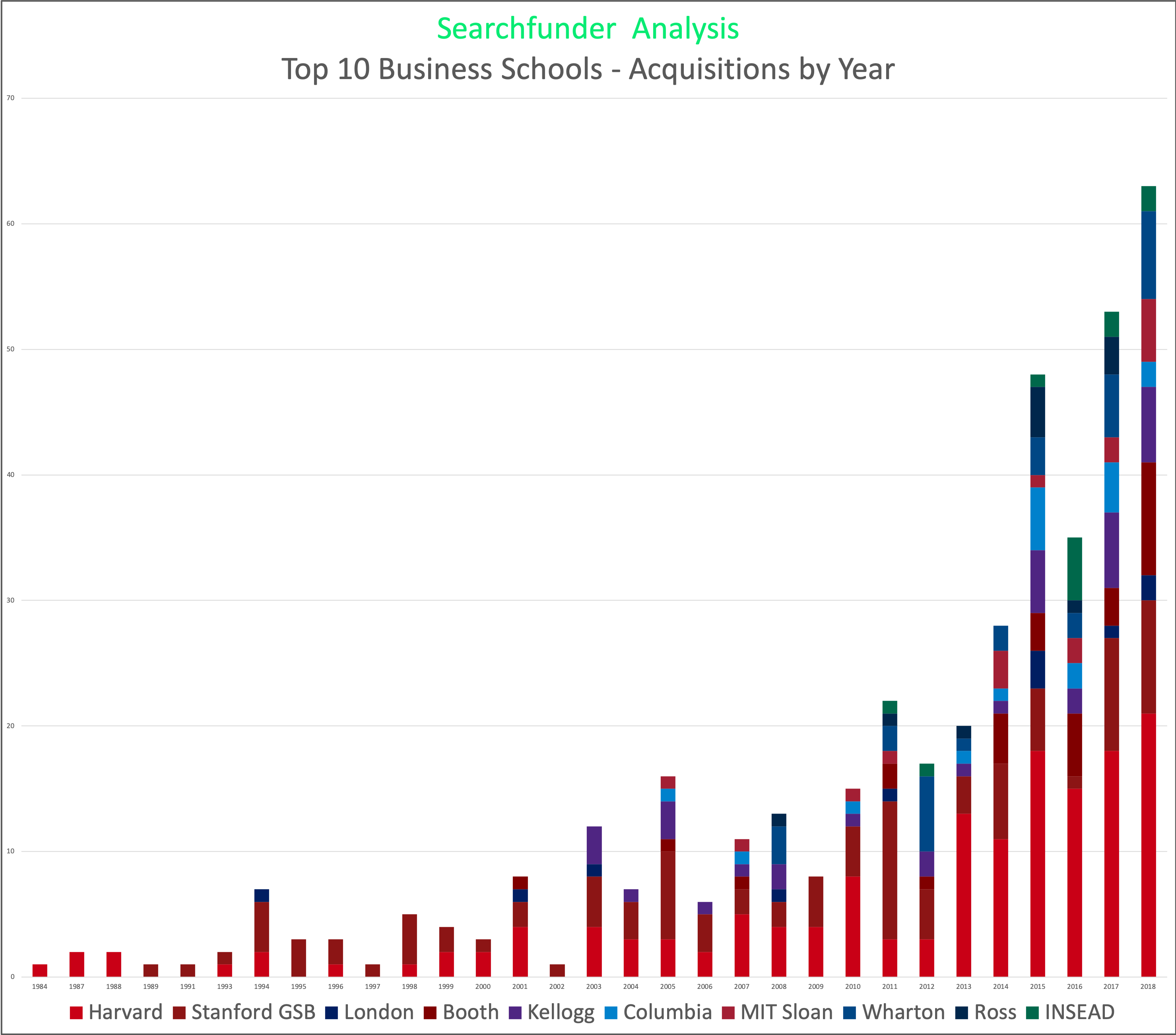

One of our community members asked about search fund acquisitions by graduate school. Given that IESE, Stanford, Kellogg, and Harvard business schools have held conferences on entrepreneurship through acquisition in recent months, we thought we'd take a gander at our crowdsourced data* to see what the answers might be.

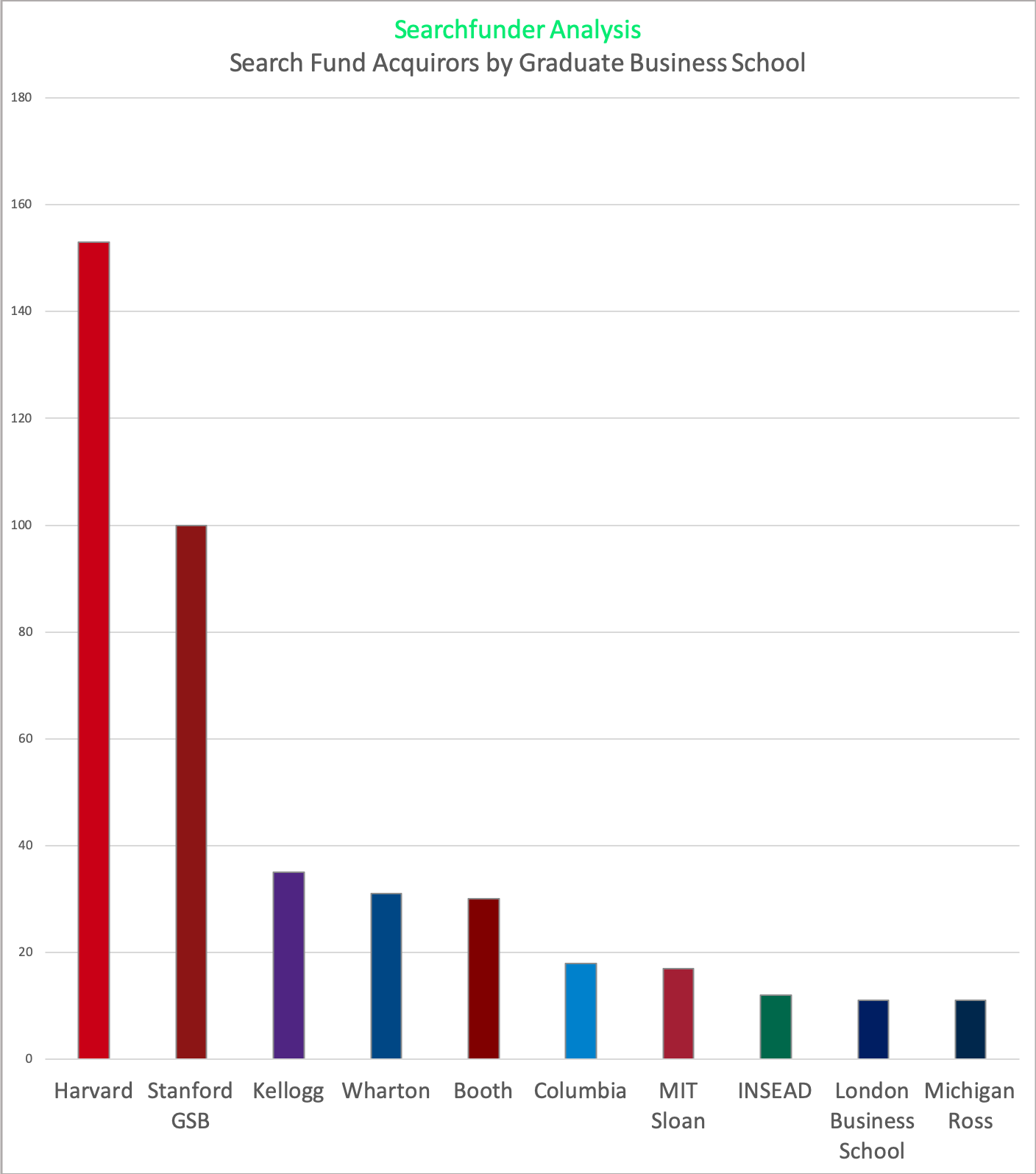

Harvard beats Stanford? We've identified over 350 schools at both the undergraduate and graduate school levels who can claim at least 1 acquiror as an alum. The above chart identifies the Top 10 graduate business schools by number of acquisitions. That means if you attended Yale undergrad and then attended Harvard Business school, HBS is listed on the above chart. Given that the search fund concept originated with Professor ^redacted at Stanford Graduate School of Business, we were surprised that Harvard leads in total number of successful search fund acquirors. If your school is under-represented on these charts, feel free to contact ^redacted to update the information.

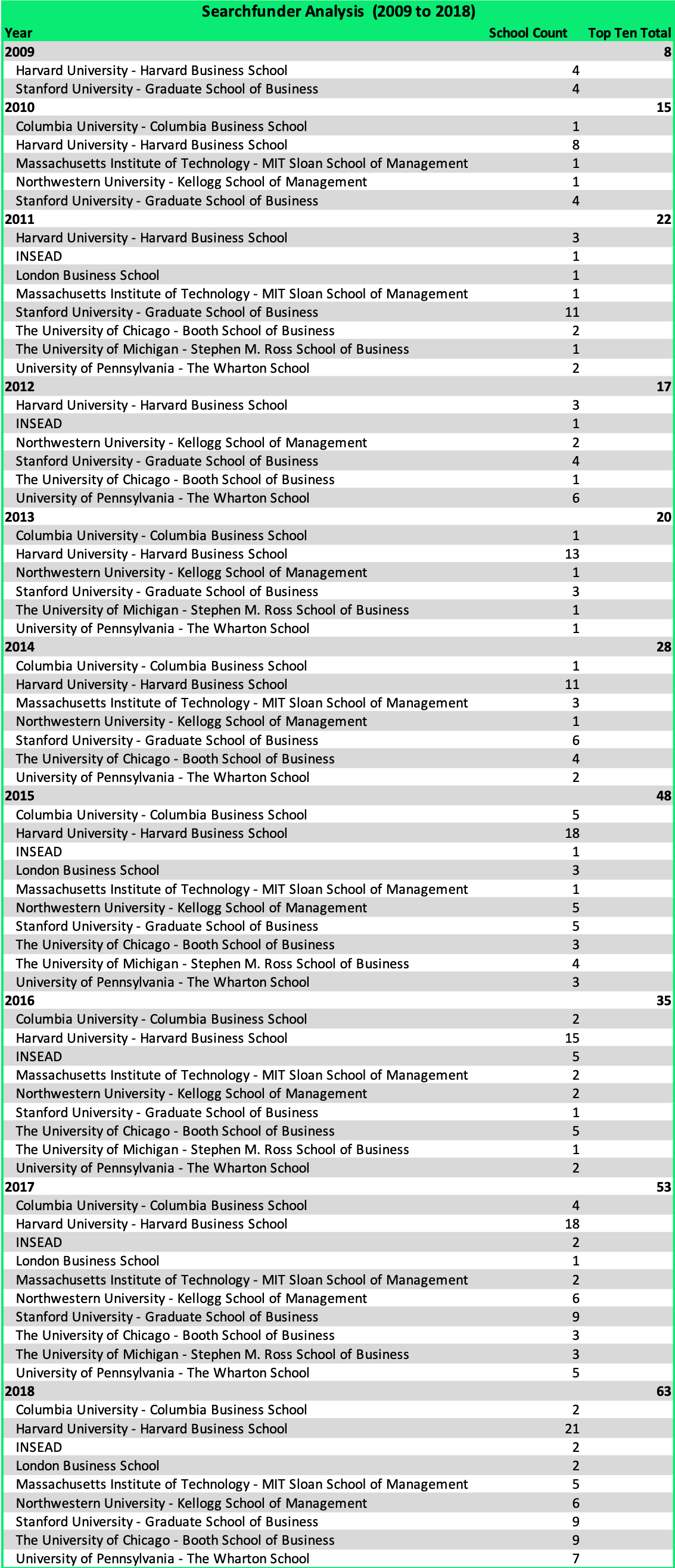

* Notes on the charts. The charts covers crowdsourced acquisitions for all types of search funds through 2018 as identified on Searchfunder.com on December 11, ###-###-#### We did not adjust for partnered searches. Thus, if 2 or more searchers purchased a company, their business school receives one credit. for each acquiror. This report has been updated to correct a compilation error.

We rely on word of mouth to spread the news about search funds. So, if you found this analysis interesting, tell your colleagues by clicking the share link.

If you have feedback or this analysis was helpful to you, please Comment and/or click the Like button below.

from Stanford University in 3899 Maple Ave, Dallas, TX 75219, USA

The GSB's "2018 Search Fund Study: Selected Observations" research actually lists the "record" number of "search fund entrepreneur" acquisitions at *17* companies in###-###-#### The chart above shows HBS alone had 18 out of 53 acquisitions. So the definition of ETA / Search-acquired business is much broader here through Searchfunder, as we know, than those who "raise a Search" and acquire a business with a broad set of investors / advisors. The number of deals getting done by folks out of HBS is impressive, but I'm curious how many of those would actually look like a "Search fund" as I might more narrowly define it versus the other forms of entrepreneurship through acquisition.

^redacted - thanks for compiling this info! Any breakdown of Search type -- "traditional" v. "self-funded" v. "single-investor / captive" Search models? Hope all are well - safe and healthy!

from Stanford University in Honolulu, HI, USA