I asked ChatGPT to help me analyze this real Hawaii-based solar installation business.

December 16, 2023

by a professional in Windermere, FL 34786, USA

I asked ChatGPT to help me analyze this real Hawaii-based solar installation business.

How do you think it did?

Spoiler alert: ChatGPT decides to make an offer below asking!

***

ChatGPT:

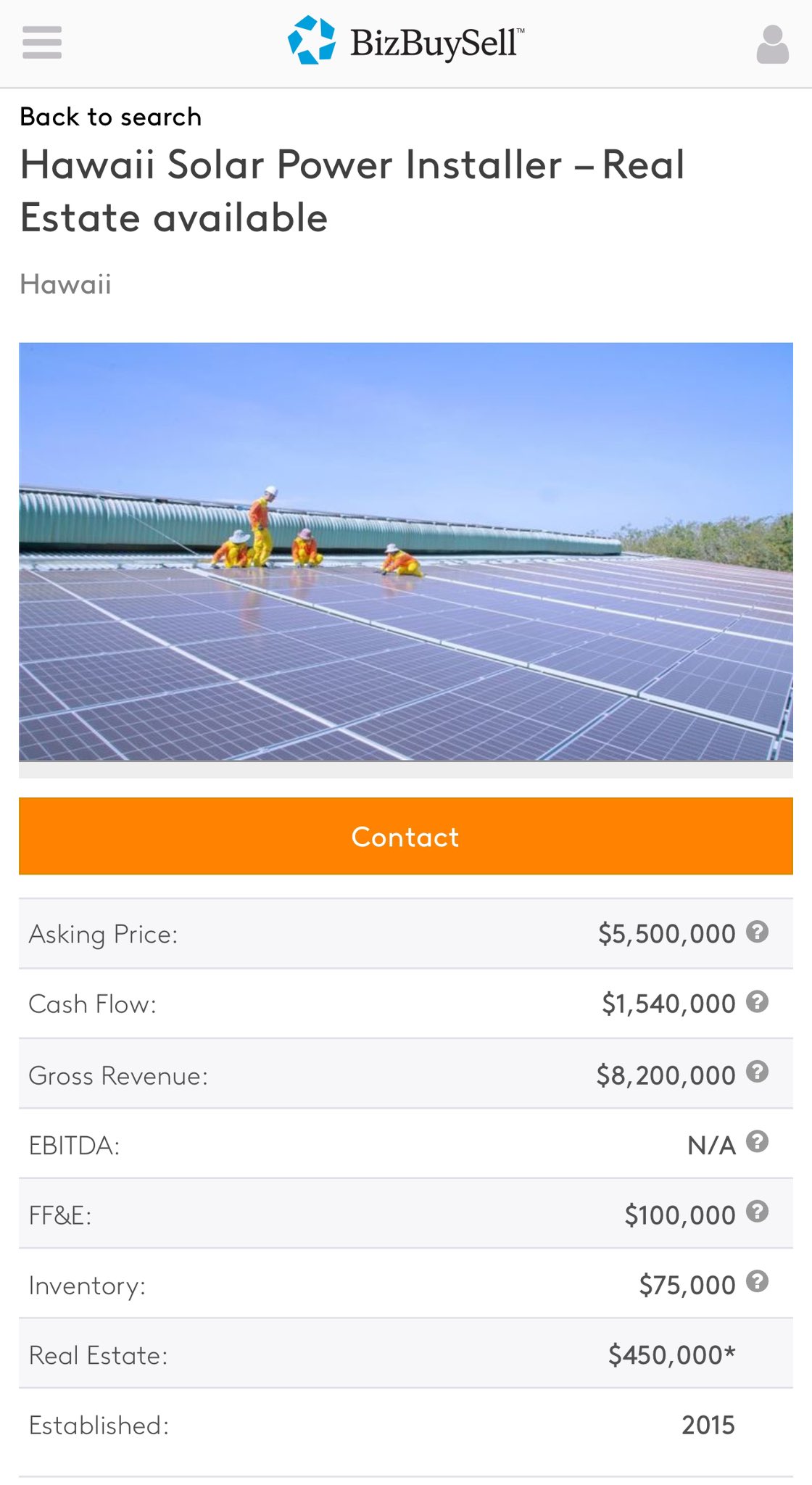

- Asking Price: $5,500,000 (excluding real estate).

- Revenue: $8,200,000.

- Cash Flow (Earnings): $1,540,000.

- Earnings Multiple: Approximately 3.57x.

- Notable Details: High growth industry, pre-qualified for SBA loan, expanding market in Hawaii, real estate available for additional $450,000, strong sales growth, and high owner profits. The business has a scalable model and a strong market presence with high-quality energy consulting and installation services.

Questions to ask on an initial discovery call:

1. Detailed Financials: Request comprehensive financial statements for the past few years to understand revenue, expenses, and profit trends.

2. Clientele and Contracts: Inquire about the current clientele base, long-term contracts, and the nature of ongoing projects.

3. Operational Processes: Ask about daily operations, the role of the current owner, staff structure, and any unique operational challenges.

4. Market Position and Competition: Seek information about their market position, competition, and how they differentiate themselves.

5. Regulatory Compliance: Understand any regulatory requirements specific to solar power installation in Hawaii.

6. Future Growth Plans: Discuss potential growth opportunities and expansion plans.

7. Real Estate Details: Clarify terms of the real estate purchase and lease agreement.

8. Reason for Selling: Understand why the owner is selling the business, which can provide insights into potential challenges.

9. Transition Support: Ask about the support offered during the transition period and any ongoing assistance post-sale.

If I were to structure an offer for the Hawaii Solar Power Installer business, based on the provided information, here's how I would approach it:

1. Would I Make an Offer?

Yes, considering the business's strong financials, growth potential, and the high demand for renewable energy in Hawaii.

2. Offer Structure:

- Offer Price: Given the asking price of $5.5 million and strong financials (cash flow of $1.54 million), an offer close to the asking price is reasonable. However, I would consider offering slightly less, around $5 million, to allow room for negotiation.

- Real Estate: I would include the real estate in the offer, valued at $450,000, given its strategic importance to the business. The total offer would thus be $5.45 million.

- Financing: I would aim to secure an SBA loan, leveraging the business's pre-qualification. A down payment of 10-20% ($545,000 to $1.09 million) would be typical for SBA loans. The rest would be financed through the loan.

- Earn out: I might propose an earnout arrangement to align part of the payment with the business's future performance, reducing initial outlay and sharing risk.

- Due Diligence Clause: The offer would be contingent upon a thorough due diligence process, confirming the financials, legal standing, and operational health of the business.

- Transition Assistance: I would request a transition period where the current owner assists with the handover to ensure continuity and stability.

- License Holding Agreement: If I don’t have the necessary licenses, I would include a clause for the current owner to remain as the license holder for a specified period.

Each component of this offer is crafted to balance risk, secure financing, and ensure a smooth transition. It's crucial to engage with financial advisors and legal experts to tailor the offer to the specifics of this business and personal financial considerations.

from Southwestern University in Houston, TX, USA

For instance, there is no such things as "SBA pre-qualified". Doesn't exist. At best, some SBA banker may have said that "from the information you've provided, this sounds like a deal that we'd pursue". But that banker is not the SBA and the SBA doesn't grade companies until they are submitted.

Similarly, whatever ends up on BizBuySell as "CashFlow" rarely resembles the accounting definition of cashflow in the company.

This would be really interesting to see if the actual information were entered, though!

from The University of Chicago in San Antonio, TX, USA