Not matter whether you come from a corporate, finance and real estate background, everyone learning about the self-funded search model eventually arrives at THE question: How in the world does the searcher get 80% of the company while putting almost no money in? You’ve checked the model. The calculations for the investor IRR and MOIC are correct, but the searcher getting 80% of the equity just feels intuitively wrong.

If you come from a corporate background, you might have seen a rockstar CEO get 5% options in a company. If you’re from a finance background, you know most PE funds and independent sponsors get 20% carry, maybe 30% if they hit a home run. If you are from a real estate background, you’re used to 20% promotes, a 40% promote for a home run and a 60% promote if you put your investors on the Forbes list. Now you’re telling me these unproven, first time CEOs get 80% equity? Not even options? This just can’t be right, can it? Let’s figure out how this makes sense.

FYI, if you enjoy this blog post you can subscribe to

Buy Small Sell High where I write about search and SMB operations. You also get a list of 5,000 business brokers to get you started.

The Risk-Return Curve

The capital structure of a business is effectively just the order in which different investors get paid. If you are first in line it’s pretty save. If you are last in line, it’s pretty risky. However, the risk doesn’t increase linearly, being second in line is almost as safe as being first, while being last is significantly more risky than being second to last.

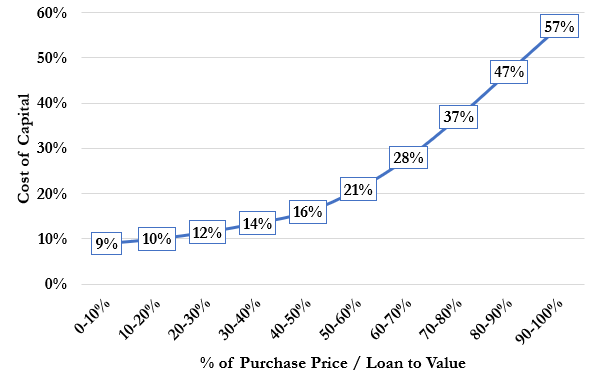

So let’s say you buy a business that generates a $1mm of after tax cash flow for $4mm (25% yield). If we split up the $4mm purchase price in ten tranches, the return expectations look something like this:

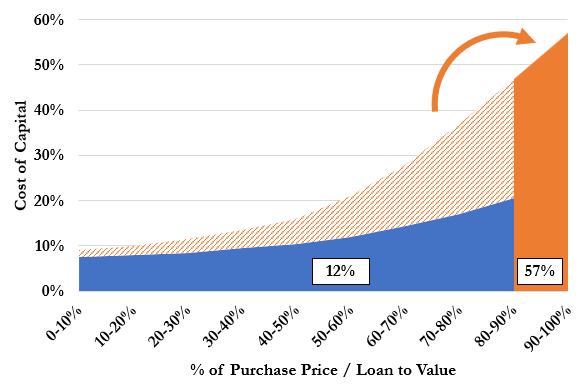

Most commercial lenders consider 50% loan to value a prudent advance rate. Above that the risk starts increasing faster. If we combine the first 50% of capital in the example above, we get a yield of 12%. This is a typical bank loan (provide $2mm of the $4mm needed for the transaction at 12% interest).

If we aggregate the second 50%, we get a return of 38%. That looks similar to the equity return profile. Higher risk, higher return.

So all we have done is to divide up the riskier and the less risky parts of a business that yields 25% total in to a safer tranche (the debt yielding 12%) and a riskier tranche (the equity yielding 38%).

However, we can split up the tranches however we want. The key takeaway here is that there is no such thing as debt and equity risk. It’s a continuous curve and you can decide what parts of the risk-return curve you want.

Here’s the same company with the debt financing 90% of the purchase price and the equity only putting in 10%. In this case, the debt is yielding 21% and the equity is yielding 57%.

So far, not much to see here. Basic finance 101. This is where the SBA loan comes in.

The SBA Cheat Code

The risk-return curve assumes that capital providers determine their required return based on the risk of their investment (what area of the curve they are investing in) – the higher the risk, the higher the cost of capital.

However, that’s not how SBA loans are priced, which creates an incredible opportunity for self-funded searchers. Because they are government guaranteed, SBA loans are priced at Prime + 225-275bps regardless of the loan to value. As a result, the interest rate is way too low relative to the risk and the additional return goes to the equity.

In our example, the underpriced SBA debt (12% interest for 90% of the purchase price) boosts the equity returns from 57% to 142%. In dollar terms, this means you are buying the business with $400k of equity and borrow the remaining $3.6mm at 12% interest. The business generates $1mm of cash flow, you pay $432k of interest which leaves $568k for the equity (142% of $400k).

Why do Self-Funded Searchers get those Extra Returns and not Investors?

This is what brings us back to how in the world self-funded searchers get 80% of the equity in their deals. As an investor, even if you only receive 20% of the equity returns while providing all of the $400k, you still receive a 28% cash on cash return (20% of 142%) without the business even growing, which is very attractive compared to most investment alternatives.

Once you add a little bit of growth for the business, you quickly get to the 30-35% equity investors returns you see in most presentations. That’s why over time, the 90% debt, 10% equity financing structure with a 2.0x step-up (20% of the equity returns going to investors) has become the standard. It produces investor returns similar to comparable investments (traditional search, venture capital, growth equity, etc.).

A logical next question at this point would be, if the deal level equity returns are 142%, why aren’t experienced investors buying those businesses themselves and just finding a decent operator to run them?

The answer is because they can’t. The SBA loan program is limited to $5mm per person. The only way to get access to more of the underpriced SBA debt is by investing in someone else that is taking out an SBA loan. Unfortunately, in order to take out an SBA loan, you have to sign a personal guarantee, which not many people are willing to do.

As a result, operators that are willing to sign the personal guarantee and take out the SBA loan have the negotiation power to claim most of the excess returns for themselves and only give investor economics that are similar to alternative investments. So that’s why self-funded searchers get 80% of the equity in their deal.

A few Caveats

Using 90% debt to buy a business is obviously a high risk - high reward play. Financial risk and business risk should balance each other. That’s why having predictable cash flow is key when taking on this much leverage.

While it might be tempting to take out less debt, it means as a searcher you have to give up significantly more equity. Keeping 80% of the equity only works for investors if the leverage is 90%, because all the returns get concentrated on such a small amount of capital (10% of the purchase price). 80% debt, you already have to give up 40% of the equity. At 70% debt, it’s 60% of the equity. This is most easily explained in the step-up concept.

This model isn’t unique or crafty. There are several markets with government backed loans that create artificially cheap capital. Mortgages are the largest market and the one where it’s most easily observed. The difference between mortgage rates for owner occupied vs investment properties shows how a government backstop artificially lowers the cost of capital for borrowers, creating opportunities (I.e. buy the house, live in it for a bit, then rent it out).

from Harvard University in New York, NY, USA

I think you need to check your math. You pay ~400k of interest but there's also principal payments I think you forgot. a$3.6mm SBA loan @ 12% over 10 years (usu. SBA term length) is roughly $620k in annual payments (P+I). That leaves you with 380k or about 95% ROE. Still great, but not that outsized 142%

in Rindge, NH 03461, USA