An Investment Thesis based on EBITDA is WRONG

January 22, 2024

by a searcher in Delaware, EE. UU.

Ebitda is a KPI for Banks. Not for us.

The “i” in “Ebitda” means, how much interest can i charge to the p&l? Because my principal is collateralized by the company's assets (and sometimes also with the personal guarantee of the owner) so…

I (the bank) will be the first to be paid after the company pays their essential obligations with 3 parties in order to maintain his business alive (and in consequence don´t lose the assets that are collateralizing (aka guaranteeing) debt).

IMO, when analyzing a company the main thing to to check is how much FREE CASH FLOW is the company accumulating on average and for how long it will be able to keep generating it…take a look:

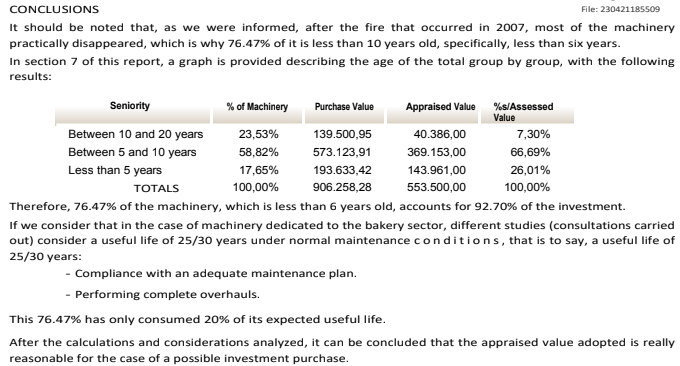

This is the conclusion of our last technical due diligence in www.bellamysignature.com for acquiring a manufacturing facility. Once I know how much I can squeeze my machinery (Property Plant and Equipment) and when (the speed) it will be required to be replaced I can make a projection about how much FREE CASH FLOW the CAPEX is going to EAT in the following years.

My point is that the financials can show good enough EBITDA for your investment thesis while being a shitty asset.

PS- If you want to take a look at the complete technical due diligence just answer this email. We are sharing it with all the members of the Self-Funded Room Community.

from SDA Bocconi in Ireland

from Massachusetts Institute of Technology in Boston, MA, USA

In a business with significant capital expense, cash for these expenses needs to come from somewhere.