Yes, I calculated by hand the analytical upper limit for company value.

February 18, 2021

by a searcher from Helsinki University of Technology in Helsinki, Suomi

There seems to be a lot of misunderstanding of the company value on the seller side. I get just completely mad estimations from brokers. A company with steady and growing losses is estimated to be worth 1M€ ! So I thought, this can’t be so hard. As I am Master of Science, I took the pencil in my hand and lit up the candle and made a nice cup of tea. As the finnish winter day came to a freezing -23 C night, I did the maths.

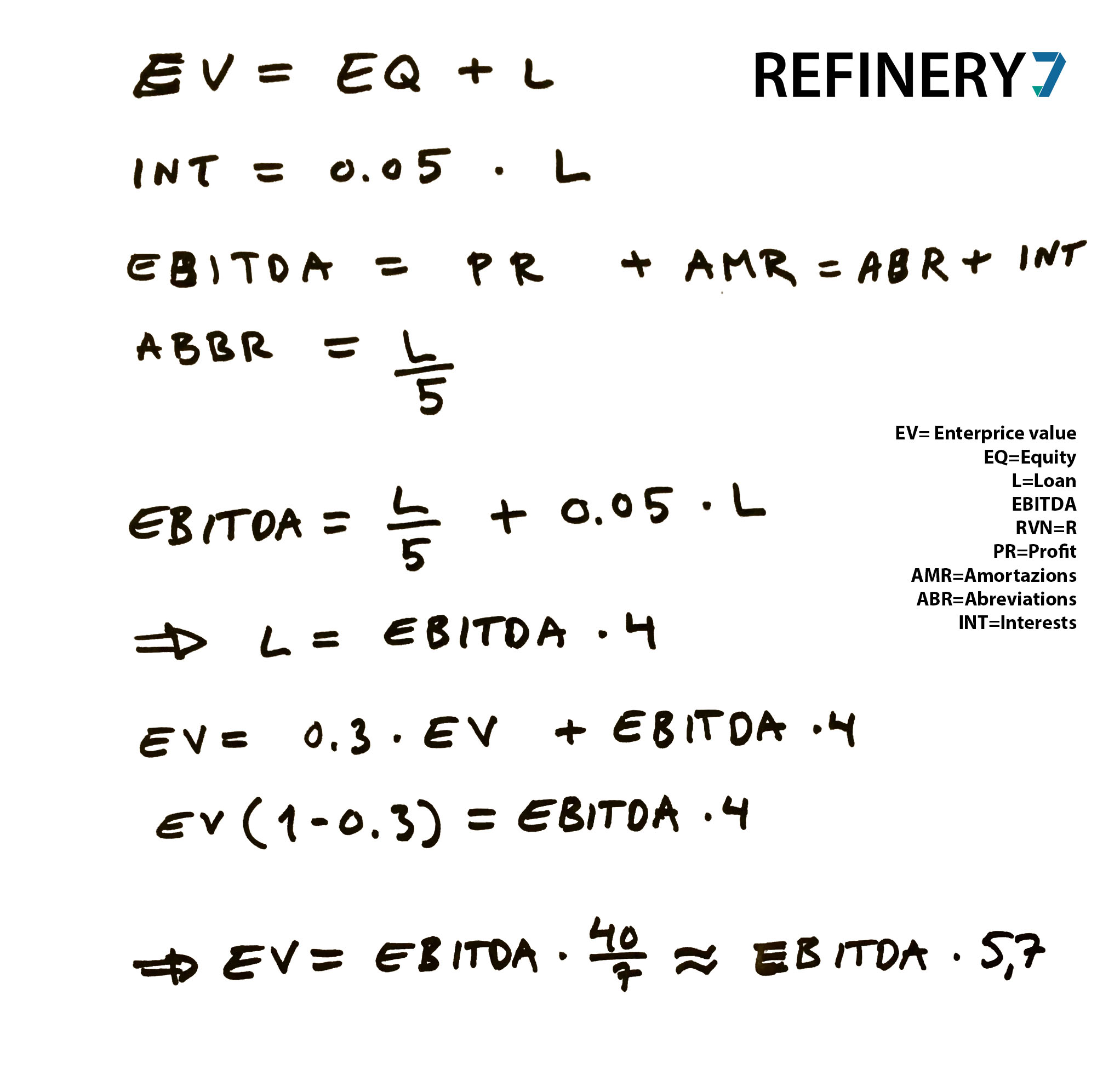

Lets define term first:

EV= Enterprice value

EQ=Equity=30% of EV

L=Loan=70% of EV

EBITDA

RVN=R=Revenue and it is not a factor here

PR=Profit

AMR=Amortazions

ABR=Abreviations

INT=Interests in bank loan

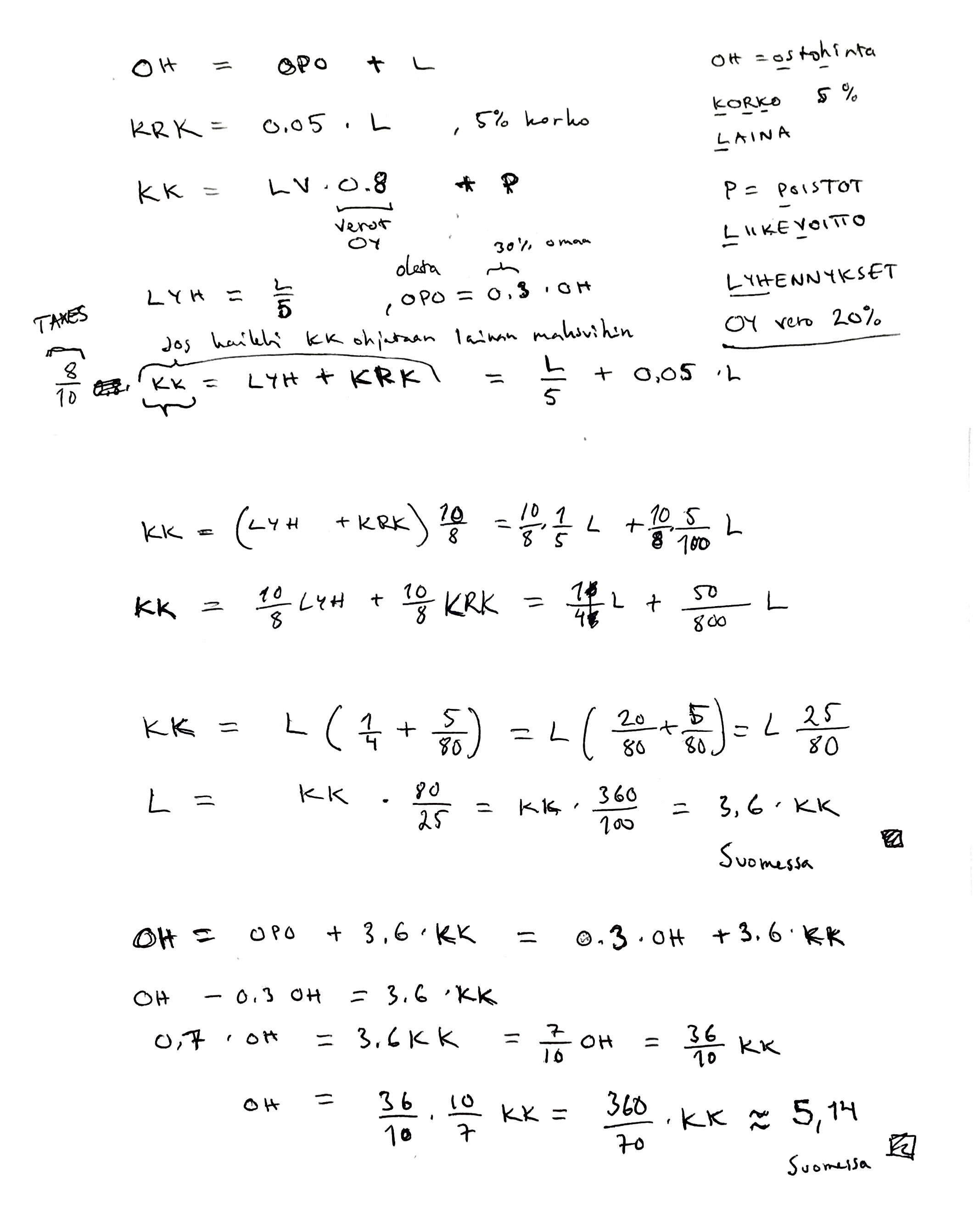

Company tax profit is 20% in FInland and 0% in Estonia. In Estonia you can leave the profit in the company, you pay tax only after you take it out. In Soviet Finland you pay the Tsar (State) immediately, whether you take money out or not.

As I calculated the steady state flow, in aerodynamical terms, I define that the EBITDA goes directly to the loan abrevations and to interests. The EQ is 30% as the banks want to see and the loan is then 70%. Loan time is 5 years as banks say these corona-days.

See the analytical mathematics in Picture 1 below. This would be Estonian calculation with 0% company tax.

So the analytical upper limit with a 5 years loan and 5% interest rate would be 5,7 times the EBITDA.

See the analytical mathematics in Picture 2 below. This would be a calculation in with a Finnish holding company with 20% company tax, even if you leave the money in the company.

So the analytical upper limit with a 5 years loan and 5% interest rate would be 5,1 times the EBITDA.

Your thoughts on this? And what do you say, that the seller wants us to pay for the premises on top of this?

Join Refinery7 as an investor - we have multiple targets in Finland & Estonia which we are ready to buy.