Working Capital Peg: Considerations Unique to Construction Contractors

June 26, 2021

by a searcher from University of Pennsylvania - The Wharton School in Portland, OR, USA

Thank you to the previous posters on working capital. I've searched the history and read all the posts and comments. My question investigates an area that I haven't seen discussed - what are the unique considerations of setting a working capital peg for a construction contractor that uses percent of completion accounting?

Background of the deal:

- Asset light commercial construction contractor focused on a single, specialty trade. When working on new construction the company is always a subcontractor and represents an important piece of the work, but minority share of the total project cost. When performing retrofit work specific to its trade focus the company operates as a general contractor.

- Base revenue comes from large, multi-year projects which then are managed in-house but staffed largely with subcontractors in the same trade.

- Additional, higher-margin revenue comes from short-notice repair work and smaller projects performed by in-house labor

- $6M revenue, $1M adjusted EBITDA with very little depreciation or interest expense

- Uses percent of completion accounting for revenue recognition which creates current assets and current liabilities on the balance sheet when billing lags or is in excess of the percent completion x total bid price.

- Likely a stock purchase with 338(h)(10) election due to transferability issues with some of the multi-year, work-in-progress contracts

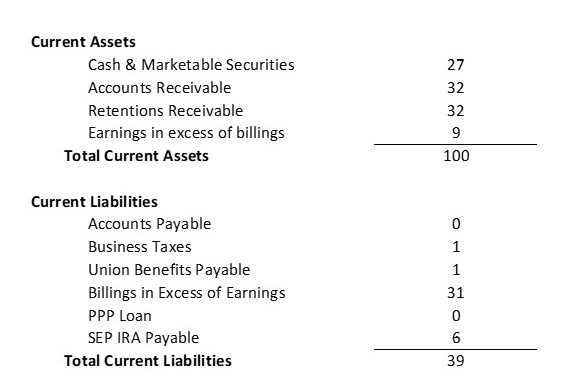

31 DEC 2020 Balance Sheet Excerpts (Current Assets and Current Liabilities only):

I've masked this data by setting total current assets to a value of 100 and indexing everything else to show proportionate size. The retiring owner has eschewed debt of any kind, including accounts payable. He pays within 10 days for his 2% discount from materials vendors which is why AP is zero. There is no inventory as all materials are job-specific.

To this point my understanding of setting working capital pegs has been that the default position is cash free/debt free, then take an average of the AR + Inventory - AP calculated on each of the trailing twelve months. In the case of a construction contractor with unique current assets and liabilities is it as simple as cash free/debt free, then take an average of the remaining current assets - current liabilities for the trailing twelve months?

If I get deeply serious about the deal I will seek expert advice unique to this company before negotiating. Some basic education from this forum on the nuances of the construction industry vs. the typical deals we discuss here would be great background education, though. Hopefully others will benefit from the responses as well.

from Vanderbilt University in Atlanta, GA, USA

from The University of Chicago in Chicago, IL, USA

Happy to help. My contact info is redacted , ###-###-#### .