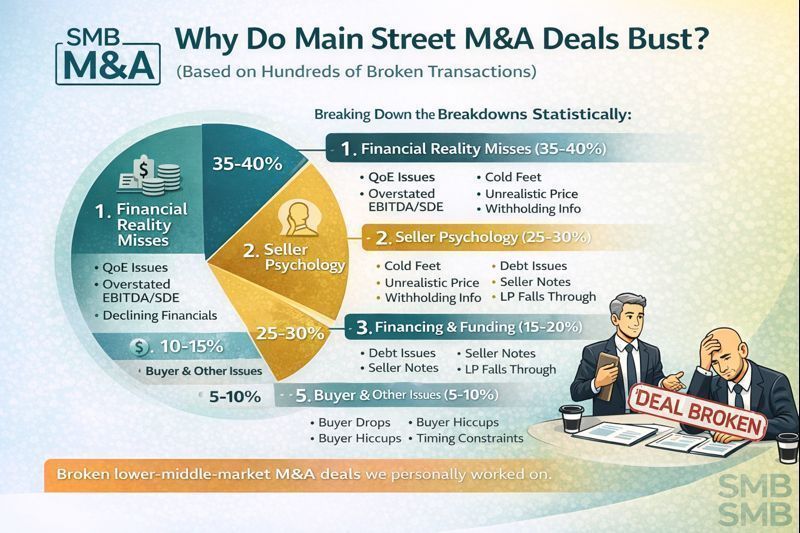

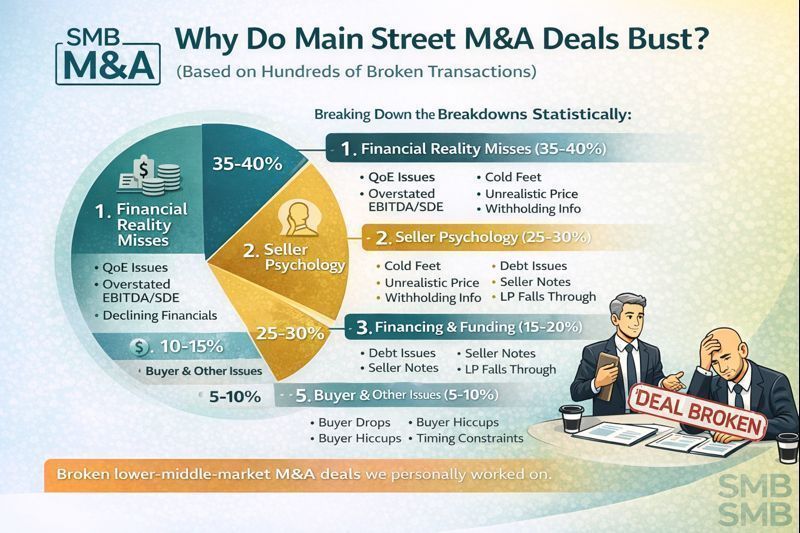

Why Do Main Street M&A Deals Bust?

January 20, 2026

by a professional in Windermere, FL 34786, USA

We've closed over 330 lower-middle-market M&A deals since 2022.

We reviewed a large set of broken lower-middle-market M&A matters. Different industries, deal sizes, buyers, sellers, and structures.

Same outcomes.

Here’s how the failures actually break down statistically:

1. Financial Reality Misses (≈35–40%)

The single biggest killer.

Includes:

QoE coming back low

EBITDA/SDE overstated

Declining or deteriorating financials

Customer concentration or lost key customers

Working capital/NWC swings that blow up economics

Translation:

The numbers didn’t support the price.

2. Seller Behavior & Psychology (≈25–30%)

Not spreadsheets. Humans.

Includes:

Seller backed out / changed mind

Seller got “heartburn”

Unrealistic price expectations

Refusal to renegotiate after diligence

Withholding information or retrading late

Family dynamics (kids taking over, tax fear, emotional attachment)

Translation:

Seller wasn’t truly ready to sell.

3. Financing & Capital Issues (≈15–20%)

Even good deals die without money.

Includes:

Buyer couldn’t secure debt

Lender pulled out

Investor / LP funding fell through

Seller note structure failed

Bank wouldn’t fund post-diligence

Translation:

Capital stack didn’t hold.

4. Deal Structure & Terms Breakdown (≈10–15%)

The “lawyer problems” people love to blame—but usually aren’t.

Includes:

Working capital disputes

Lease guarantees

Asset vs. stock flip issues

Seller note terms

Indemnities, reps, or PA concessions

Translation:

Risk allocation couldn’t be bridged.

5. Buyer-Side Issues (≈5–10%)

Buyers walk too.

Includes:

Buyer’s business complications

Internal disagreements

Change in strategy

Loss of key employee

Buyer silence or disengagement

Translation:

Buyer lost confidence or capacity.

6. Process / Miscellaneous (≈5%)

Noise, but still real.

Includes:

Broker interference

Switching counsel

Timing constraints

Silent clients

Unknown / no explanation

Translation:

Momentum died.

The Big Takeaway

Most Main Street deals don’t die because of lawyers.

They die because:

Financial truth arrives late

Sellers aren’t emotionally or economically prepared

Capital is fragile

Risk isn’t addressed early

The best closings happen when:

QoE is scoped early

Sellers are educated before LOI

Financing is pressure-tested

Structure is discussed honestly, not aspirationally

Curious which category surprises people the most.

Where have you seen deals actually fall apart?

have you seen deals actually fall apart?

have you seen deals actually fall apart?

have you seen deals actually fall apart?

have you seen deals actually fall apart?

from Pennsylvania State University in Sanford, FL, USA

in Windermere, FL 34786, USA