What is a good sba interest rate? Sba interest rate by size of the deal

January 21, 2025

by a lender from University of Southern California in Los Angeles, CA, USA

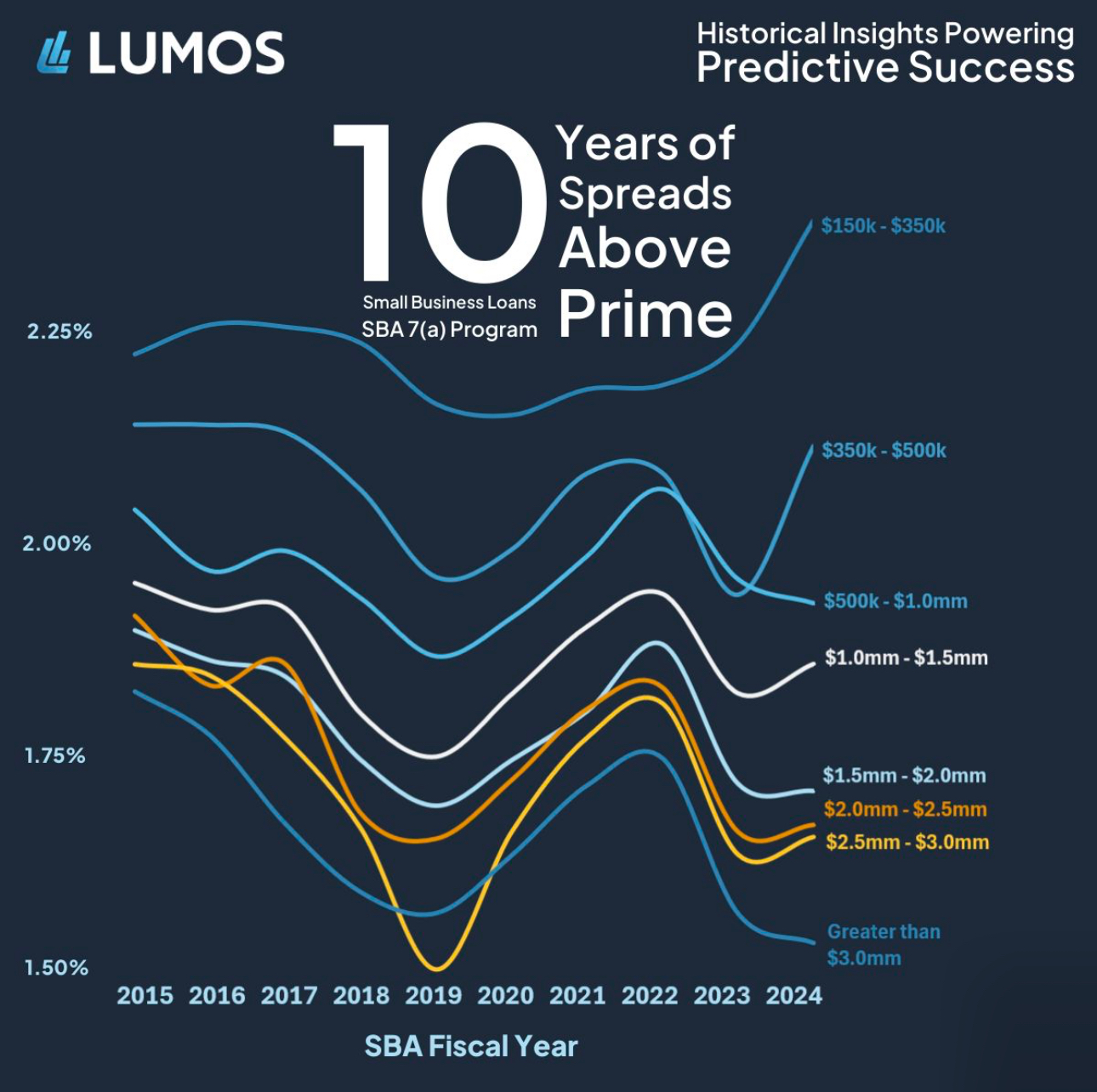

Just came across this new data with Lumos that I think the Searchfunder community would appreciate.

Here’s a quick look at current average spreads by loan size:

Loan Size Current Spread Above Prime

$150K–$350K 2.45%

$350K–$500K 2.20%

$500K–$1M 1.95%

$1M–$1.5M 1.85%

$1.5M–$2M 1.80%

$2M–$3M 1.75%

Greater than $3M 1.65%

The caveat here is that most of these loans are working capital and real estate loans for existing businesses (but also has startups). Rates for business acquisitions tend to be higher, maybe by 0.5% or more depending on the deal. For loans greater than $1m, spreads today are more favorable compared to 10 years ago.

I am increasingly seeing very different pricing for the same business acquisition deal across different banks. For example, I recently worked with a client who almost moved forward with the first term sheet they received for a $5M business acquisition at Prime + 2.5%, This was a pristine credit deal, long term commercial contracts, 45 years operating history, a seasoned management team and an operator with relevant experience. By conducting a full outreach for them we were able to get them two offers from the same bank - 7.6% fixed for 5 years and Prime + 0.5% variable. The client chose the fixed rate, saving $125K in interest annually. There is no reason not to run a full process yourself or work with a good sba loan broker.

If you’re considering an SBA loan, I would love to work with you. We work with all the major SBA lenders. The bank pay us after your loan closes, so this is a 100% free service for you.

You can reach me here or directly at redacted You can also click here to schedule a meeting with me: https://cal.com/ishan-jetley-3d73m8/30min. Look forward to chatting!

#sba #sbaloans #sbabroker #sbainterestrate