The stalemate ends. Market data shows valuation gap finally closing

December 01, 2025

by an investor from University of Miami in Miami, FL, USA

For two years, I've watched the same pattern kill deals:

Sellers anchored to 2021 valuations, buyers walking away from inflated pricing.

But as 2025 draws to a close, that stalemate has ended.

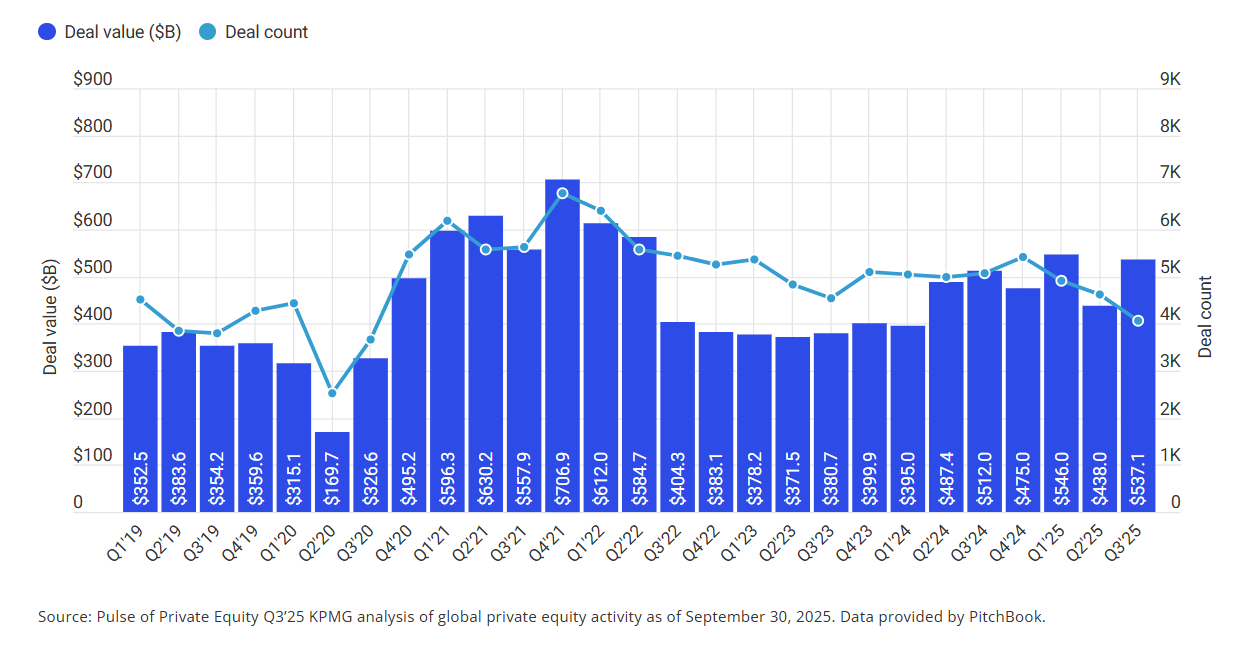

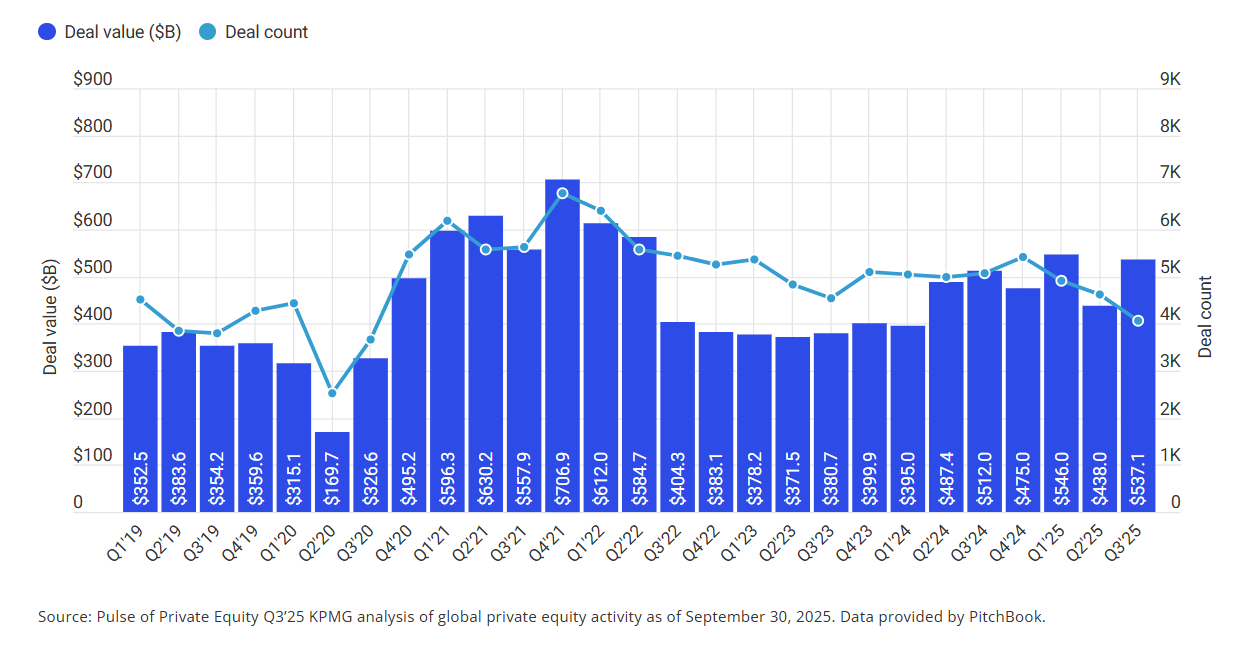

Global PE deal volume hit $1.5 trillion through the first three quarters of the year (on pace to reach a four-year high, according to KPMG's Private Equity Pulse). Q3 alone saw deal value reach a record ~$310 billion. More importantly, EY's latest GP survey shows about two-thirds of respondents now report that the valuation gap has narrowed, enabling buyers and sellers to find common ground and move forward with confidence.

Exit activity surged even more dramatically. KPMG’s report (mentioned above) draws on Dealogic and PitchBook data, shows exit value through Q3 at levels not seen since 2021, with public listings reaching roughly $198.7 billion (the highest since 2020).

The M&A world is healing. Deals are actually closing again.

To read the full post...

Subscribe to https://operator-led.beehiiv.com/

Exit activity surged even more dramatically. KPMG’s report (mentioned above) draws on Dealogic and PitchBook data, shows exit value through Q3 at levels not seen since 2021, with public listings reaching roughly $198.7 billion (the highest since 2020).

The M&A world is healing. Deals are actually closing again.

To read the full post...

Subscribe to https://operator-led.beehiiv.com/

Exit activity surged even more dramatically. KPMG’s report (mentioned above) draws on Dealogic and PitchBook data, shows exit value through Q3 at levels not seen since 2021, with public listings reaching roughly $198.7 billion (the highest since 2020).

The M&A world is healing. Deals are actually closing again.

To read the full post...

Subscribe to https://operator-led.beehiiv.com/

Exit activity surged even more dramatically. KPMG’s report (mentioned above) draws on Dealogic and PitchBook data, shows exit value through Q3 at levels not seen since 2021, with public listings reaching roughly $198.7 billion (the highest since 2020).

The M&A world is healing. Deals are actually closing again.

To read the full post...

Subscribe to https://operator-led.beehiiv.com/

from Princeton University in United States

from University of Texas at Austin in Dallas, TX, USA