The Silent Killer in SMBs: Revenue Up, Cash Down

November 21, 2025

by a professional from Tulane University - A. B. Freeman School of Business in Portland, ME, USA

They hit their revenue target but nearly went bankrupt.

The timing trap nobody talks about:

Revenue ≠ Cash.

Most founders celebrate hitting numbers.

But timing kills more businesses than bad products.

Your business model hides timing risks

that won't show up on a P&L until it's too late.

Here's what to watch:

→ SaaS/Subscription:

- Annual contracts = big ARR.

But cash arrives monthly while you pay sales commissions upfront.

→ Services/Agency:

- Invoice on completion = revenue recognized.

Cash arrives###-###-#### days later while payroll hits every 2 weeks.

→ Product/Inventory:

- Strong sales = healthy margins.

But you paid suppliers 90 days ago and customers pay in 45.

→ High-growth mode:

Every new customer = more revenue.

But scaling burns cash faster than invoices convert.

The pattern?

Your revenue timeline and cash timeline are different.

Miss that gap and growth becomes a death spiral.

One check you can do today:

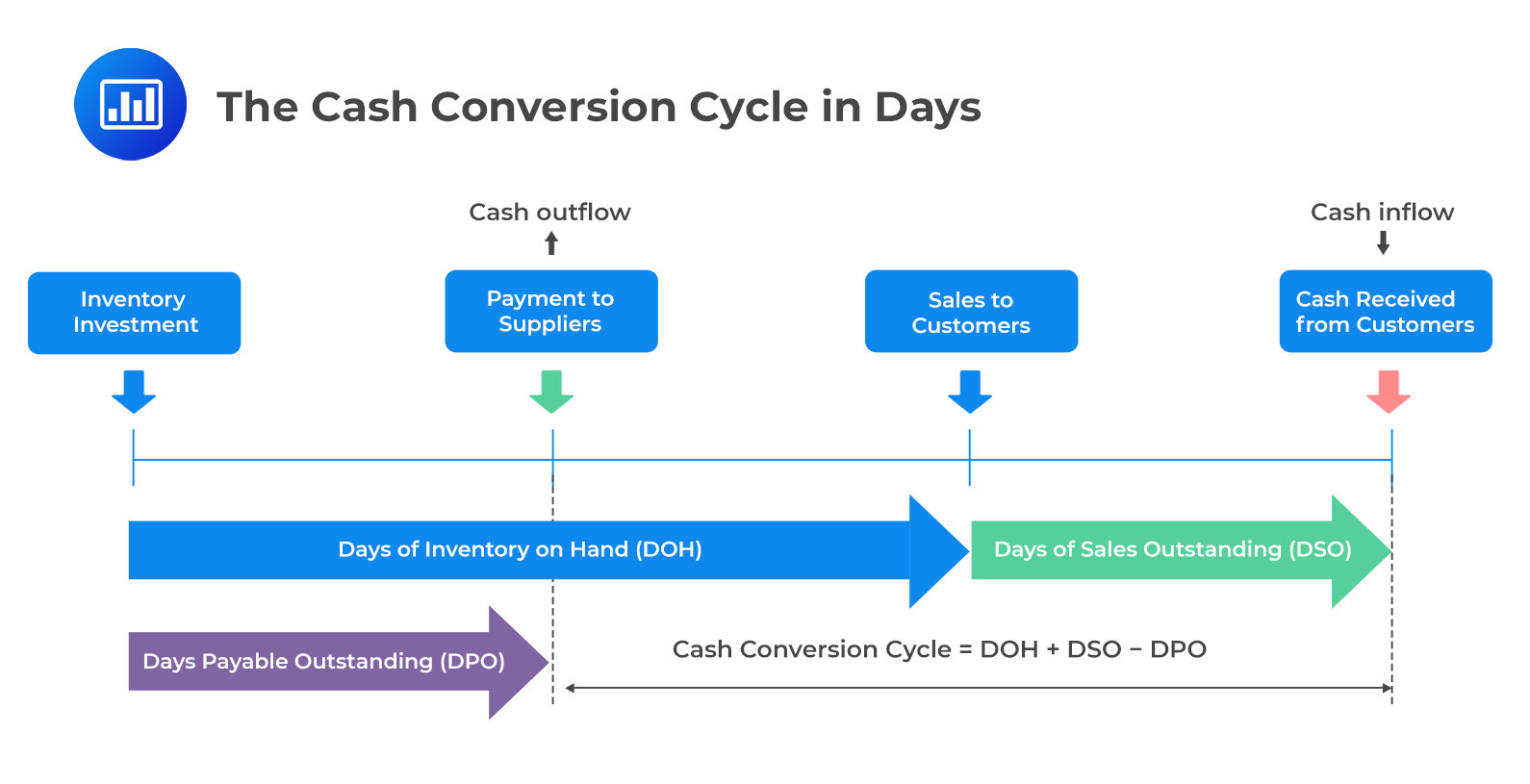

Map your average Days Sales Outstanding (DSO)

against your average Days Payable Outstanding (DPO).

If DSO > DPO, you're funding growth out of pocket.

Cash flow isn't a finance problem.

It's a survival problem.

What timing trap have you seen catch founders off guard?

They hit their revenue target but nearly went bankrupt.

The timing trap nobody talks about:

Revenue ≠ Cash.

Most founders celebrate hitting numbers.

But timing kills more businesses than bad products.

Your business model hides timing risks

that won't show up on a P&L until it's too late.

Here's what to watch:

→ SaaS/Subscription:

- Annual contracts = big ARR.

But cash arrives monthly while you pay sales commissions upfront.

→ Services/Agency:

- Invoice on completion = revenue recognized.

Cash arrives###-###-#### days later while payroll hits every 2 weeks.

→ Product/Inventory:

- Strong sales = healthy margins.

But you paid suppliers 90 days ago and customers pay in 45.

→ High-growth mode:

Every new customer = more revenue.

But scaling burns cash faster than invoices convert.

The pattern?

Your revenue timeline and cash timeline are different.

Miss that gap and growth becomes a death spiral.

One check you can do today:

Map your average Days Sales Outstanding (DSO)

against your average Days Payable Outstanding (DPO).

If DSO > DPO, you're funding growth out of pocket.

Cash flow isn't a finance problem.

It's a survival problem.

What timing trap have you seen catch founders off guard?