The SDE Add-Back Reality Check

January 12, 2026

by a professional in Brooklyn, NY, USA

If you're evaluating small businesses, you've probably seen listings showing $300k EBITDA and $500k SDE (or sometimes referred to as cash flow). CIM claims these are "all legitimate add-backs" – owner's salary, their car lease, family travel. But it's almost double EBITDA!

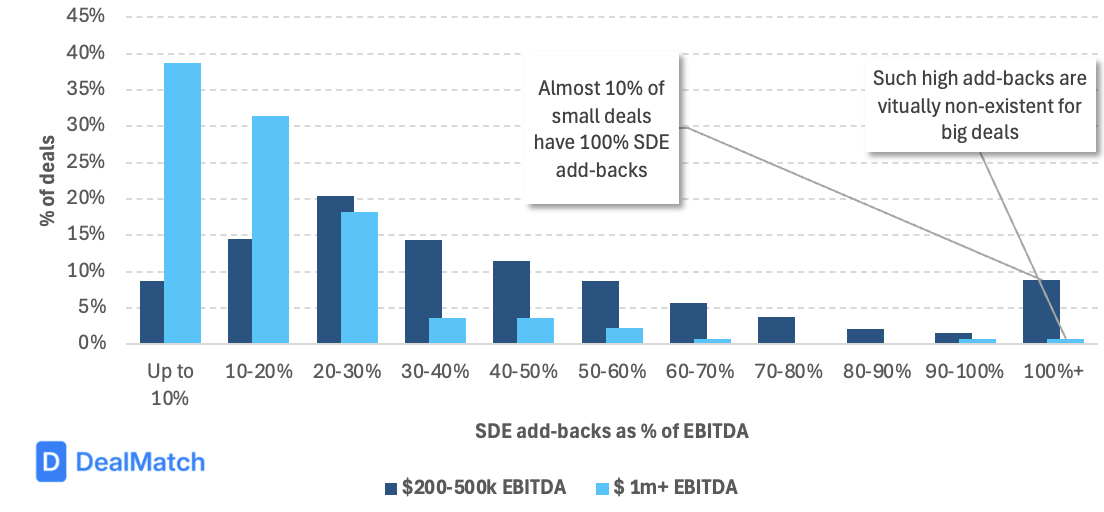

📊 Crazy stat: Almost 10% of small deals ($200-500k EBITDA) have SDE add-backs exceeding 100% of EBITDA*...

...which is virtually non-existent in the larger segment ($ 1M+).

Industry experts consistently say 10-20% add-backs are reasonable. Beyond that, you're entering murky territory – especially when negotiating with SBA lenders.

🚨 What is your experience?

---

PS: If you are interested in 50% off DealMatch in your first month, please ping me!

* data is based on public listings mentioning both SDE and EBITDA

If you're evaluating small businesses, you've probably seen listings showing $300k EBITDA and $500k SDE (or sometimes referred to as cash flow). CIM claims these are "all legitimate add-backs" – owner's salary, their car lease, family travel. But it's almost double EBITDA!

📊 Crazy stat: Almost 10% of small deals ($200-500k EBITDA) have SDE add-backs exceeding 100% of EBITDA*...

...which is virtually non-existent in the larger segment ($ 1M+).

Industry experts consistently say 10-20% add-backs are reasonable. Beyond that, you're entering murky territory – especially when negotiating with SBA lenders.

🚨 What is your experience?

---

PS: If you are interested in 50% off DealMatch in your first month, please ping me!

* data is based on public listings mentioning both SDE and EBITDA

from Dartmouth College in Garden Grove, CA, USA

in Brooklyn, NY, USA