The Best of Both Worlds: Marrying ETA and Real Estate

January 12, 2021

by a searcher from University of Pennsylvania - The Wharton School in New York, NY, USA

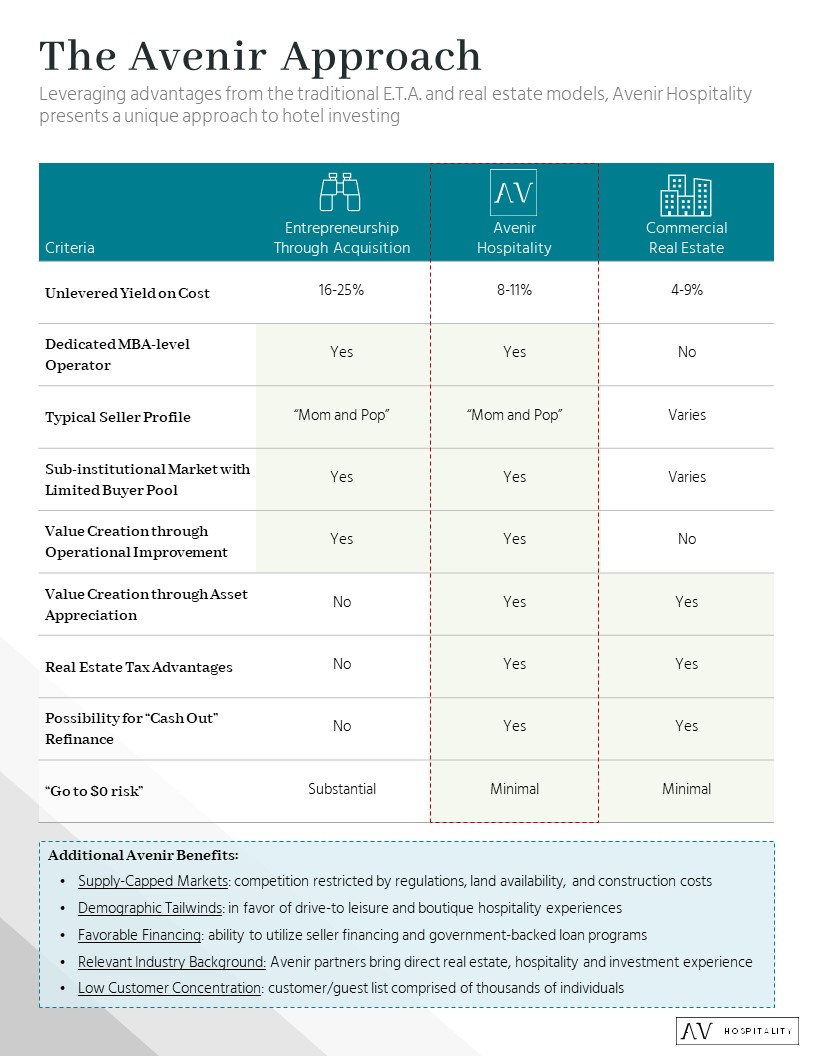

Hello search fund community! We are excited to share a high-level view of our strategy to acquire independent, boutique hotels that captures advantages of both the classic ETA and real estate models. Our approach allows us to marry the attractive value creation potential of ETA with the lowered risk profile, tax advantages and leverage potential of real estate.

While the general sentiment towards hotels is negative today, we see an enormous dichotomy within the industry that presents vastly different trajectories for different assets depending on property type and location. To identify opportunities, this sector should be examined with a scalpel, not a shovel.

With a spread between treasury and commercial real estate yields at one of the highest levels it’s been in three decades, immense pent-up travel demand and favorable financing, we at Avenir Hospitality are very excited about the future as we follow in the advice of Warren Buffet: “be greedy when others are fearful”. We expect to close on our first deal in H1-2021, so if you are interested in investing or learning more please reach out!

from University of Virginia in Red Bank, NJ, USA

from Harvard University in Cambridge, MA, USA