Taking a decision in public health policy vs. entrepreneurship

May 08, 2020

by a searcher from Ecole Polytechnique in Boulogne-Billancourt, France

The objective of this short article is to highlight how we behave as entrepreneurs in front of the risk inherent to our activity, particularly when deciding to pursue a Search Fund. I thought it might be interesting to compare this behavior with how policy makers currently in charge are dealing with the sanitary crisis.

Probability vs. consequences

Let’s start with a recent example to illustrate our subject: Hyrdoxychloroquine. A lot of people gave their opinion regarding the potential efficiency of this drug on Covid, from politics to physicians, all of them without real scientific and solid argument. At the end of April, the scientific knowledge regarding this drug could be sum up by a single sentence: Chloroquine may be a good treatment (and we will know more when studies are over).

How do you deal with a “maybe” when you are policy maker?

Actually, you don’t. It gives no clue about what kind of public policy you should roll out, how to handle large scale sanitary risks (mutation risks, healthcare system saturation, etc.) while bearing the responsibility to protect a population. Infectiology has nothing to do with establishing a public health policy.

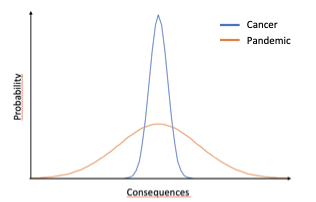

Why? Because to establish this kind of policy you need to take a close look not at the average value of a system but at the distribution of values, and its consequences.

In terms of sanitary risk prevention as well as entrepreneurship, averages are incomplete and sometimes misleading indicators

Let’s say you are few weeks ago, beginning of March. You study the average potential output of the Covid pandemic which is only at a few hundreds of cases in most western countries and for which key parameters (R0, mortality rate, etc.) are still unclear (which they are still now). Based on this, if you listen to people saying that Covid is likely to be negligible in terms of casualties compared to cancer of diabetes, you may end up doing a big mistake. Yes, cancer is killing ~600,000 people each year in the US, which is sadly huge, but it has a stable mortality rate over the years. Meaning it might kill 610,000 one year and 590,000 the other but never several millions. For a pandemic like Covid the probability of it actually reaching 2% mortality rate with high infectiousness and killing several millions of people in the US maybe low but it’s not negligible.

Translating this to a Search Fund project is interesting: If you look at the average performance of Search Funds (>30% IRR, > 3x ROI), it is clearly a no-brainer. However, you need to have a closer look at the distribution of performance to notice that around 25% of searcher don’t find a company or to realize that around 15% of international Search Funds are returning below 1x.

Add a pinch of cognitive bias

It’s quite common for a professional investor to have a look at the above-mentioned metrics, less common is the ability to overcome cognitive bias when deciding to invest. If you are not a professional investor but a young entrepreneur, things get tricky and it’s quite easy to fall into confirmation and/or overconfidence bias:

- Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or strengthens one's prior personal beliefs or hypotheses. Meaning that, if your initial hypothesis is to become an entrepreneur and to pursue a Search fund, you might not see the various warnings and the negative figures in the literature regarding Search Funds. To be honest, I have been an entrepreneur and an investor before doing a Search Fund and this happened to me the first time I read the Stanford primer!

- Overconfidence bias is a bias in which a person's subjective confidence in his or her judgements is reliably greater than the objective accuracy of those judgements. For example, if you ask a group of 100 entrepreneurs about their chance of success, around 80 to 90 will tell you that they will succeed running their own company, but they will also tell you that, ran by someone else, this same company would have between 50 to 60% chance to succeed

Know yourself, and your figures!

From an entrepreneur perspective the first insight would be to read carefully, know all the figures, and look for the bad scenario, not just the average, because it can happen. Then ask questions around you about the project, how it fits to your profile. Talk to investors in a preliminary way, talk to other searchers to make sure you have understood all the implications and what it needs.

This will help you take a step back, and maybe better evaluate your real chance of success : it’s not wasted time because in the end I would think it’s extremely reinsuring, from an investor point of view, to know that the searcher has in mind all the potential outcomes and has made the job to look at it from possibly the most objective point of view. It shows a strong commitment and maturity level vs. someone that is just attracted by the average performance of the model.

from IESE Business School in Lille, France

As a Searcher I strongly recommend to consult not only peers in all different phases (raising, searching, operating and having failed in one of thoses phases) to better understand how it works until the end. This is a rather friendly ecosystem and talking to > 25 Searchers is not that difficult when you make a proper use of www.searchfunder.com.

Then, finding the right team of investors who can overcome your own bias. Building up a team of###-###-#### smart and diverse investors, all commited into you and with sufficient knowledge and experience into the Search Fund model, and then consulting them on a regular basis, is what will help you not only closing on your dream deal, but as well avoiding closing a very bad one ! When closing the deal, you pay them a step-up, therefore consider them as valuable consultants / coach and make the best use of their time and experience.

Your investors are as incented as you are into your success: that is the real strengh of the SF model

from IESE Business School in Paseo de la Castellana, 210, 28046 Madrid, Spain

I trust your recommendations should be a must: "know all the figures, and look for the bad scenario, not just the average, because it can happen. Then ask questions around you about the project, how it fits to your profile. Talk to investors in a preliminary way, talk to other searchers to make sure you have understood all the implications and what it needs." My only addition...talk more to searchers and CEOs...and less to investors :-)