Seeking Lending for Hot Service Business Acquisition (2.2x Net Income!)

April 01, 2023

by a searcher in Cleveland, OH, USA

Good afternoon!

I am a principal from a board of funeral industry leaders seeking to buy funeral homes, cemeteries, and crematories. We have passed on over 50 deals to find this strong of an acquisition at this low of a multiple

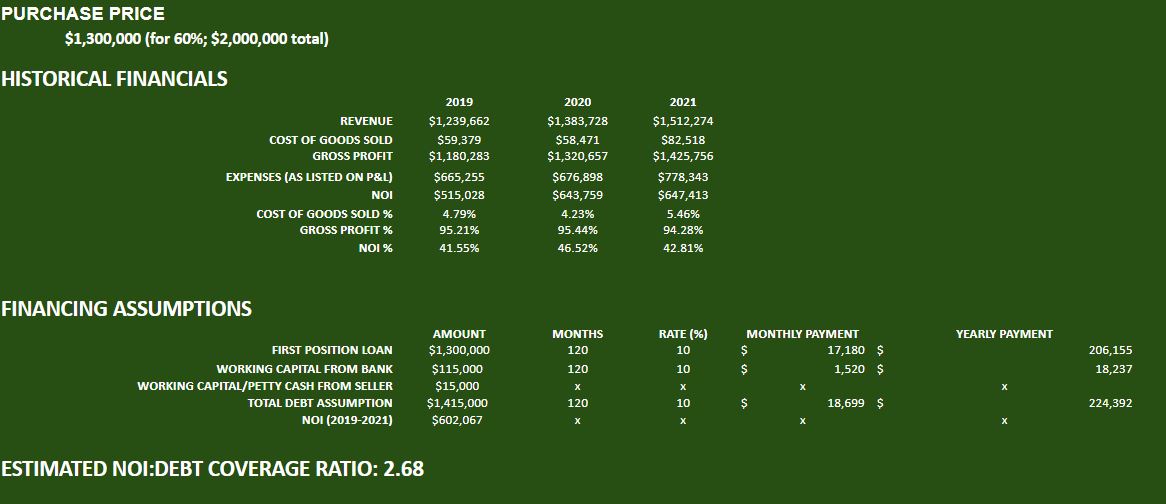

We are buying a cluster of funeral homes (plus one cemetery & one crematory) in Colorado for a total of $2,000,000. We are seeking to buy 60% of this business at a value of $1,300,000, while the seller will stay working in the business for the following 36 months, before divesting his remaining shares at an agreed-upon value of $700,000. He is also receiving 4% of our holding company that will be forming a new asset around this deal, and leaving $15k in the bank for us post-close. Additionally, he will receive a salary cut that will add $13k to the cash flow of this business. All management, staff & directors are staying in place.

Seeking to finance the entirety of the $1,300,000, and we'd like to overfinance this transaction by $115,000. Since this is a partnership with the seller and he is remaining invested in this deal, his equity should suffice as our equity, allowing the bank/lender who represents us to have a strong position in this deal.

Let me know if interested! Below is a debt coverage analysis.

from Eastern Illinois University in 900 E Diehl Rd, Naperville, IL 60563, USA