SDE calculation from Tax Return vs. from P&L?

September 05, 2025

by a searcher from Baruch College-The City University of New York - The Zicklin School of Business in Edison, NJ, USA

I have a general question on a business I am underwriting:

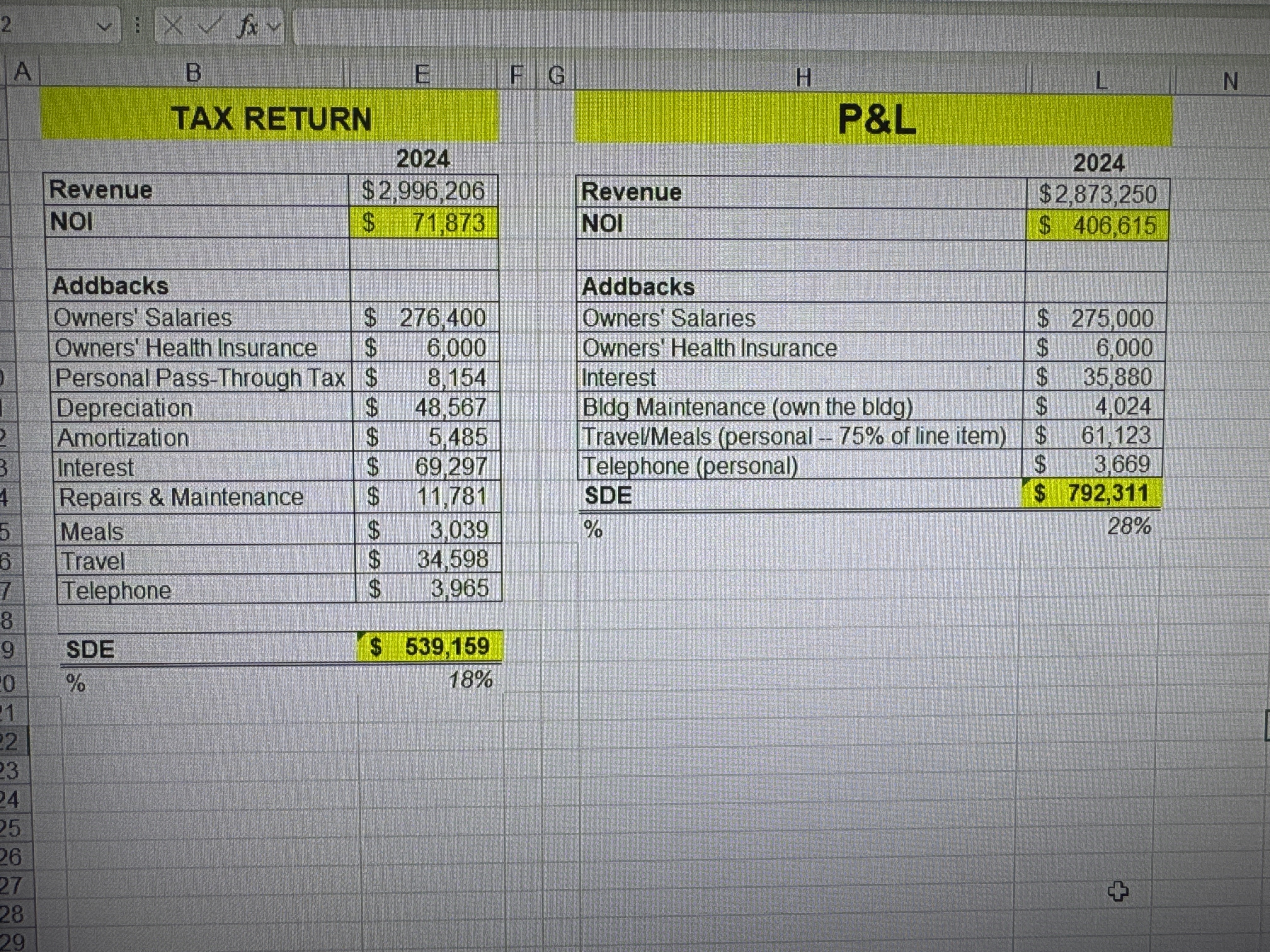

The SDE calculated from the tax return is lower by $200k from the SDE calculated from P&L. Is that normal? What could the reasons for this happening, any examples?

I have a general question on a business I am underwriting:

The SDE calculated from the tax return is lower by $200k from the SDE calculated from P&L. Is that normal? What could the reasons for this happening, any examples?

from Columbia University in Fairfax, VA, USA

from University of Toledo in Shaker Heights, OH, USA