SBA Tried To Blow Up This Deal...

December 06, 2025

by a searcher from University of Houston in Houston, TX, USA

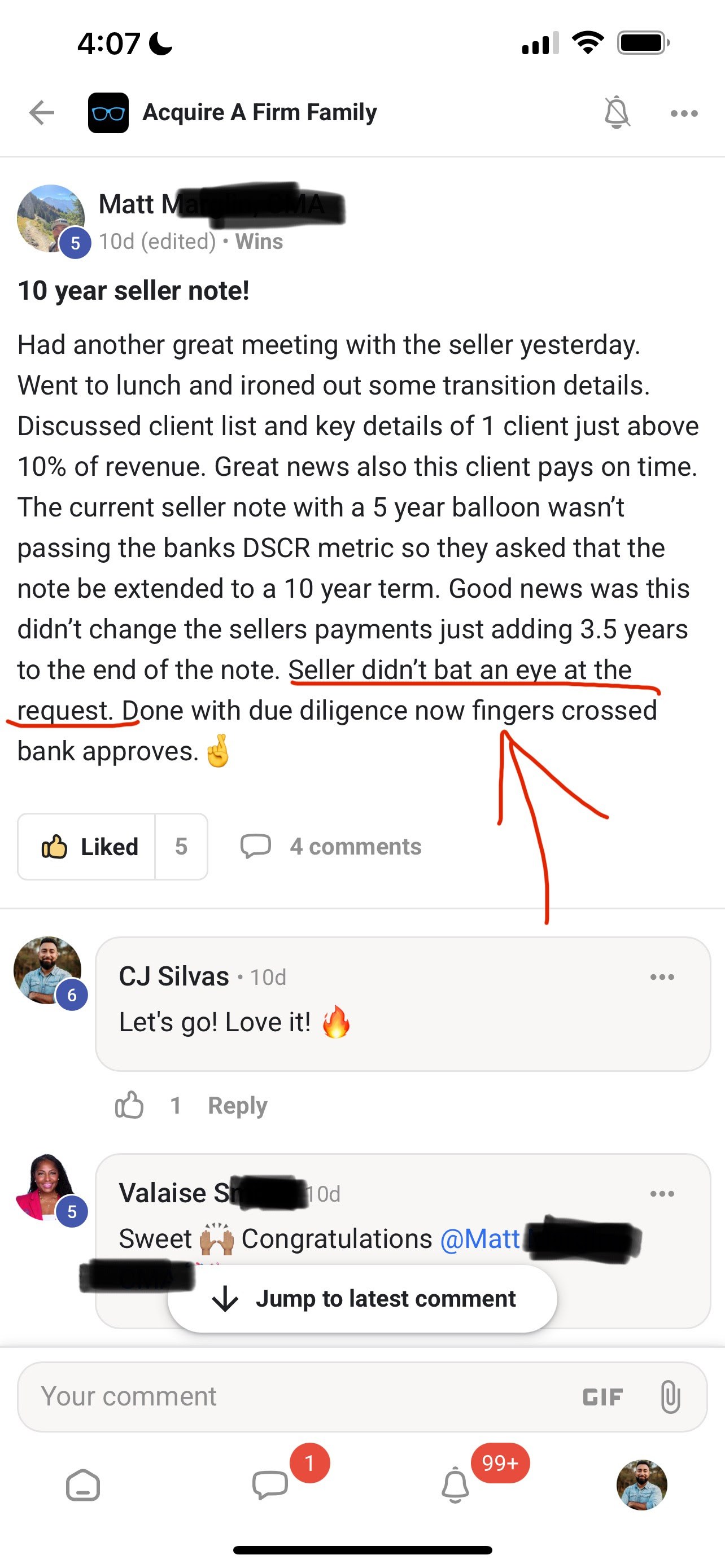

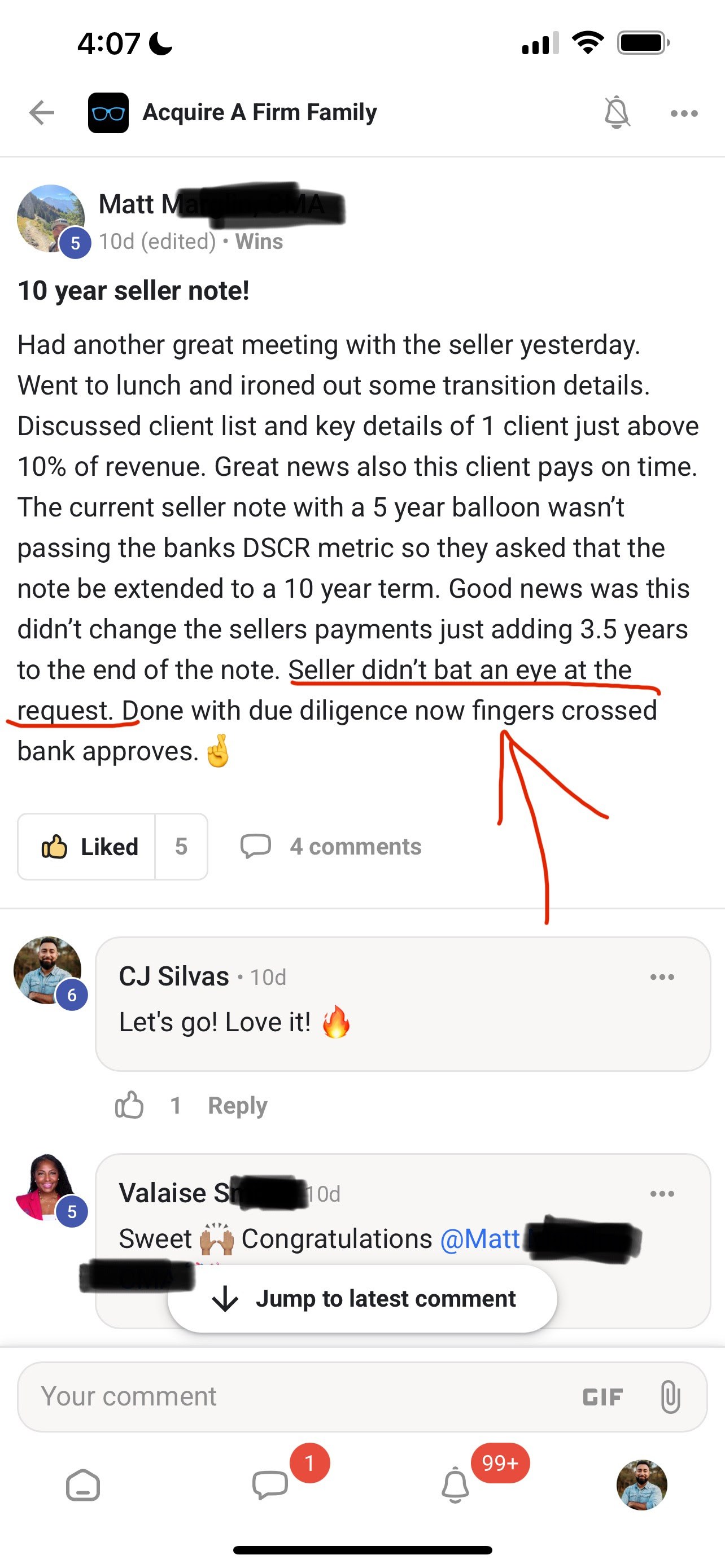

Matt's an accountant buying a $750k CPA firm.

His deal was moving right along until...

The SBA dropped a bomb on him.

The way you set up your deal is everything. There’s an art to negotiation. This literally saved Matt's deal.

Before I tell you about that, here's an example I like to use to explain how important the setup is:

If you took a 5-star filet mignon and placed it on fine china, white tablecloth, candles lit, a glass of wine, jazz in the background, etc, how good does that look? Amazing, right?

Now take that same 5-star steak and put it on a trash can lid. How appetizing is it now? Not so much.

What changed? The setup.

The way you frame an offer or counteroffer can completely change how a seller receives it. It can be the difference in your deal getting across the finish line or dying right before your eyes.

Let's get back to Matt. (By the way, he's NOT a CPA and yes, he's buying a CPA firm.)

At the 11th hour, the SBA wanted him to switch his 5 yr seller note into a standard 10 yr seller note. Underwriters thought the cash flow looked better with that change.

Matt was stuck. He was convinced the seller wouldn’t go for it. Understandably so.

But after a conversation with me, he saw what the real issue was: We just had to frame it the right way. Filet mignon on fine china.

As you can see in the pic…the “seller didn’t bat an eye” at the request.

This was because we framed up his request the proper way. We’re not doing anything special. There’s simply a process. And if you follow the process, you will acquire a firm and get it across the finish line.

I'll keep you posted once Matt gets his commitment letter from the bank!

I'll keep you posted once Matt gets his commitment letter from the bank!

I'll keep you posted once Matt gets his commitment letter from the bank!

I'll keep you posted once Matt gets his commitment letter from the bank!