M&A Monday – Is QSBS Right For My Acquisition?

August 18, 2025

by a professional from Georgetown University in Maryland, USA

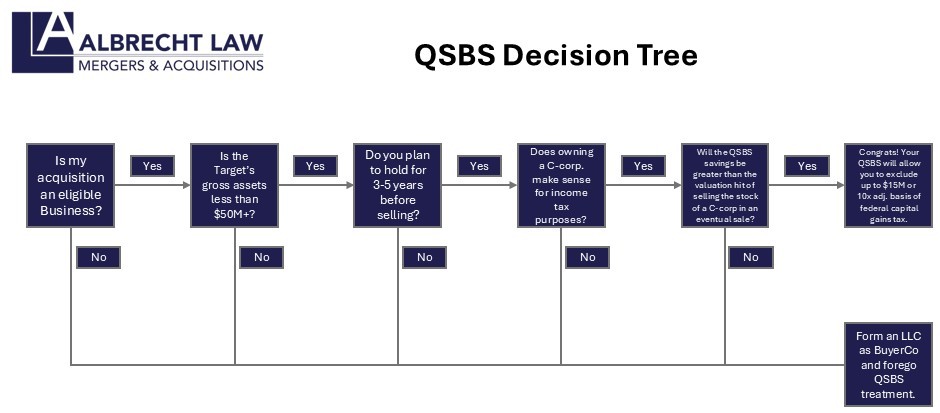

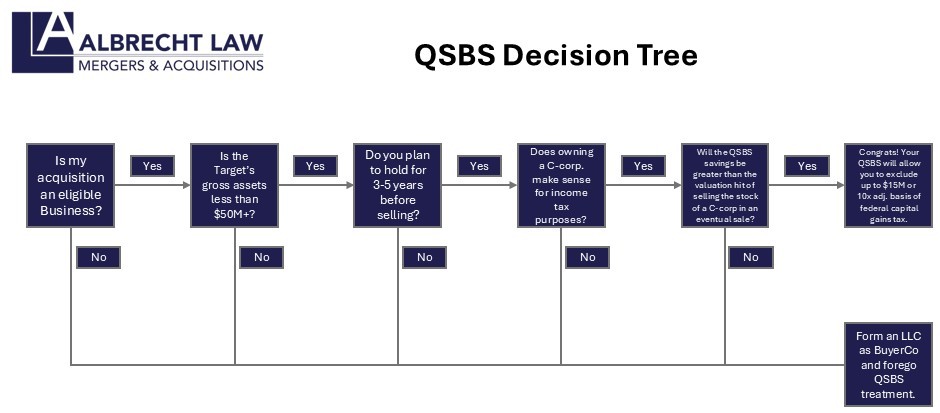

This M&A Monday, we are addressing one of the threshold questions in an acquisition (after the LOI is signed), what are the pros and cons of structuring my deal as QSBS-eligible?

QSBS is a game-changer. It allows a Buyer of a small to medium-sized business to exclude most if not all (greater of $15m or 10x your adjusted basis on a shareholder by shareholder basis) of their federal capital gains on a sale (most states also comply). If done correctly, this will keep millions of extra dollars in your pocket, however, there are some cons. This post will give you a quick decision-tree guide to determining whether to explore QSBS.

Our clients have a dedicated tax structuring discussion with @josh to determine the optimal tax structure for their deal (including whether structuring their deal to recognize the benefits of QSBS is the right path forward).

Before we dive into the decision tree, why is QSBS worth considering? Under Section 1202, QSBS offers an exclusion of up to 100% of capital gains (up to the greater of $15 million (recently increased) or 10x the adj. basis) when you sell stock in a qualifying business, provided a three to five-year hold period. Federal capital gains tax can be 20% + state taxes – QSBS can be a path to millions in tax savings.

Before we dive into the decision tree, why is QSBS worth considering? Under Section 1202, QSBS offers an exclusion of up to 100% of capital gains (up to the greater of $15 million (recently increased) or 10x the adj. basis) when you sell stock in a qualifying business, provided a three to five-year hold period. Federal capital gains tax can be 20% + state taxes – QSBS can be a path to millions in tax savings.

Step 1: Is My Acquisition an Eligible Industry Type?

QSBS requires a qualified business, such as technology, manufacturing, or retail. Disqualified industries include professional services (e.g., law, accounting), finance, insurance, hospitality, and farming. If your Target is in an eligible industry, proceed to the next step.

Step 2: Is the Target’s Gross Assets Less Than $50M?

The buyer entity post-acquisition must have gross assets of $50 million (recently increased to $75m in the Big Beautiful Bill) or less at the time of stock issuance and immediately after. If so, proceed.

Step 3: Do You Plan to Hold for 3-5 Years Before Selling? Pre-Big Beautiful Bill, QSBS required a 5-year holding period, but now there is a pro-rated exclusion after 3 years (if issued after August 1, ###-###-#### If you plan to hold more than 5 years (or at least 3), proceed to the next step.

Step 4: Are You Okay Owning a C-Corp? Step 4 and 5 are the most critical ones and require underwriting. To get QSBS, you must receive initially issued shares of a C corporation. Owning a C-corp. means that there is a chance that profits could be subject to double taxation: profits are taxed at the corporate level (21% federal rate), and distributions (e.g., dividends) are taxed again at the shareholder level. Thus, if your strategy is to make distributions throughout your hold period to stockholders, a C-corp could be bad, from a tax perspective. If your strategy is a long-term hold with distributions, then your exit value must be sufficiently high (i.e., tax savings on exit are sufficiently high) to justify the decision to pursue QSBS. If owning a C-corp makes sense from a business perspective, proceed.

Step 5: Will QSBS Savings Outweigh the Valuation Hit? To get the QSBS exclusion, you must sell the stock of the C-corp to a new buyer after 3-5 years. While, this can save you millions (up to $15 million, recently raised) or 10x your basis), selling the stock of C-corp deprives a future buyer of the basis step-up (losing a massive depreciation benefit), and assuming a higher level of liability. The new buyer also has to be okay owning a C-corp (many buyers prefer not to). This causes a “valuation hit” of approximately 15%-25%. Of course, there are deals where there is no valuation hit. You have to model the impact of selling stock in a C-corp against the benefit of QSBS. If QSBS still makes sense, proceed.

Congratulations – You have reached the end of the decision tree – if you have arrived here, you should likely structure QSBS-eligible. If you want to be QSBS eligible, you will need to (a) have a very competent tax lawyer review your structure and your corporate lawyer incorporate your C-corp, and (b) preferably, have a tax lawyer, like Josh Siegel draft a QSBS memo (analyze the target business and provide insight regarding the go forward QSBS rules and metrics) so you can reliably achieve QSBS treatment when you eventually sell.

Two notes, while most states recognize QSBS, some do not (California, Alabama, Mississippi, Pennsylvania). Second, there have been various attempts in Congress to eliminate QSBS and this benefit could be eliminated in the future (although it now does not seem likely, and it has been in the Code since 1993).

Finally, I cannot emphasize this enough: have a sharp M&A and tax lawyer advise you on this because I have seen people mess this up and lose millions of dollars.

Step 1: Is My Acquisition an Eligible Industry Type?

QSBS requires a qualified business, such as technology, manufacturing, or retail. Disqualified industries include professional services (e.g., law, accounting), finance, insurance, hospitality, and farming. If your Target is in an eligible industry, proceed to the next step.

Step 2: Is the Target’s Gross Assets Less Than $50M?

The buyer entity post-acquisition must have gross assets of $50 million (recently increased to $75m in the Big Beautiful Bill) or less at the time of stock issuance and immediately after. If so, proceed.

Step 3: Do You Plan to Hold for 3-5 Years Before Selling? Pre-Big Beautiful Bill, QSBS required a 5-year holding period, but now there is a pro-rated exclusion after 3 years (if issued after August 1, ###-###-#### If you plan to hold more than 5 years (or at least 3), proceed to the next step.

Step 4: Are You Okay Owning a C-Corp? Step 4 and 5 are the most critical ones and require underwriting. To get QSBS, you must receive initially issued shares of a C corporation. Owning a C-corp. means that there is a chance that profits could be subject to double taxation: profits are taxed at the corporate level (21% federal rate), and distributions (e.g., dividends) are taxed again at the shareholder level. Thus, if your strategy is to make distributions throughout your hold period to stockholders, a C-corp could be bad, from a tax perspective. If your strategy is a long-term hold with distributions, then your exit value must be sufficiently high (i.e., tax savings on exit are sufficiently high) to justify the decision to pursue QSBS. If owning a C-corp makes sense from a business perspective, proceed.

Step 5: Will QSBS Savings Outweigh the Valuation Hit? To get the QSBS exclusion, you must sell the stock of the C-corp to a new buyer after 3-5 years. While, this can save you millions (up to $15 million, recently raised) or 10x your basis), selling the stock of C-corp deprives a future buyer of the basis step-up (losing a massive depreciation benefit), and assuming a higher level of liability. The new buyer also has to be okay owning a C-corp (many buyers prefer not to). This causes a “valuation hit” of approximately 15%-25%. Of course, there are deals where there is no valuation hit. You have to model the impact of selling stock in a C-corp against the benefit of QSBS. If QSBS still makes sense, proceed.

Congratulations – You have reached the end of the decision tree – if you have arrived here, you should likely structure QSBS-eligible. If you want to be QSBS eligible, you will need to (a) have a very competent tax lawyer review your structure and your corporate lawyer incorporate your C-corp, and (b) preferably, have a tax lawyer, like Josh Siegel draft a QSBS memo (analyze the target business and provide insight regarding the go forward QSBS rules and metrics) so you can reliably achieve QSBS treatment when you eventually sell.

Two notes, while most states recognize QSBS, some do not (California, Alabama, Mississippi, Pennsylvania). Second, there have been various attempts in Congress to eliminate QSBS and this benefit could be eliminated in the future (although it now does not seem likely, and it has been in the Code since 1993).

Finally, I cannot emphasize this enough: have a sharp M&A and tax lawyer advise you on this because I have seen people mess this up and lose millions of dollars.

Before we dive into the decision tree, why is QSBS worth considering? Under Section 1202, QSBS offers an exclusion of up to 100% of capital gains (up to the greater of $15 million (recently increased) or 10x the adj. basis) when you sell stock in a qualifying business, provided a three to five-year hold period. Federal capital gains tax can be 20% + state taxes – QSBS can be a path to millions in tax savings.

Before we dive into the decision tree, why is QSBS worth considering? Under Section 1202, QSBS offers an exclusion of up to 100% of capital gains (up to the greater of $15 million (recently increased) or 10x the adj. basis) when you sell stock in a qualifying business, provided a three to five-year hold period. Federal capital gains tax can be 20% + state taxes – QSBS can be a path to millions in tax savings.

Step 1: Is My Acquisition an Eligible Industry Type?

QSBS requires a qualified business, such as technology, manufacturing, or retail. Disqualified industries include professional services (e.g., law, accounting), finance, insurance, hospitality, and farming. If your Target is in an eligible industry, proceed to the next step.

Step 2: Is the Target’s Gross Assets Less Than $50M?

The buyer entity post-acquisition must have gross assets of $50 million (recently increased to $75m in the Big Beautiful Bill) or less at the time of stock issuance and immediately after. If so, proceed.

Step 3: Do You Plan to Hold for 3-5 Years Before Selling? Pre-Big Beautiful Bill, QSBS required a 5-year holding period, but now there is a pro-rated exclusion after 3 years (if issued after August 1, ###-###-#### If you plan to hold more than 5 years (or at least 3), proceed to the next step.

Step 4: Are You Okay Owning a C-Corp? Step 4 and 5 are the most critical ones and require underwriting. To get QSBS, you must receive initially issued shares of a C corporation. Owning a C-corp. means that there is a chance that profits could be subject to double taxation: profits are taxed at the corporate level (21% federal rate), and distributions (e.g., dividends) are taxed again at the shareholder level. Thus, if your strategy is to make distributions throughout your hold period to stockholders, a C-corp could be bad, from a tax perspective. If your strategy is a long-term hold with distributions, then your exit value must be sufficiently high (i.e., tax savings on exit are sufficiently high) to justify the decision to pursue QSBS. If owning a C-corp makes sense from a business perspective, proceed.

Step 5: Will QSBS Savings Outweigh the Valuation Hit? To get the QSBS exclusion, you must sell the stock of the C-corp to a new buyer after 3-5 years. While, this can save you millions (up to $15 million, recently raised) or 10x your basis), selling the stock of C-corp deprives a future buyer of the basis step-up (losing a massive depreciation benefit), and assuming a higher level of liability. The new buyer also has to be okay owning a C-corp (many buyers prefer not to). This causes a “valuation hit” of approximately 15%-25%. Of course, there are deals where there is no valuation hit. You have to model the impact of selling stock in a C-corp against the benefit of QSBS. If QSBS still makes sense, proceed.

Congratulations – You have reached the end of the decision tree – if you have arrived here, you should likely structure QSBS-eligible. If you want to be QSBS eligible, you will need to (a) have a very competent tax lawyer review your structure and your corporate lawyer incorporate your C-corp, and (b) preferably, have a tax lawyer, like Josh Siegel draft a QSBS memo (analyze the target business and provide insight regarding the go forward QSBS rules and metrics) so you can reliably achieve QSBS treatment when you eventually sell.

Two notes, while most states recognize QSBS, some do not (California, Alabama, Mississippi, Pennsylvania). Second, there have been various attempts in Congress to eliminate QSBS and this benefit could be eliminated in the future (although it now does not seem likely, and it has been in the Code since 1993).

Finally, I cannot emphasize this enough: have a sharp M&A and tax lawyer advise you on this because I have seen people mess this up and lose millions of dollars.

Step 1: Is My Acquisition an Eligible Industry Type?

QSBS requires a qualified business, such as technology, manufacturing, or retail. Disqualified industries include professional services (e.g., law, accounting), finance, insurance, hospitality, and farming. If your Target is in an eligible industry, proceed to the next step.

Step 2: Is the Target’s Gross Assets Less Than $50M?

The buyer entity post-acquisition must have gross assets of $50 million (recently increased to $75m in the Big Beautiful Bill) or less at the time of stock issuance and immediately after. If so, proceed.

Step 3: Do You Plan to Hold for 3-5 Years Before Selling? Pre-Big Beautiful Bill, QSBS required a 5-year holding period, but now there is a pro-rated exclusion after 3 years (if issued after August 1, ###-###-#### If you plan to hold more than 5 years (or at least 3), proceed to the next step.

Step 4: Are You Okay Owning a C-Corp? Step 4 and 5 are the most critical ones and require underwriting. To get QSBS, you must receive initially issued shares of a C corporation. Owning a C-corp. means that there is a chance that profits could be subject to double taxation: profits are taxed at the corporate level (21% federal rate), and distributions (e.g., dividends) are taxed again at the shareholder level. Thus, if your strategy is to make distributions throughout your hold period to stockholders, a C-corp could be bad, from a tax perspective. If your strategy is a long-term hold with distributions, then your exit value must be sufficiently high (i.e., tax savings on exit are sufficiently high) to justify the decision to pursue QSBS. If owning a C-corp makes sense from a business perspective, proceed.

Step 5: Will QSBS Savings Outweigh the Valuation Hit? To get the QSBS exclusion, you must sell the stock of the C-corp to a new buyer after 3-5 years. While, this can save you millions (up to $15 million, recently raised) or 10x your basis), selling the stock of C-corp deprives a future buyer of the basis step-up (losing a massive depreciation benefit), and assuming a higher level of liability. The new buyer also has to be okay owning a C-corp (many buyers prefer not to). This causes a “valuation hit” of approximately 15%-25%. Of course, there are deals where there is no valuation hit. You have to model the impact of selling stock in a C-corp against the benefit of QSBS. If QSBS still makes sense, proceed.

Congratulations – You have reached the end of the decision tree – if you have arrived here, you should likely structure QSBS-eligible. If you want to be QSBS eligible, you will need to (a) have a very competent tax lawyer review your structure and your corporate lawyer incorporate your C-corp, and (b) preferably, have a tax lawyer, like Josh Siegel draft a QSBS memo (analyze the target business and provide insight regarding the go forward QSBS rules and metrics) so you can reliably achieve QSBS treatment when you eventually sell.

Two notes, while most states recognize QSBS, some do not (California, Alabama, Mississippi, Pennsylvania). Second, there have been various attempts in Congress to eliminate QSBS and this benefit could be eliminated in the future (although it now does not seem likely, and it has been in the Code since 1993).

Finally, I cannot emphasize this enough: have a sharp M&A and tax lawyer advise you on this because I have seen people mess this up and lose millions of dollars.

from University of North Carolina at Chapel Hill in Atlanta, GA, USA

from DePaul University in Austin, TX, USA