Is the search market really that broken?

January 16, 2026

by an intermediary from Johns Hopkins University in Brooklyn, NY, USA

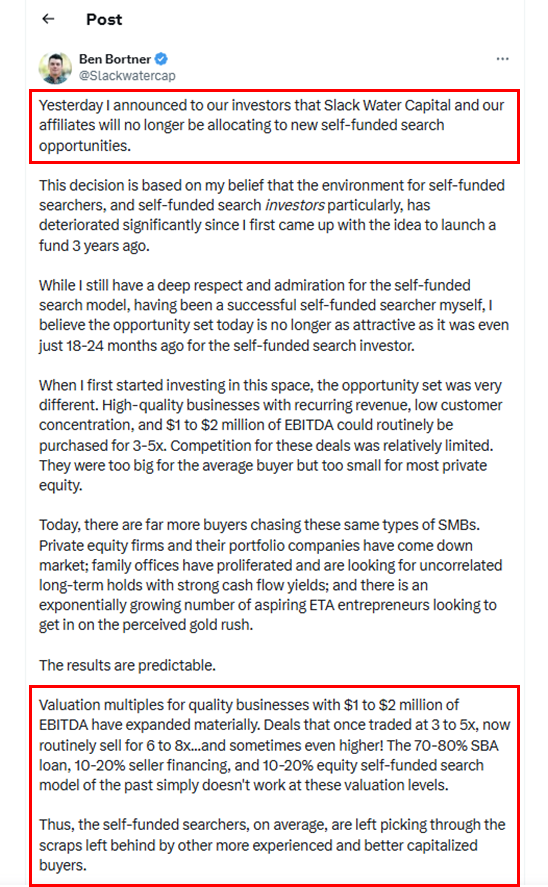

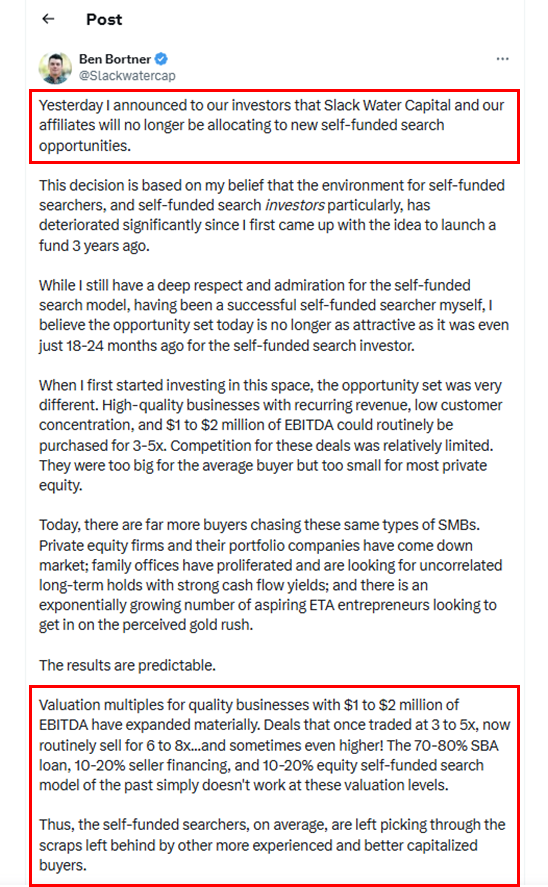

Saw Ben Bortner's post on X today about Slack Water stepping back from new self-funded search investments. I agree the space is more crowded. There are more funds and more searchers competing for the same deals. But I disagree with the core arguments on pricing and the state of the opportunity overall.

On pricing: the claim that $1-2M EBITDA businesses are now "routinely" trading at 6-8x doesn't line up with the data. Last week we published an analysis of tens of thousands of active, brokered SMB listings across 500+ sources. The average asking multiple is ~3.7x, with most industries still clustering in the 3-4x range. There are absolutely deals above 6x, but they're a minority, not the baseline.

On opportunity: we've had hundreds of searchers sign up for DealMatch since we launched last year. Three have closed deals so far. The difference wasn't luck. It was consistency and stamina. Search is like a gym membership: the people who show up regularly, week after week, are the ones who get results. Most people sign up, browse for a few weeks, and fade out.

On what actually works now: checking BizBuySell a few times a week doesn't cut it anymore. You either need very high volume brokered flow or you need to go outbound. We support both. We just launched outbound functionality in DealMatch so you can run direct campaigns to owners who aren't in a process yet.

Search is harder. But the opportunity hasn't dried up. It just takes more volume and better tools.

Original announcement: https://x.com/Slackwatercap/status/2012164474141114536

Original announcement: https://x.com/Slackwatercap/status/2012164474141114536

Original announcement: https://x.com/Slackwatercap/status/2012164474141114536

Original announcement: https://x.com/Slackwatercap/status/2012164474141114536

from Harvard University in New Jersey, USA

from Harvard University in New Jersey, USA