Investment Thesis (1/2): Our Sectors of Focus

July 15, 2024

by a searcher from INSEAD in Singapore

Dear Investors,

Thank you for sticking with us and being a part of our startup story. We commit to keeping you posted on our journey and hope you enjoy reading these updates. Please let me know if you would like to opt out of these newsletters. Today, we will touch on our investment thesis - our sectors of focus.

Investment Thesis: The sectors we are targeting

Foremost, we align our investment thesis with the major tailwinds of Southeast Asia. As most of our readers are from this region, our assumption is that most are attuned to the positive megatrends. For the uninitiated, the following is a quick introduction:

Population: Southeast Asia, at 670m, is the 3rd largest population globally (after China and India) and boasts of a young, urbanized and tech-savvy demographic. Unlike North America, Europe and China where population growth is stagnant or even shrinking, Southeast Asia is still considered fast-growing. That said, markets like Thailand, Malaysia and Singapore are starting to reflect signs of an aging population.

Economic: The rising middle class has led to consistent GDP per capita growth over the last decade driven by stable politics, surging entrepreneurial activity and favorable demographics. Coupled with the ever growing population base, Southeast Asia maintains the possibility of out-growing other emerging regions in the world over the next decade.

Political: The neutrality of the region is likely to continue attracting foreign direct investments (FDIs) due to the ongoing geo-political dislocation. Vietnam and Indonesia have been key beneficiaries with establishments of manufacturing bases from Korean (Samsung, LG) and Chinese (CATL, Rept Battero Energy) companies, respectively. Malaysia has attracted semiconductor investments as a hedge against the China-Taiwan dispute while Singapore is at the center of attention for the re-domiciliation of major Chinese companies, like Bytedance, parent of Tik-Tok, and Shein, a global ultra fast-fashion brand.

Technology: The region is very well-connected digitally with over 440m internet users and 90%+ mobile penetration. The Philippines holds the title of being the global leader in social media usage with an average of 4 hours and 15 mins each day, the highest across the world. Tech-enabled disruptions will continue to impact investment, innovation and productivity growth.

Social: The digital transformation and closer integration of the region globally is opening up opportunities for Southeast Asians, particularly among the younger generations. Vietnam, Thailand and Indonesia are exporting agricultural products to the west. Record numbers of youth are attending universities outside the region and more women are taking part in economic opportunities, creating a more educated and diverse workforce than ever.

How does this backdrop influence our search priorities?

The Southeast Asian economy will continue to expand, evolve and diversify. On the consumer front, a larger population base and higher discretionary income will promote consumption growth with additional incomes spent on higher quality food, lifestyle, services and education. In addition, the increasingly aging population means higher government and consumer expenditures into healthcare. From a commercial perspective, the multiplier effect from FDIs will create many more local businesses which will require the greater need for financing and business services. As a trend, ecommerce, digitalization and AI will continue to flourish, prompting greater investments into data centers and maintenance services. Lastly, these growing economic and trade activities will drive higher energy and industrial output mainly across the emerging Southeast Asian markets.

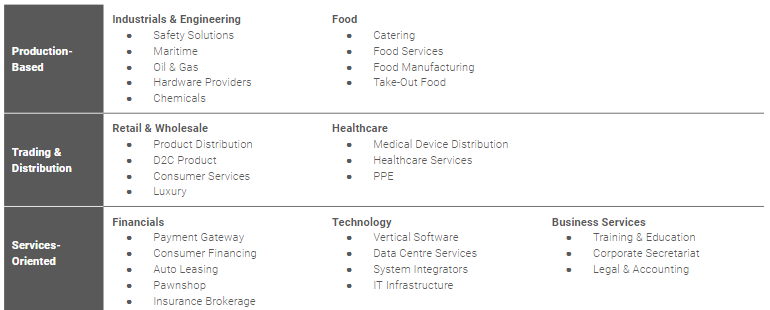

We also draw parallels between how emerging markets like Southeast Asia will evolve towards a developed market such as the USA. Today, the energy, commodities and industrial sectors dominate the Southeast Asian economy. This picture reminds us of the US in the 1960s when the country was recovering from the 2nd World War where companies like General Electric, Dupont, Exxon, Goodyear and Bethlehem Steel took the reins. 60 years later, energy, commodities and industrials still matter in the US economy, but the economy is much more diversified with retail (Walmart, Amazon), technology (Alphabet, Microsoft) and healthcare (UnitedHealth Group, J&J) companies monopolizing the top spots. Analyzing these megatrends and drawing parallels with Southeast Asia, we believe the long term opportunities lie in the following 7 sectors, in no order of preference:

We like these sectors as we can ride the long term regional macroeconomic tailwind that will result in a higher organic growth for our investments. Passive and organic growth will be a primary source of earnings growth and an important factor of alpha when thinking about our returns. We like organic growth because it is cheaper and has lower downside risk, allowing us to be laser-focus on improving customer loyalty and retention, and growing their share of wallets over time. A growing pie also means more customers for all, and our strategy is to win them through inexpensive word-of-mouth acquisition strategy (as opposed to an expensive and risky predatory approach).

We believe that there are plenty of M&A opportunities across Southeast Asia. While we look across the region for deal flow, our initial target will likely have their dominant presence in Singapore and Malaysia. This makes the most sense due to the (1) ease of doing business, (2) (relatively) stronger rule of law, (3) availability of debt capital, (4) availability of skilled labor and (5) our familiarity of doing business here. Anecdotally, regional private equity players have also traditionally been successful in Singapore and Malaysia which provides additional validation that these 2 markets are likely the points of entry for [Capital z].

7 Sectors is a lot, don’t you think?

Some investors responded that our search verticals seem very broad and lack focus. Do hear us out on why we are deliberate in keeping it broad from the get-go:

First, searching in these sectors does not mean that we will acquire companies in all of these sectors. Eventually, we will acquire only 1 company in only 1 sector (to start with). All efforts will be focused on making that 1 company successful.

Second, being broad in our discovery process allows us to learn the nuances of different industries, educating us to better operate our business downstream. By adopting a generalist and first-principle mindset, we aim to extract and journal all best practices as part of our due diligence. These learnings can then be applied into the single company that we will acquire.

Third, we want to buy at a reasonable valuation, which means we need to be patient with the negotiation process. To mitigate this long sales cycle, we need to build a broader sales funnel, engaging with multiple high quality targets so that we do not have time pressure to close a transaction.

Last, Eric and I love and enjoy the intellectual flexibility that comes with meeting founders and entrepreneurs. Engaging them everyday inspires us and gives us the drive to do better everyday.

As such, we believe that being open-minded to ingest information from various industries and learn as we move along offers more benefits than downsides. If you feel that there are sectors that we have overlooked, feel free to let us know.

Organization Update: Our First Advisor!

We welcome Kenneth onto our Board of Advisors! Kenneth is a solid, well-rounded, and business-minded legal counsel. An M&A lawyer by training, he currently serves as the Chief Legal Officer at one of the MAS-licensed digital asset exchanges. What’s even cooler is that he had lived and worked in Myanmar for 5 years, advising international clients looking to navigate the ever-changing legal landscape of a frontier economy. Kenneth’s passion lies in the private markets - he is a venture partner with a highly-regarded Hong Kong VC and was heavily involved in Variable Capital Company fund formation work, as well as venture capital investment structure. Further, Kenneth is an entrepreneur himself - having set up various businesses including an ASEAN-focused investment and legal consultancy, a sports apparel brand, and a football club and academy in Portugal. In his free time, Kenneth volunteers as the Head of the Sustainability Sub-Committee of the Tanjong Pagar-Tiong Bahru Citizen Consultative Committee, where he works closely with Minister Indranee Rajah (Minister in the Prime Minister's Office and Second Minister for Finance, Second Minister for National Development). Kenneth is a loving father of 2, a girl and a boy. We had known each other for 20+ years, living in one of the halls of the National University of Singapore where we were part of the same hockey team.

We are extremely excited to have him onboard! Kenneth will advise us on the legal aspects of structuring and M&A transactions. Legality is fundamental to our business model and we will need advice from the get-go. This is why Kenneth was the first person I called when Eric and I were conceptualizing our search fund. Please reach out and say hello to him over LinkedIn!

Our Key Asks: Thank you for looking out for us

If you have made it this far, thank you for reading. We would very much like to stay engaged with every one of you as much as we can. Please reach out to Eric or me if you:

Have any questions on our sectors of focus or even a related topic in mind that you would like to hear our views on in the future,

Know of anyone who may be helpful to our vision and business,

Know of any potential investors keen to invest in private companies,

Have in mind an awesome name for us to consider! (We are already brainstorming some names, but yet to confirm)

Upcoming update next week: Investment Thesis (2/2): The type of business that we are looking for.

Have a stellar week and see you soon!

Best Regards,

Eric and Zachary

p/s: If you missed our views of the Southeast Asia VC landscape last week, please find it here.

from The University of North Carolina at Chapel Hill in Toronto, ON, Canada