Inflation thoughts - how are other searchers thinking through this?

November 09, 2021

by a searcher from New York University - Leonard N. Stern School of Business in Nags Head, NC 27959, USA

It's becoming quite clear that inflation is starting to pick up materially and the Fed doesn't seem to react quickly as evident by only modest QE tapering due to "transitory inflation".

I'm curious how other searchers are thinking through this issue? The obvious answer is to find a business with pricing power but would love to hear the unique ways searchers may be considering.

Some high-level recent stats:

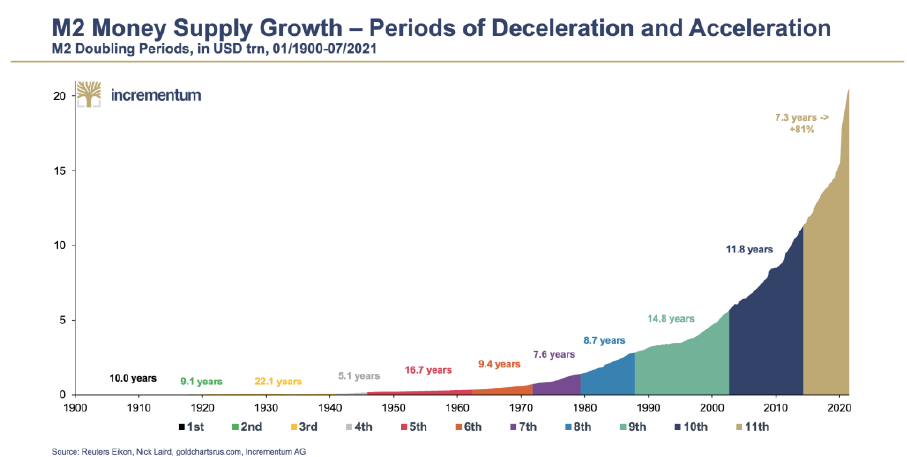

money supply (M2) has increased ~30% in the last 18 months which is driving this inflationary environment

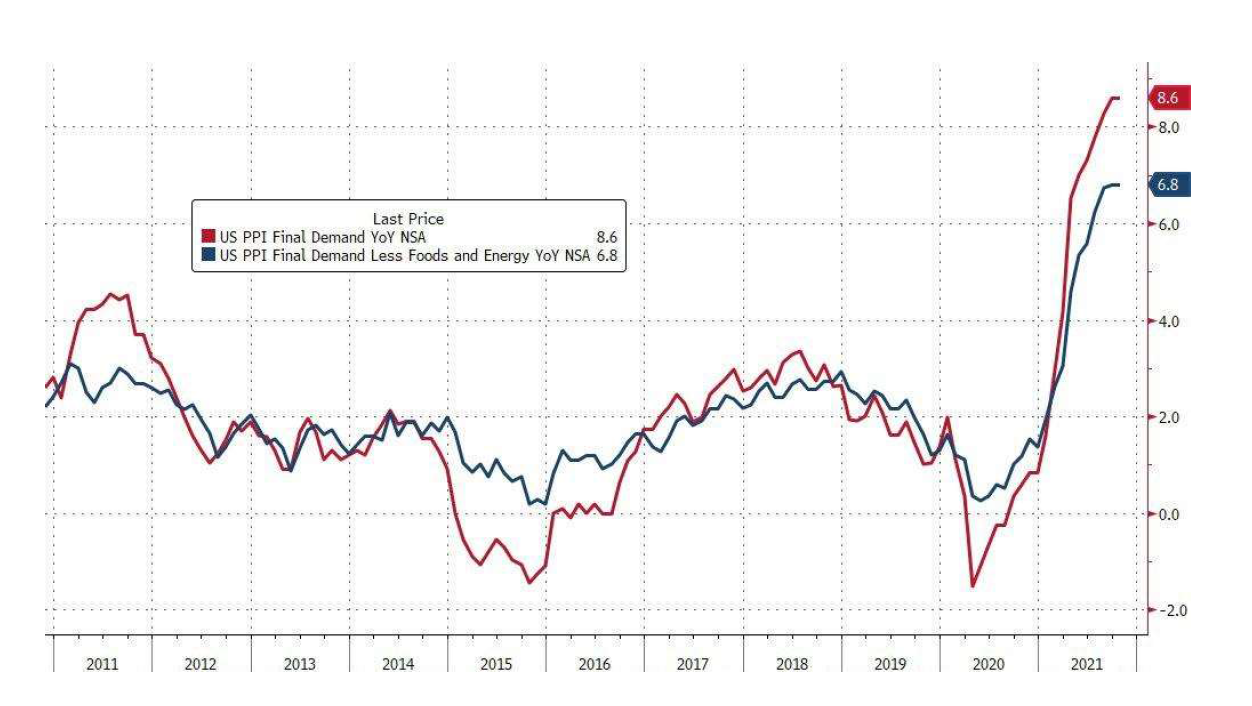

PPI +8.6% for October (released 11/9)

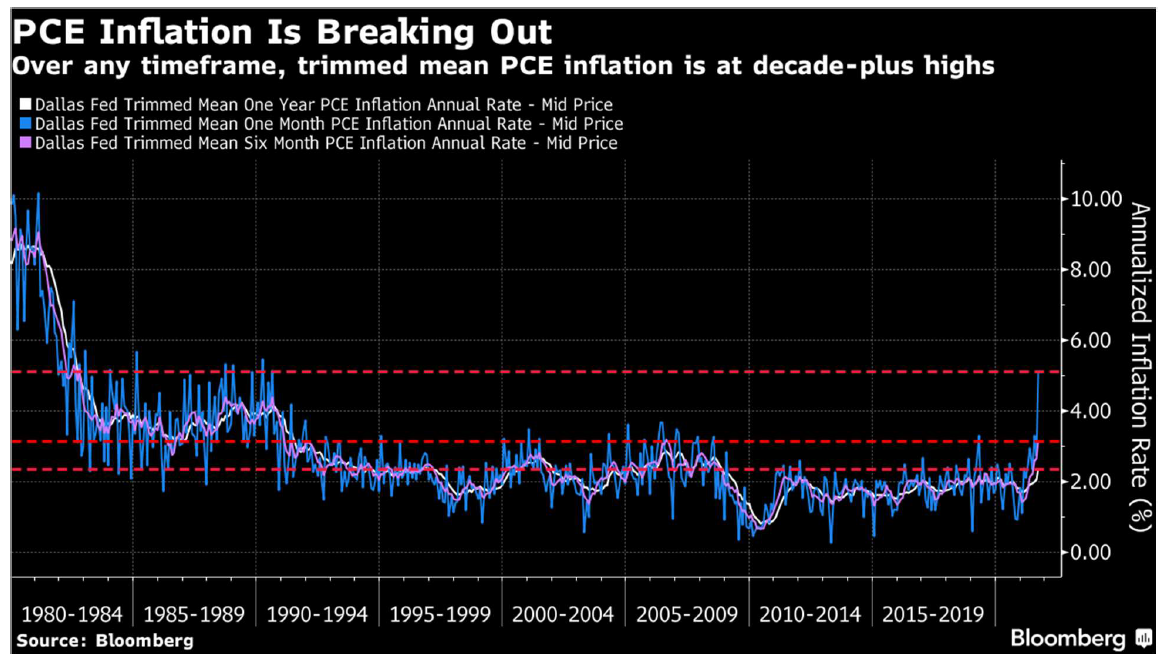

Core PCE - (the Fed's favored inflation measure) has set a new 30-year high. October's reading will be released tomorrow

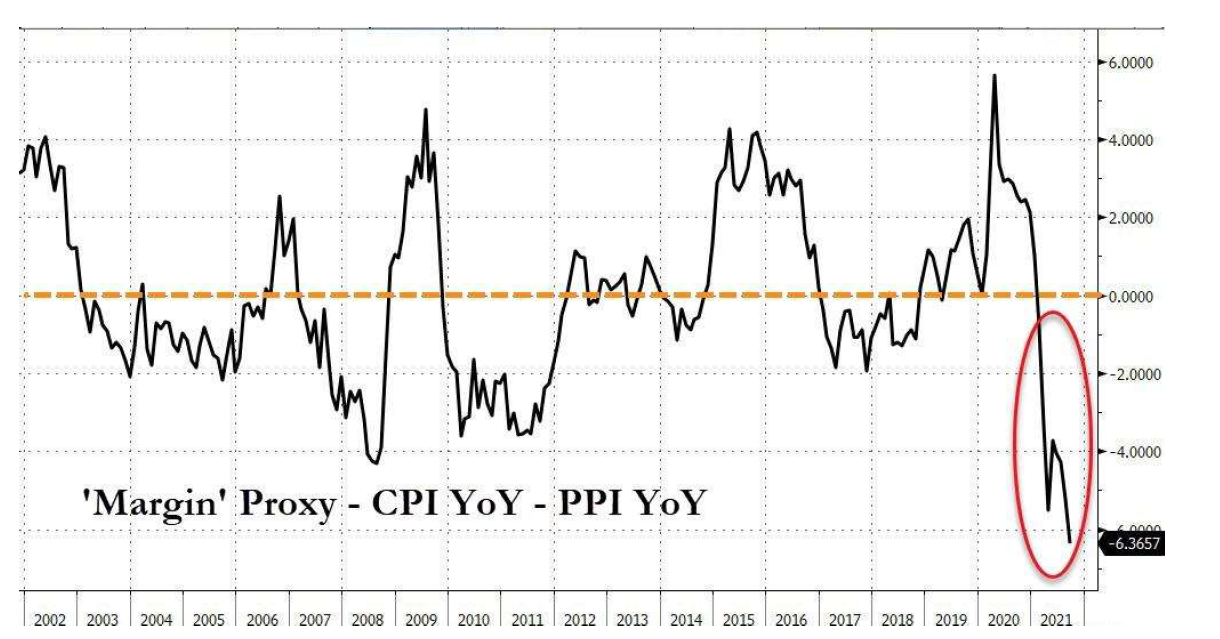

The gap between CPI and PPI is the widest it's been - either consumers are going to get crushed or margins are going to get squeezed. Or a bit of both as what usually happens. Notably, profit margins are at all-time highs

Costco ($200B revenue) recent comments on inflation

Costco CFO 9/24/21 call

"Inflationary factors abound: higher labor costs, higher freight costs, higher transportation demand, along with container shortages and port delays, increased demand in certain product categories, various shortages of everything from computer chips to oils and chemicals, higher commodities prices. It's a lot of fun right now. Some inflationary soundbites, if you will."

from University of North Carolina at Chapel Hill in Reno, NV, USA

from Harvard University in Miami, FL, USA