In the quest for good investments: The industry analysis

April 05, 2022

by an investor from IESE Business School in Calle de Núñez de Balboa, 120, 28006 Madrid, España

In the Search phase, focusing on the correct industries or sectors is key to achieve the desired growth and development of the acquired company. It is true that a good business is a good business, but some sectors will enhance a company's value creation and therefore become a better investment.

Reviewing the industry or sector should be the first step in analysing the different investment alternatives. Industries will positively or negatively affect investments in the future and will also play a very relevant role for shareholders.

Arada Capital Partners looks for several characteristics closely related to each other, the most relevant being the following:

Invest in the correct moment: industry growth and the stage of maturity of the industry.

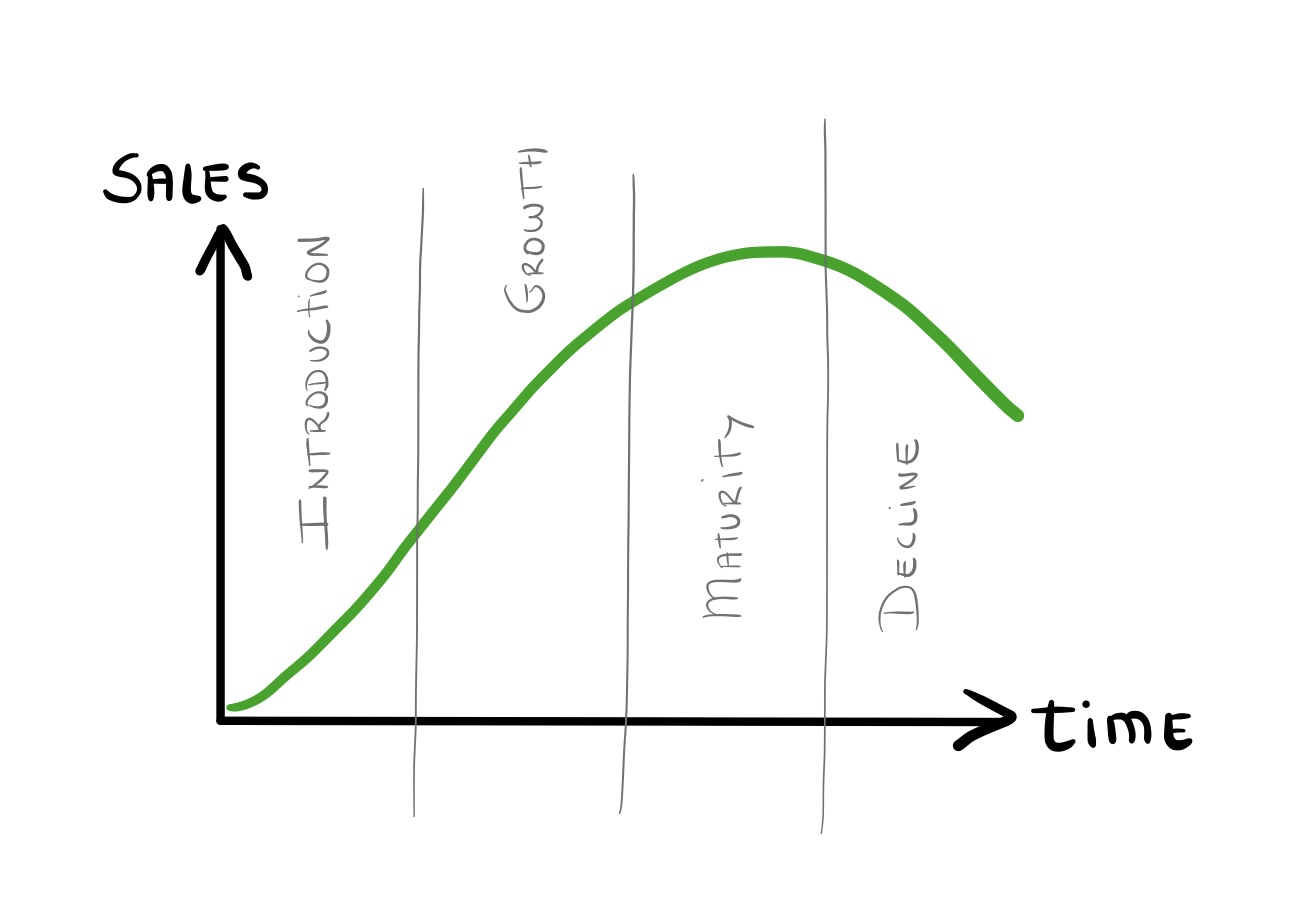

Companies are like sailing ships, it is important to have a tailwind if you want to move fast. The historical and projected growth of the industry is one of the key factors to analyse. All industries evolve through the following stages:

1. Introduction: new and developing industries. Although the competition might be limited, it usually takes some time to establish itself. This first stage is not what we look for in Arada Capital Partners, returns might skyrocket, but the companies tend to be small and more likely to fail.

2. Growth: the industry/ business has proven its viability and the expansion stage begins. In this stage, many new companies will enter the industry and products/ services will improve. It is not easy to differentiate when this stage begins, but Investors reap high reward at low risk since demand outstrips supply.

3. Maturity: rapid growth will fade at this stage, giving way to a period of slower growth and stabilization. Although sales may continue to grow, they will do so at a much slower pace than before. Products will no longer be as innovative but rather standardised and competition will be high because there will be many competitors that were attracted in the growth phase. This does not have to be a bad stage in which to acquire a company, far from it, they are proven businesses in which the viability of the business is more than proven. It will simply be necessary to take into account other characteristics of the sector that ensure that the investment is worthwhile: limited competition, entry barriers, cyclicality...

4. Decline: this stage can be caused by a multitude of variables: changes in the sector or industry, loss of interest in a product, etc. It is sometimes worth questioning sectors facing these decline stages: was the decline inevitable or could have the management of the companies made some decisions that could have changed the outcome?

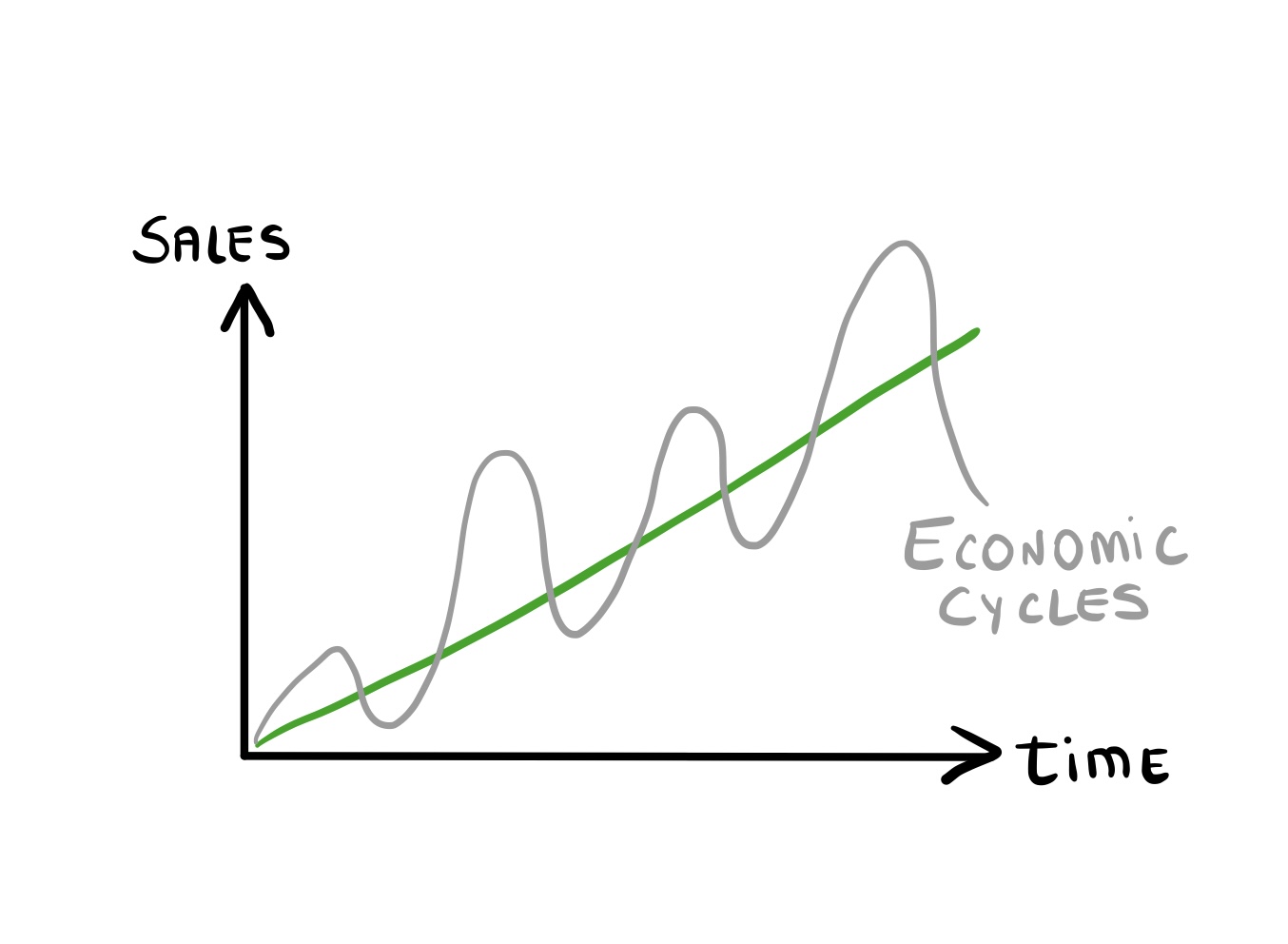

Beware! Cyclical and seasonal industries might be too dangerous for the search fund model

We invest in companies where the management will become the main shareholder and will be part of the advisory committee, ensuring the alignment between all the shareholders and employees. But we must always remember that there will be a NEW management and therefore we all seek to minimize the risks.

Non-cyclical companies will typically be easier to manage, since the challenges that will appear will have less or no exposure to economic cycles

a) Intensity of industry rivalry: many variables must be analysed to better understand the intensity of rivalry within an industry. Note than some variables might be common between various forces of the model:

- Concentration of rivals

- Product homogeneity

- Brand loyalty

- Excess production capacity

- Consumer switching costs

- Network effect

b) Barriers to entry: main factors to analyze:

- High fixed costs

- Economies of scale

- Network effects

- Government regulation

- Specialized skills or equipment needed

c) Bargaining power of clients: this negotiating power will increase when clients are bigger or more concentrated and have good information

- Client concentration

- Client information and coordination

d) Bargaining power of suppliers: this negotiating power will increase when suppliers are bigger or more concentrated and have good information

- Supplier concentration

- Supplier information and coordination

e) Threat of Substitute Goods/Services

- Low switching costs

- Substitutes price differences

- Substitutes attributes differentiation

f) Power of Complementary Good/Service Providers: Complementary goods or services can add value to the existing products in an industry. However, when complements have unattractive features or provide no value to consumers, they can become an issue for the industry by slowing growth and limiting profitability

from INSEAD in Brasília - Brasilia, Federal District, Brazil

in London, UK