How to run your Pre-LOI Investment Analysis in 1 hour (full post - 7 mins read)

January 06, 2026

by a professional from IESE Business School in Amsterdam, Netherlands

BACKGROUND

Pre-LOI investment analysis typically takes 5 to 10 hours spread over 1 to 2 days. In this article, we'll demonstrate how you can run this in less than 1 hour while deepening your analysis and generating more insights to increase upside, mitigate risks, optimize your deal structures and negotiate better.

EXECUTIVE SUMMARY

You can complete your Pre-LOI Investment Analysis within 1 hour by reducing your "Build Time" and "Analysis Time" by 90%:

- Build Time:

Use our Pre-LOI Search Fund LBO which covers 90% of what you'll need for a Pre-LOI deal review (see download link at end of post)

- Analysis Time:

Use the Fontics Excel plug-in which cuts investment analysis in Excel by 90% (read along for applications specific to Search Funds)

We break down the indicative time split for to complete your review within 1 hour

[30 mins]: Extract Key Deal Terms

[10 mins]: Update Pre-LOI LBO

[5 mins]: Identify Main Drivers

[5 mins]: Run Scenarios

[5 mins]: Optimize Deal Structure

[5 mins]: Get Indicative Deal Direction [i.e. to proceed or not]

Note: this article assumes some basic understanding of Finance and Excel

APPROACH

Your Pre-LOI deal analysis basically answers the question: "should I spend more time evaluating this deal"?

Your analysis is split into qualitative (industry, geography, moats etc) and quantitative (deal economics: MOIC, IRR etc). This article focuses on the quantitative analysis.

The goal of your quantitative analysis is to classify a deal as Green, Amber or Red.

- Green: deal looks good "as is". I will proceed with the LOI

- Amber: deal may need some work. If there is potential to fix this without a lot of hassle or risk, I will proceed with the LOI

- Red: deal needs significant modifications to work. Except there is a some arbitrage or other "secrets" I can apply to this, I will not proceed with the LOI.

This mapping helps you save some time / effort down the road. Also, based on a session in November run by a leading Search Fund QoE provider in the North America market, over 90% of QoE reports return with some downward adjustments to EBITDA.

Interpretation: the Pre-LOI EBITDA is probably the most optimistic starting EBITDA of the deal.

STEPS

The Pre-LOI investment analysis will typically take 5 to 10 hours spread over 1 to 2 days. However, we demonstrate how this can be completed within 1 hour while increasing the depth of analysis as well as the quality of insights.

- The LBO model: we have developed a Pre-LOI LBO model that covers 90% of what you require in each deal. The model should work for most deals with little to no modification.

- Analysis: mostly falls into a 3 buckets: identifying the major drivers of risk and return, running sensitivity analysis, and building scenarios (base, upside and downside cases). With Fontics, you can evaluate all these in minutes.

Now the work begins!

1. Extract Key Deal Terms:

Extract items like EBITDA, Revenue Growth, Depreciation, Capex, Debt, etc from the teaser. This should take < 30 minutes.

2. Update Pre-LOI LBO:

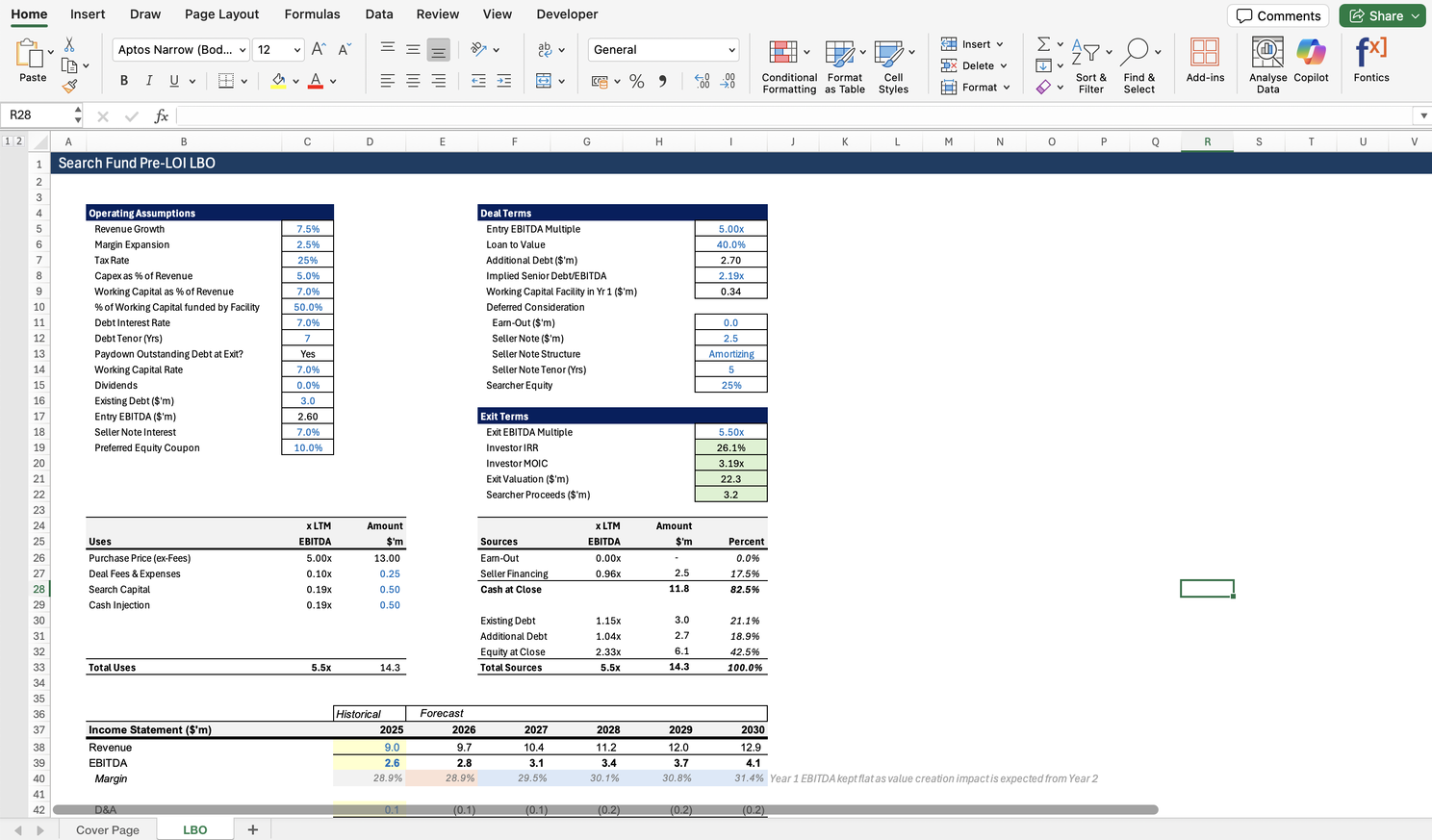

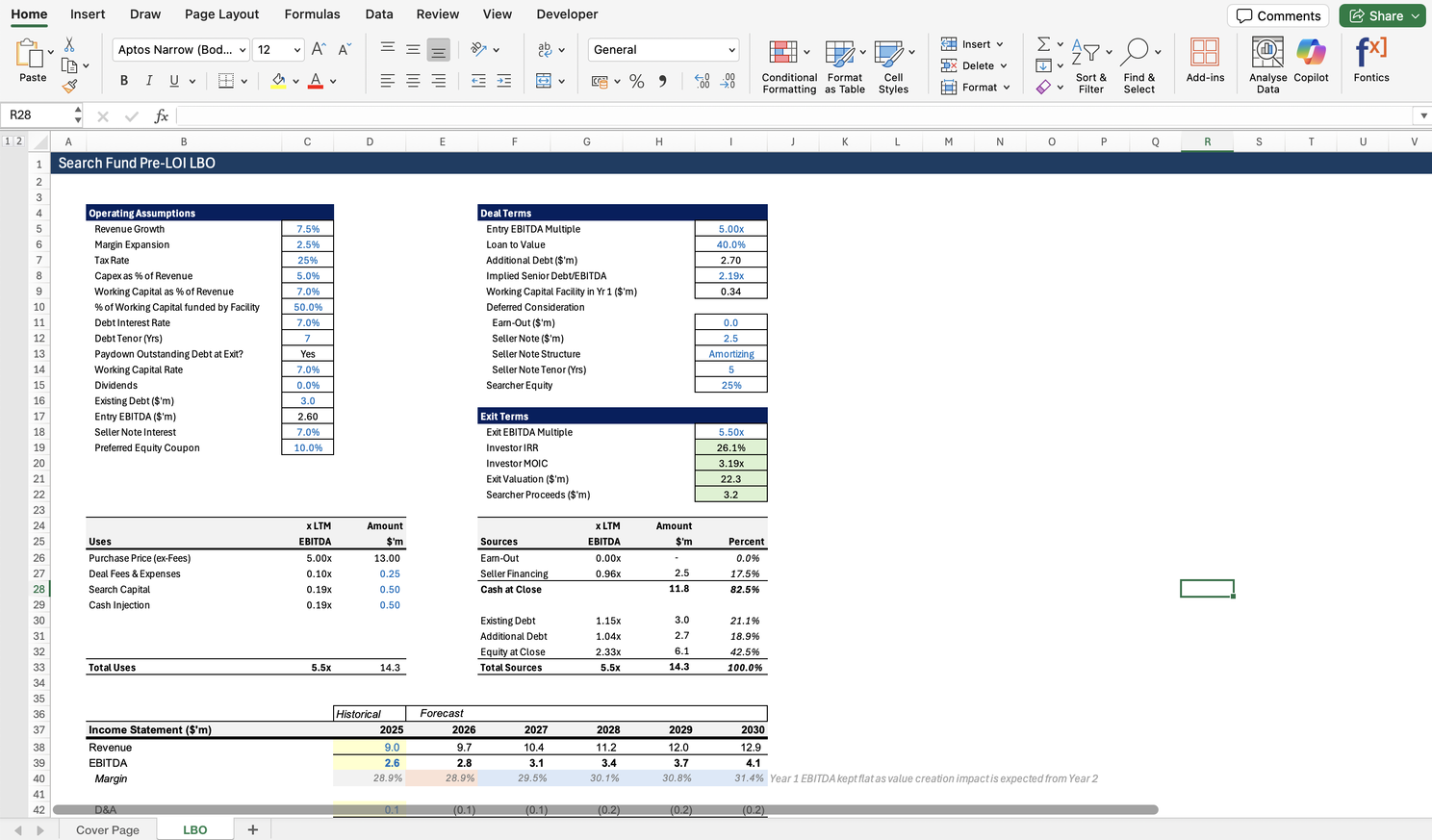

Update the relevant sections of the LBO (in blue text) which is a blend of deal parameters and market-specific nuances like multiples, interest rates, seller note, earn-outs etc. This should take < 10 minutes  Fig 1: Pre-LOI LBO (Available for FREE) - see download link at end of post

3. Identify Main Drivers:

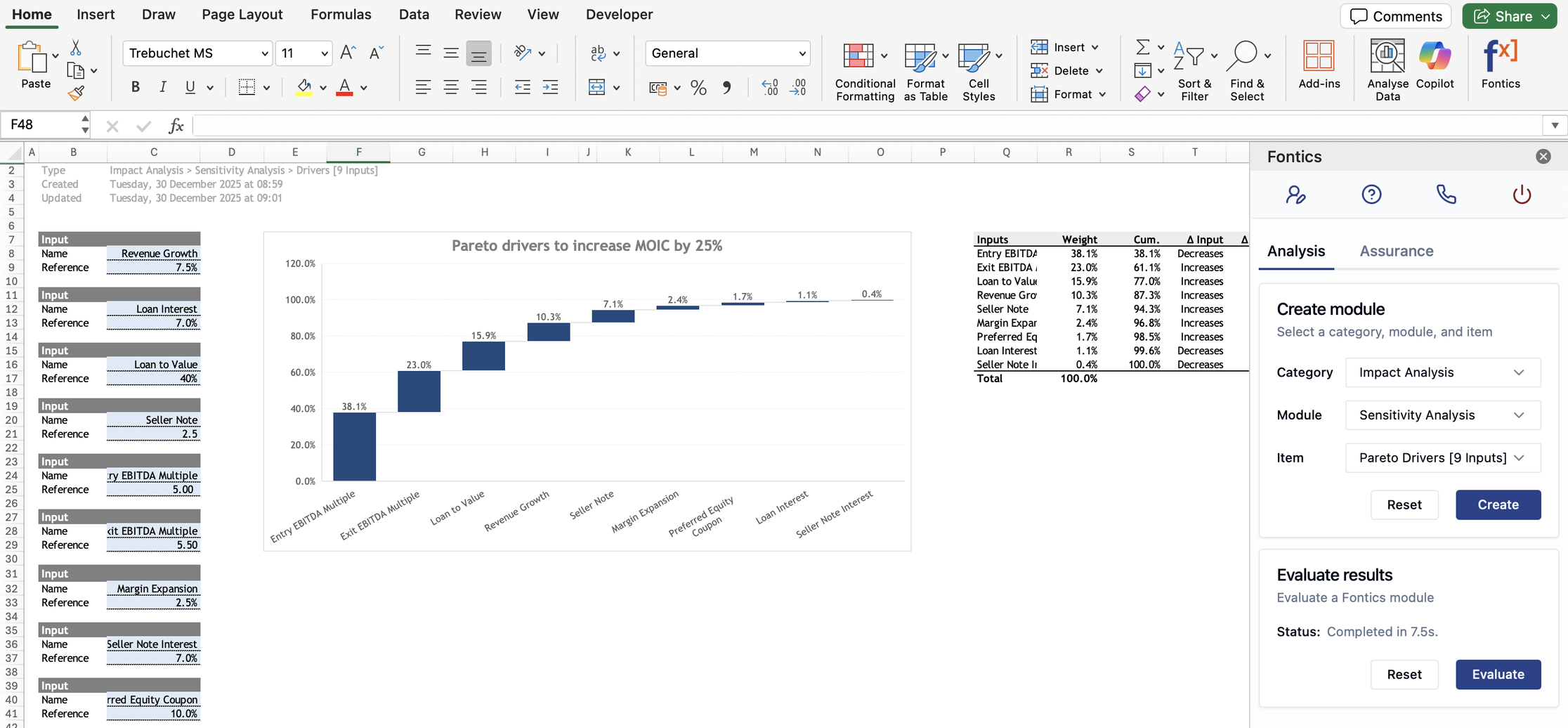

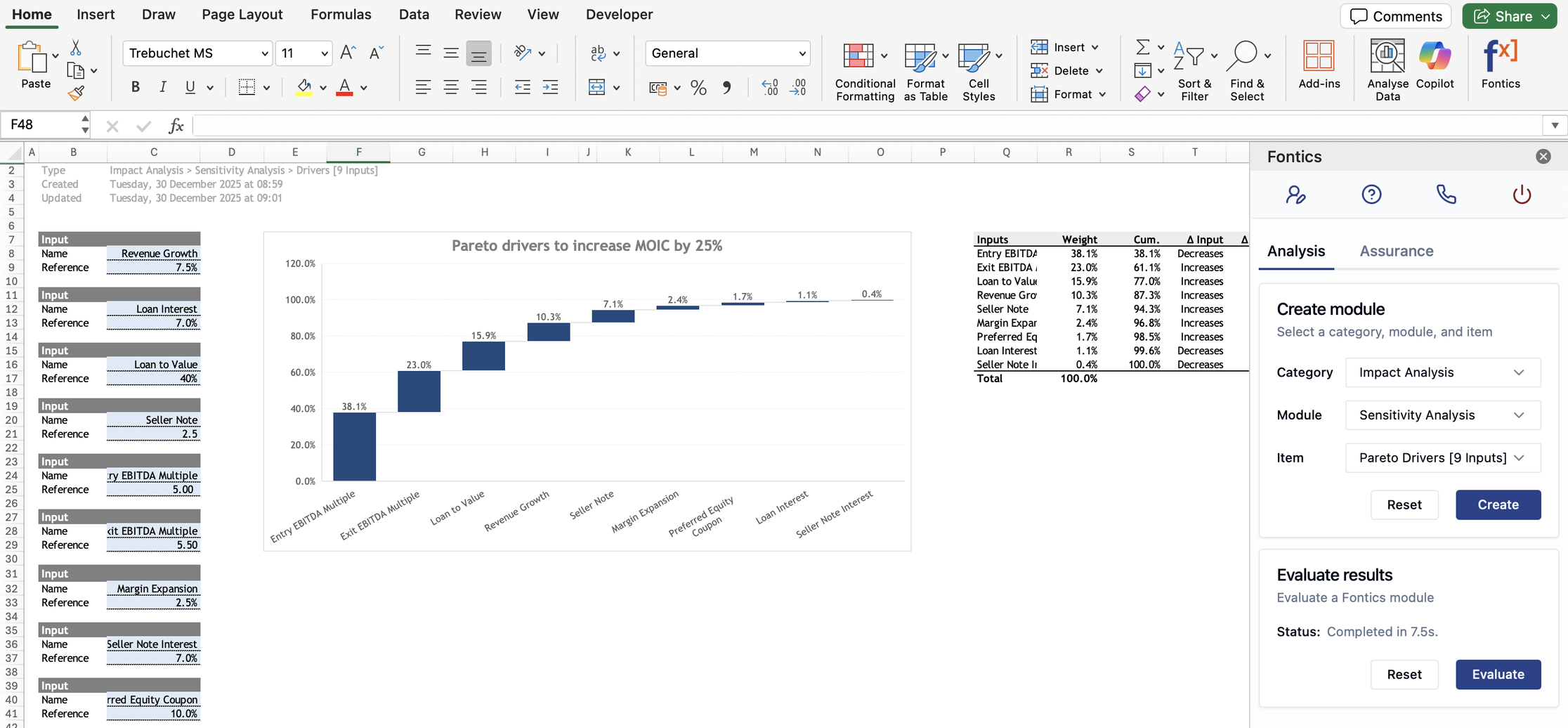

What are the primary drivers of risks and upside for this deal? The old way: using Excel only, this may take 1 hour+. With Fontics, you can run this in < 5 minutes using the Pareto Drivers module.

Fig 1: Pre-LOI LBO (Available for FREE) - see download link at end of post

3. Identify Main Drivers:

What are the primary drivers of risks and upside for this deal? The old way: using Excel only, this may take 1 hour+. With Fontics, you can run this in < 5 minutes using the Pareto Drivers module.

Fig 2: Fontics Pareto Drivers Module

Interpretation: in this example, 5 inputs drive 90%+ of the MOIC increase. You can focus on the top 3 to 5 in your scenario analysis, deal structuring and negotiations.

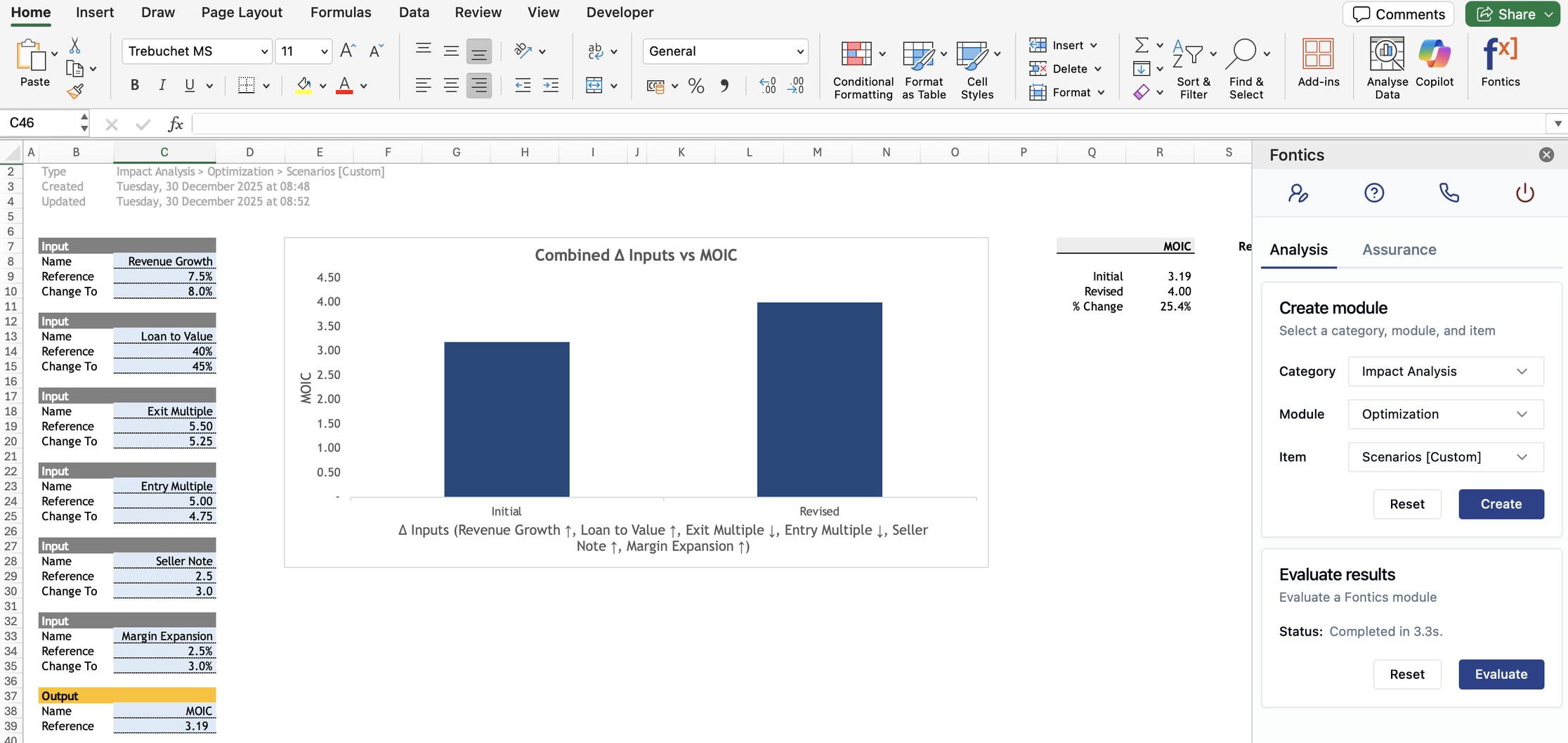

4. Run Scenarios:

Create base, upside and downside cases.

The old way: creating 3 cases for 10+ parameters and a toggle. This is limiting, prone to errors and does not make the main drivers obvious, their weights or the changes driving the cases (increase or decrease inputs). This will typically take 1 hour+.

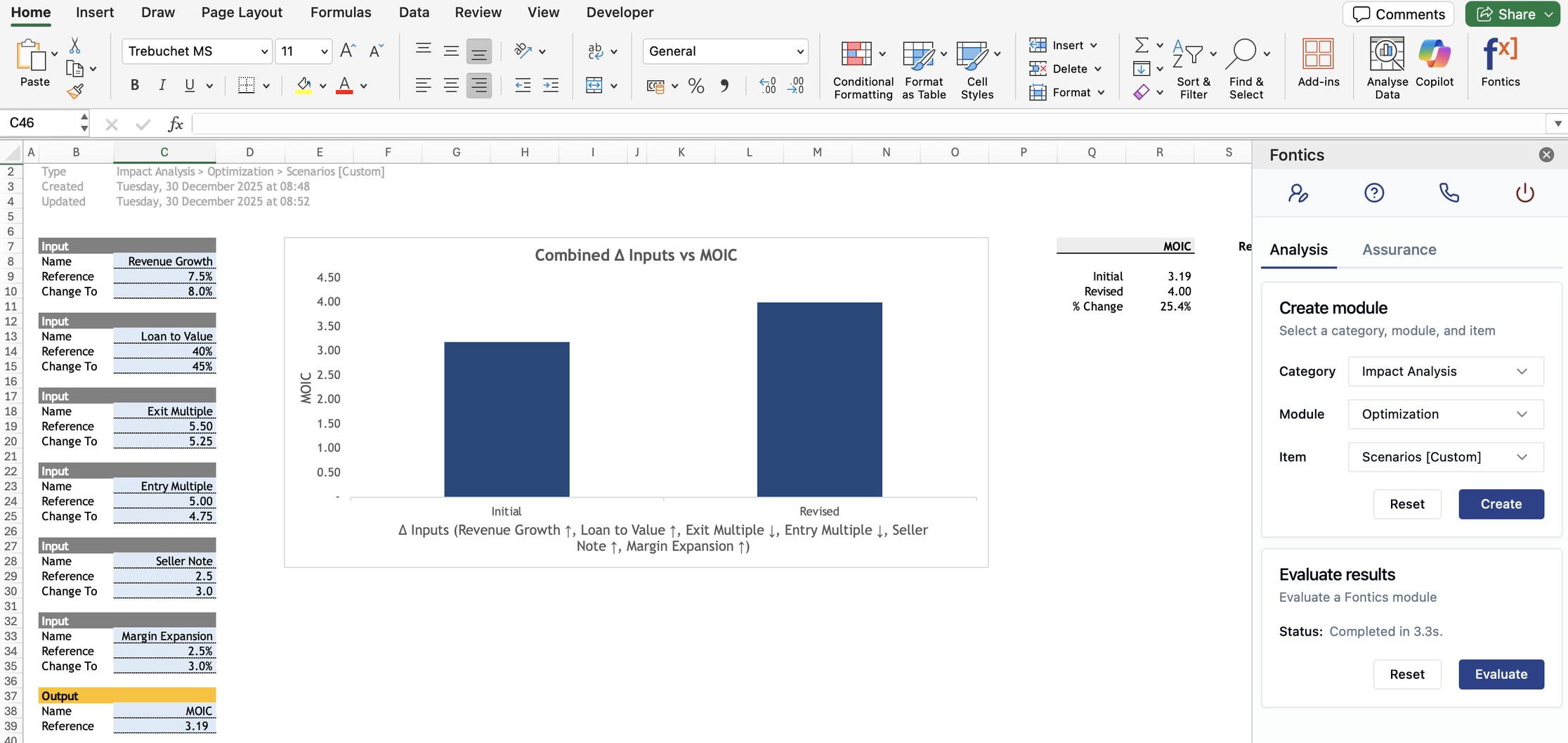

With Fontics, you can run 10+ scenarios on the main drivers in < 5 mins using the Optimize - Scenarios module

Fig 2: Fontics Pareto Drivers Module

Interpretation: in this example, 5 inputs drive 90%+ of the MOIC increase. You can focus on the top 3 to 5 in your scenario analysis, deal structuring and negotiations.

4. Run Scenarios:

Create base, upside and downside cases.

The old way: creating 3 cases for 10+ parameters and a toggle. This is limiting, prone to errors and does not make the main drivers obvious, their weights or the changes driving the cases (increase or decrease inputs). This will typically take 1 hour+.

With Fontics, you can run 10+ scenarios on the main drivers in < 5 mins using the Optimize - Scenarios module

Fig 3: Fontics Optimize - Scenarios Module

Interpretation: you can change the value of each parameter and within 5 seconds, get a before and after chart and % change of MOIC (or IRR etc as the case may be). This truncates the scenario analysis process from hours to minutes and you'll never have to manually manage toggles again.

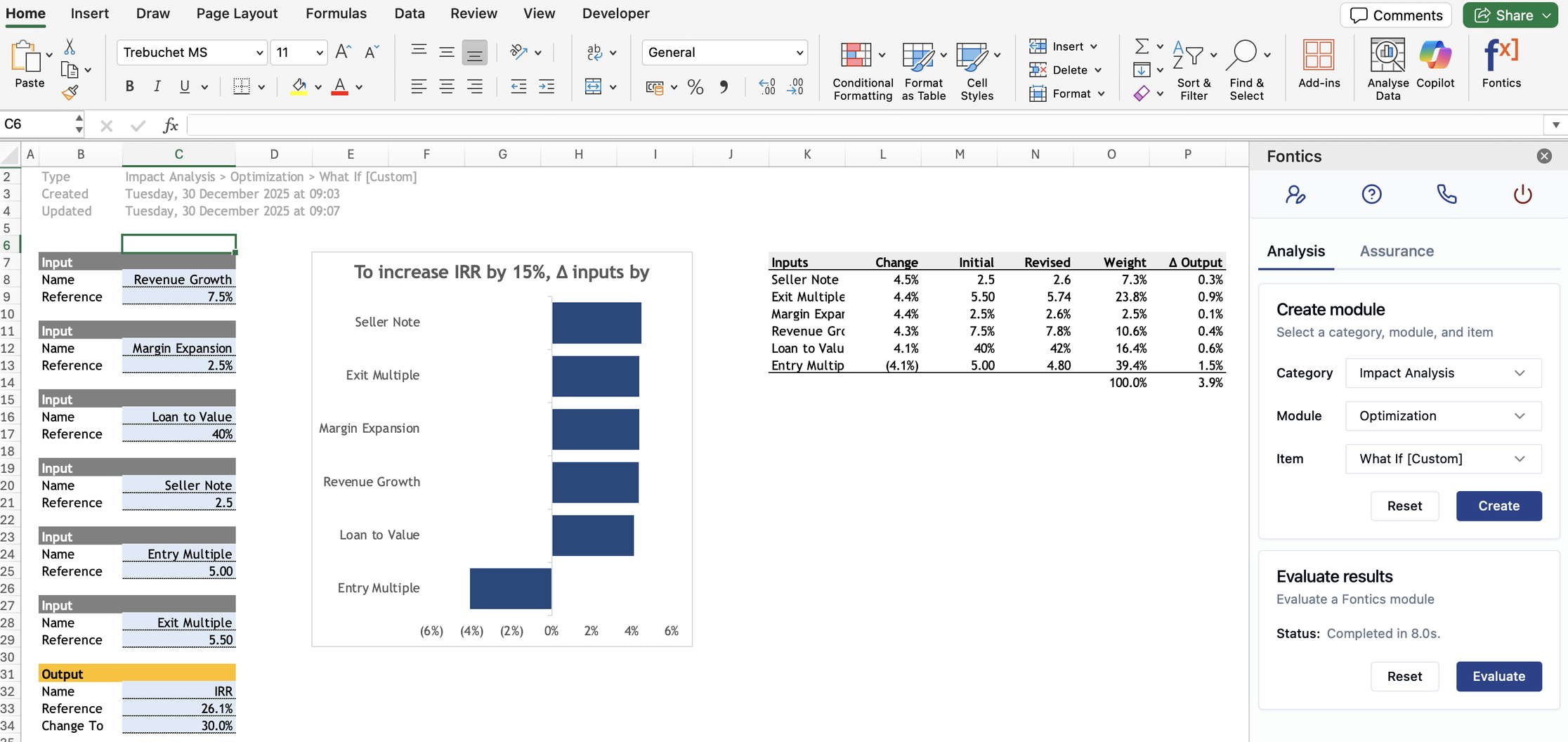

5. Optimize Deal Structure:

You tweak the parameters to see what you can improve and how it impacts your deal economics. E.g. seller financing structure, earn outs, bank debt, margin expansion etc. The old way: this may take you 1 hr+ to iterate on these parameters. With Fontics once you can change the parameters on your model and re-run your scenarios within seconds, enabling you to analyze as fast as you think.

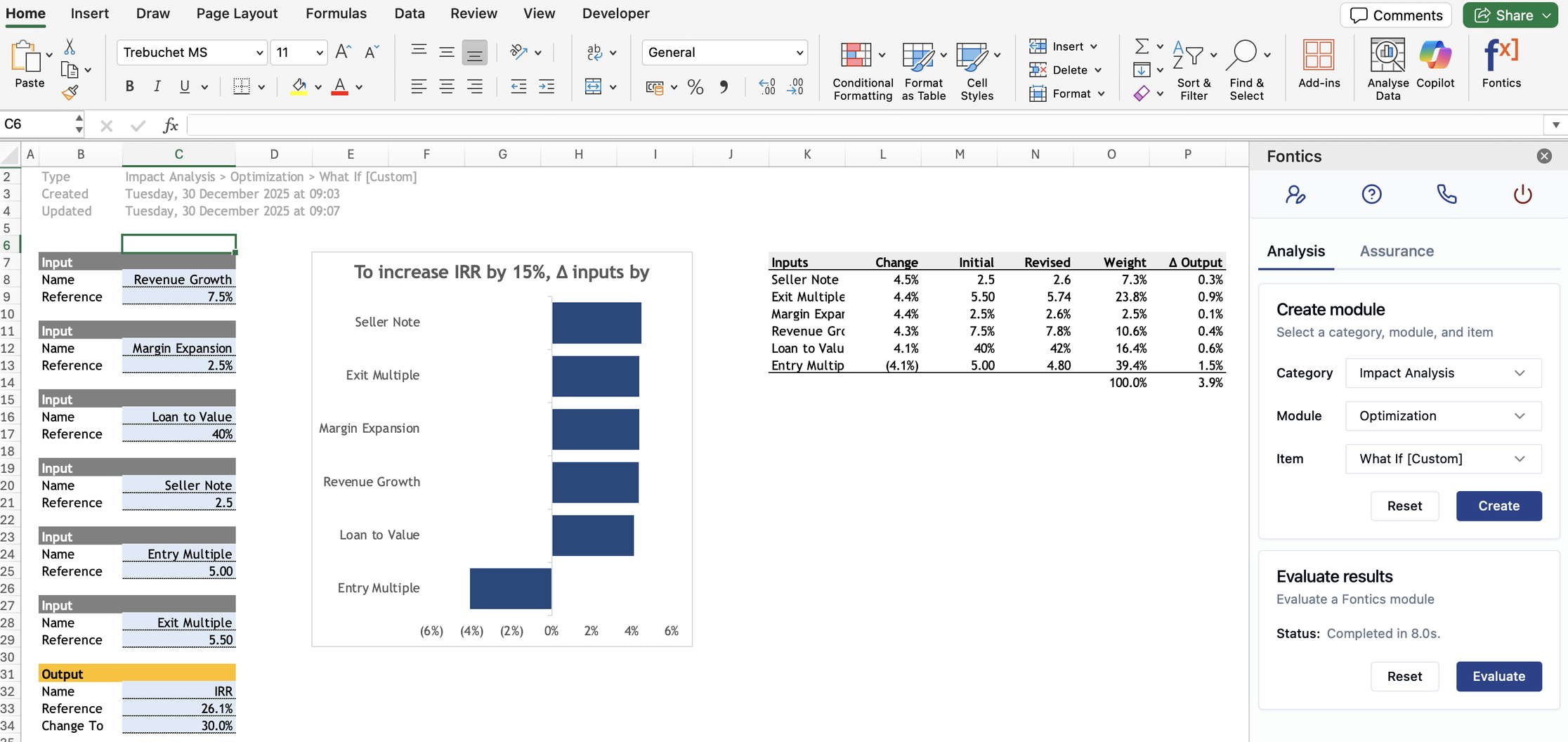

The Optimize - Scenarios module works for this, and you can also backsolve to your answer using the Optimize - What-If module to answer the question: i.e. what changes can I make to my main drivers simultaneously to improve my deal economics?

Fig 3: Fontics Optimize - Scenarios Module

Interpretation: you can change the value of each parameter and within 5 seconds, get a before and after chart and % change of MOIC (or IRR etc as the case may be). This truncates the scenario analysis process from hours to minutes and you'll never have to manually manage toggles again.

5. Optimize Deal Structure:

You tweak the parameters to see what you can improve and how it impacts your deal economics. E.g. seller financing structure, earn outs, bank debt, margin expansion etc. The old way: this may take you 1 hr+ to iterate on these parameters. With Fontics once you can change the parameters on your model and re-run your scenarios within seconds, enabling you to analyze as fast as you think.

The Optimize - Scenarios module works for this, and you can also backsolve to your answer using the Optimize - What-If module to answer the question: i.e. what changes can I make to my main drivers simultaneously to improve my deal economics?

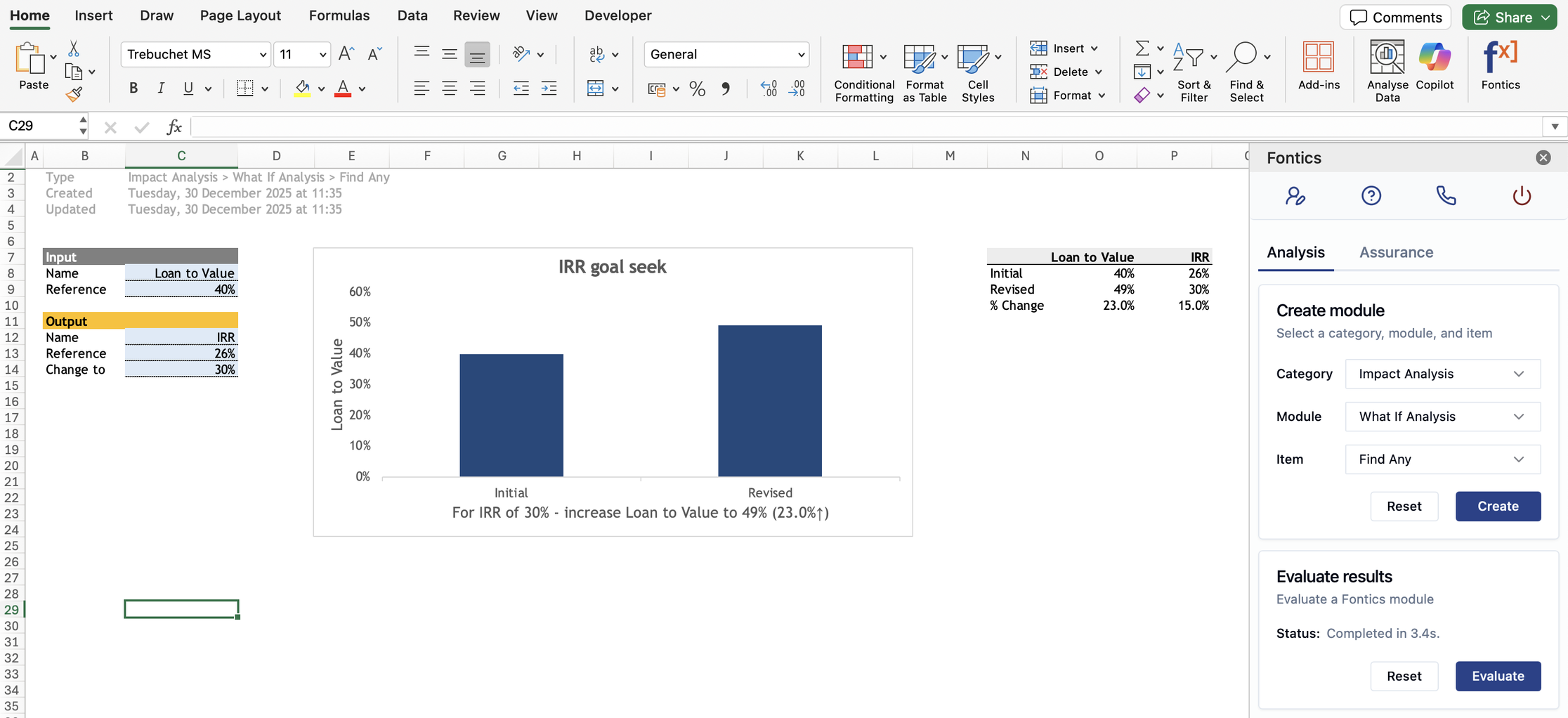

Fig 4: Fontics Optimize - What-If Module

Interpretation: simultaneous backsolve was not possible previously in Excel. Fontics makes it possible. Increasing your IRR from 26% to 30% requires less than a 5% change across your major drivers (some will increase, others will decrease) which simplifies deal structuring, risk management and negotiations.

6. Get Indicative Deal Direction:

By reducing your typical quantitative deal review time from 1 to 2 days to < 1 hour, you can iterate faster, identify the main drivers of risks and upside, evaluate what could work for your or not, and have the relevant levers to negotiate with the seller. E.g. if your deal can only work at 15% revenue growth or 60% loan to value and 10% margin expansion, it is probably a red deal.

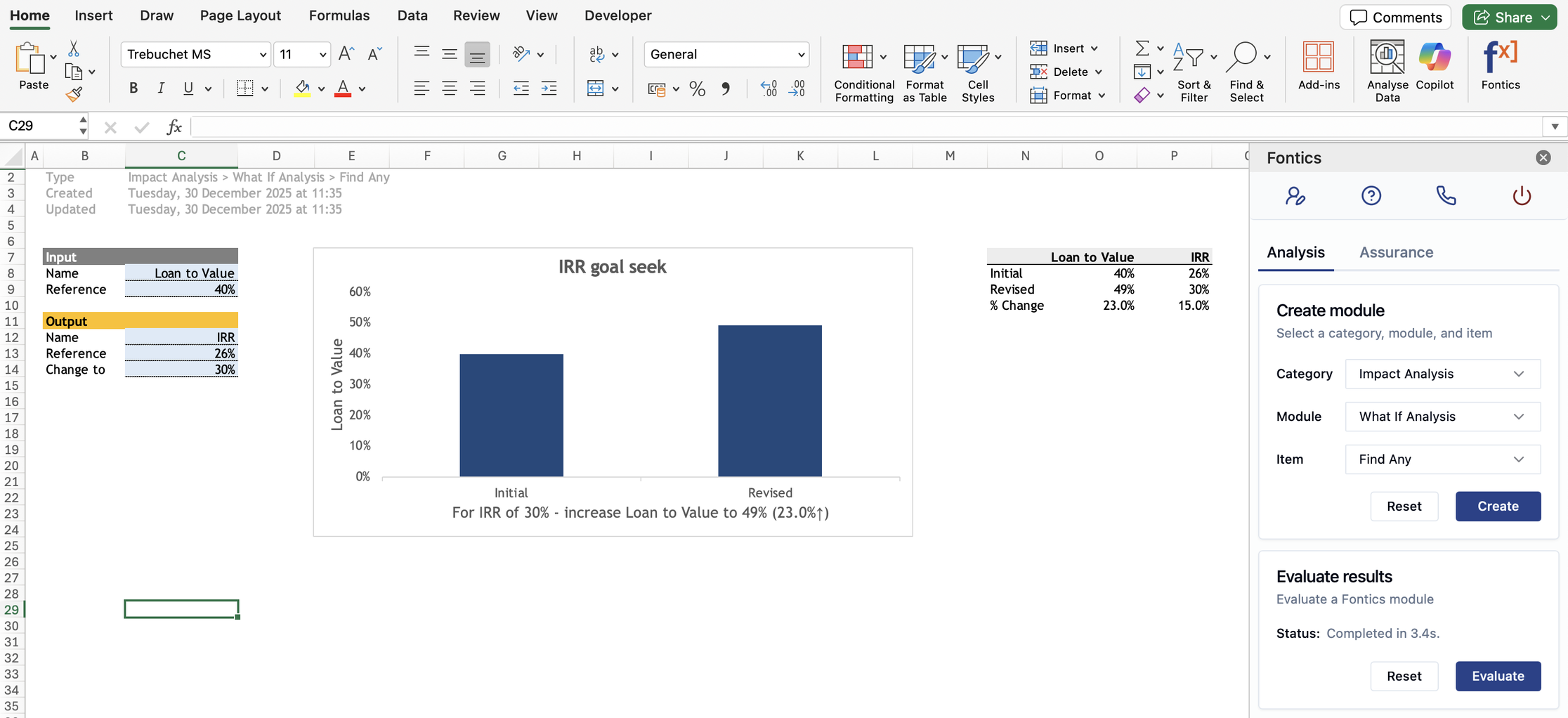

Additional analysis

You can run What-If analysis in < 30s with automatically visualized before and after chart (see below). Unlike traditional Excel which restricts goal seek to only static cells, Fontics can use any cell in your model (including formula cells) for goal seek. E.g. could be what Year 5 EBITDA value will improve my IRR to 30% or what revenue in Year 3 will drive EBITDA of $4.5m in year 5?

Fig 4: Fontics Optimize - What-If Module

Interpretation: simultaneous backsolve was not possible previously in Excel. Fontics makes it possible. Increasing your IRR from 26% to 30% requires less than a 5% change across your major drivers (some will increase, others will decrease) which simplifies deal structuring, risk management and negotiations.

6. Get Indicative Deal Direction:

By reducing your typical quantitative deal review time from 1 to 2 days to < 1 hour, you can iterate faster, identify the main drivers of risks and upside, evaluate what could work for your or not, and have the relevant levers to negotiate with the seller. E.g. if your deal can only work at 15% revenue growth or 60% loan to value and 10% margin expansion, it is probably a red deal.

Additional analysis

You can run What-If analysis in < 30s with automatically visualized before and after chart (see below). Unlike traditional Excel which restricts goal seek to only static cells, Fontics can use any cell in your model (including formula cells) for goal seek. E.g. could be what Year 5 EBITDA value will improve my IRR to 30% or what revenue in Year 3 will drive EBITDA of $4.5m in year 5?

Fig 5: Fontics What-If Find Any Module

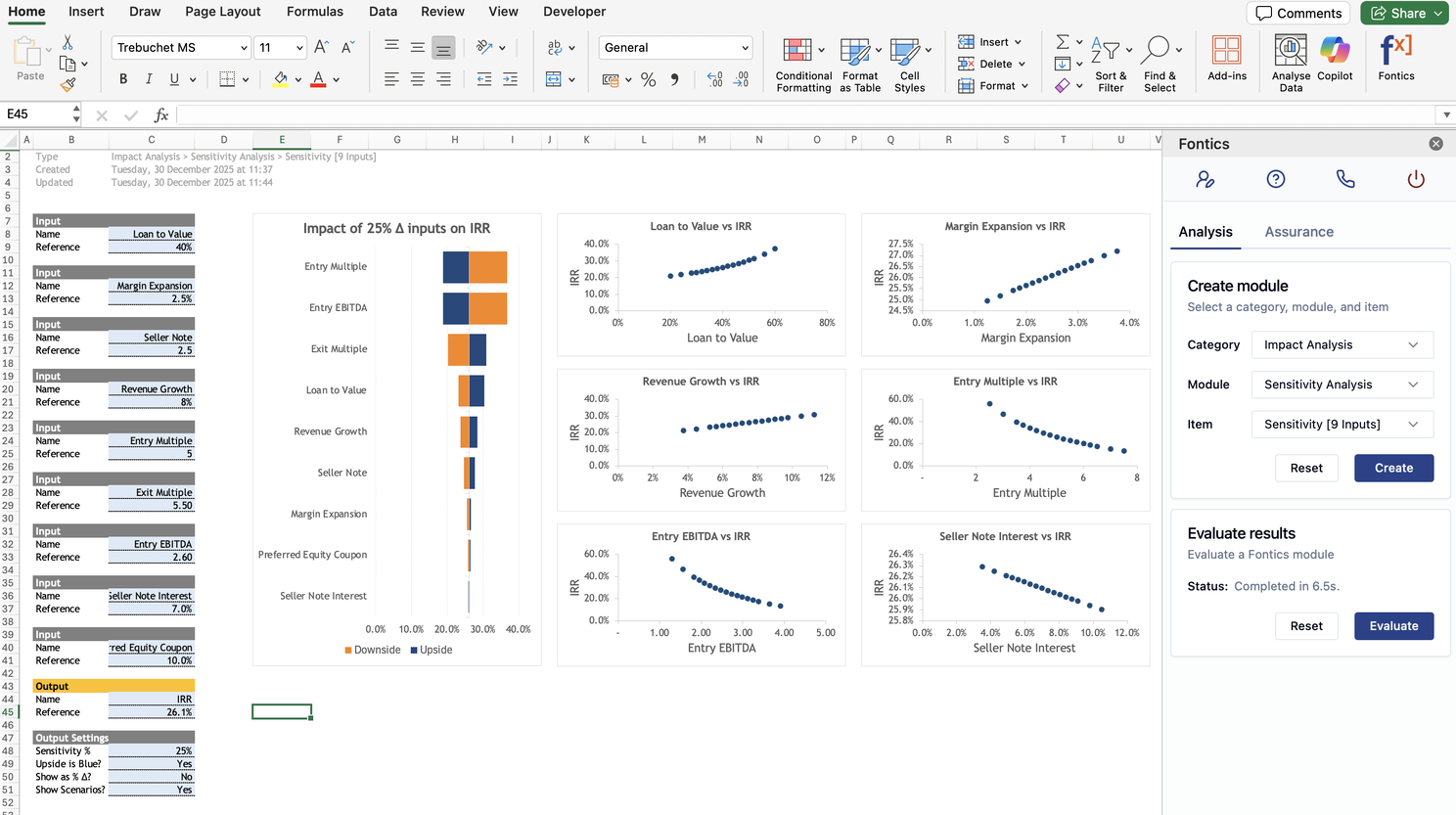

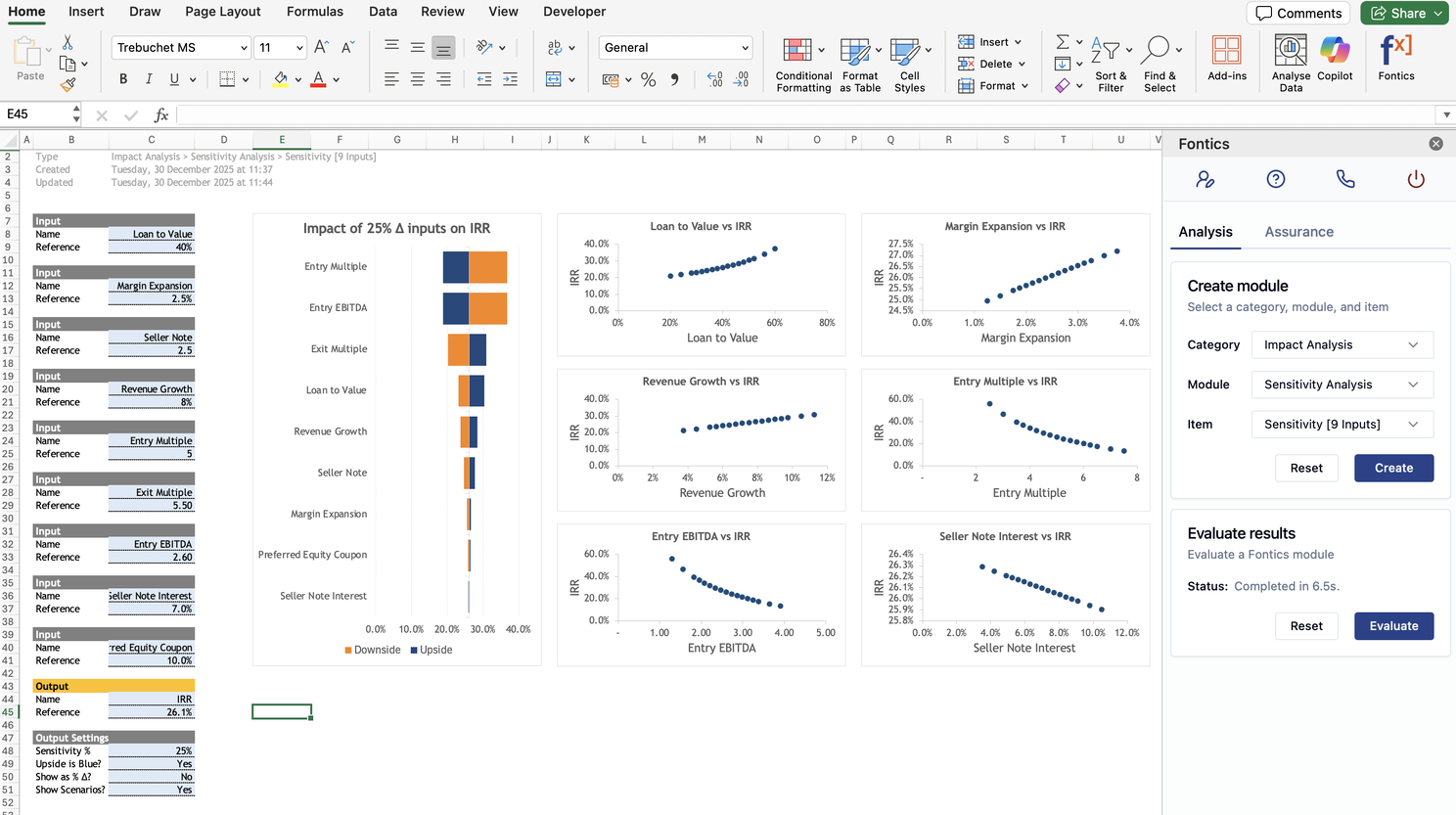

You can also run the classic Sensitivity Analysis (Tornado Charts) with 100+ individual input scenarios in < 2 mins.

Fig 5: Fontics What-If Find Any Module

You can also run the classic Sensitivity Analysis (Tornado Charts) with 100+ individual input scenarios in < 2 mins.

Fig 6: Fontics Sensitivity Analysis Module

CLOSING

Fontics accelerates your deal review cycle, and speeds up your Pre-LOI investment analysis by 10x,, and reduces this from days to < 1 hour. It unlocks analysis that where challenging or impossible to run in Excel, and provides levers to improve upside, protect your downside and negotiate better.

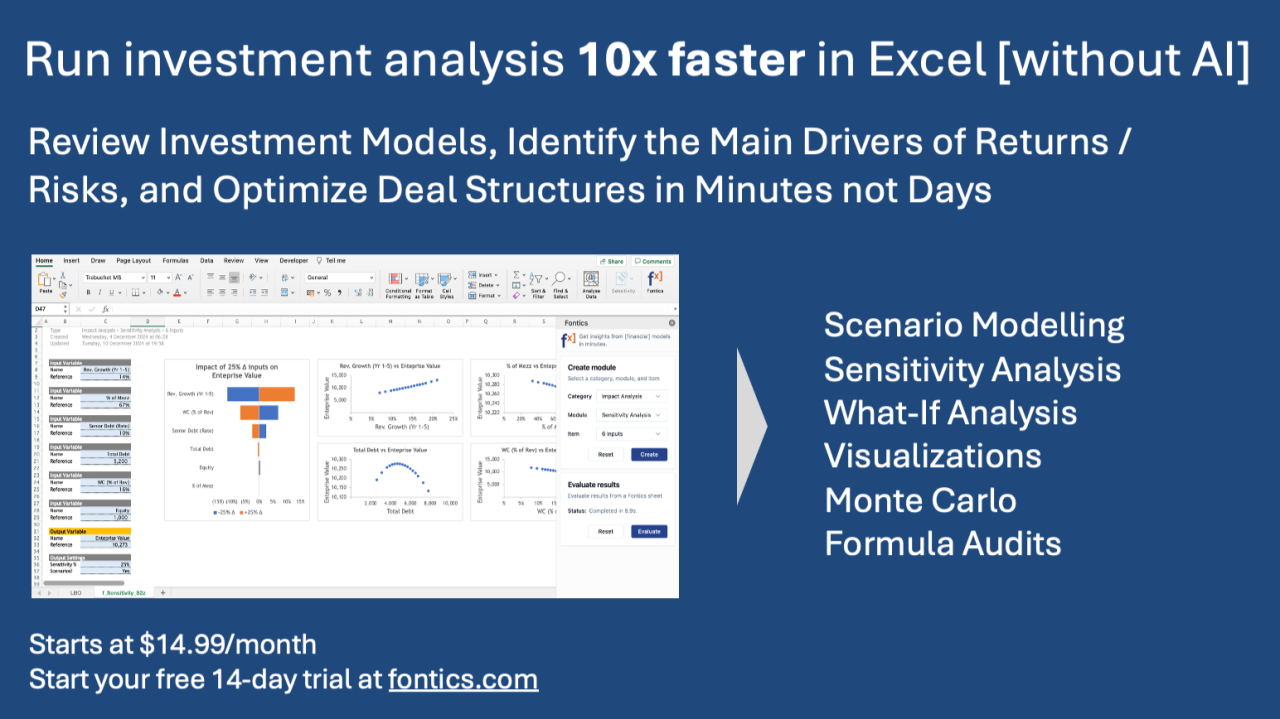

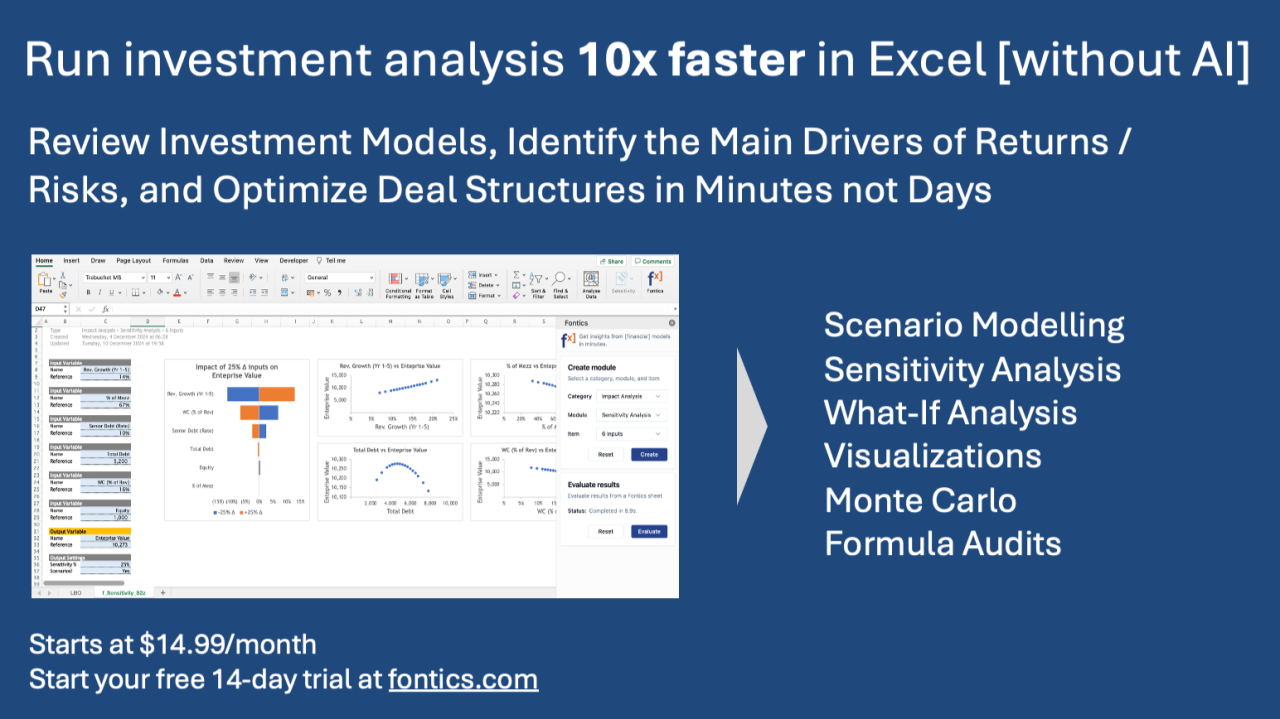

About Fontics: Fontics is an Excel plug-in to run investment analysis 10x faster in Excel. All calculations are deterministic and does not use AI. With Fontics, you can review investment models, identify the main drivers of returns / risk and optimize deal structure in minutes not days. It has 25+ modules including Scenario Analysis, Sensitivity Analysis, What-If Analysis, Visualizations, Monte Carlo Simulations and Model Audits.

Fig 6: Fontics Sensitivity Analysis Module

CLOSING

Fontics accelerates your deal review cycle, and speeds up your Pre-LOI investment analysis by 10x,, and reduces this from days to < 1 hour. It unlocks analysis that where challenging or impossible to run in Excel, and provides levers to improve upside, protect your downside and negotiate better.

About Fontics: Fontics is an Excel plug-in to run investment analysis 10x faster in Excel. All calculations are deterministic and does not use AI. With Fontics, you can review investment models, identify the main drivers of returns / risk and optimize deal structure in minutes not days. It has 25+ modules including Scenario Analysis, Sensitivity Analysis, What-If Analysis, Visualizations, Monte Carlo Simulations and Model Audits.

Fig 7: About Fontics

Note: Fontics is extremely valuable in the Post-LOI deal analysis, when you build your expanded LBO (if you need one) and can help you think through deal structures and provide levers for negotiation, but will not replace professional market-specific deal structuring advice from your financial advisor and your financial due diligence via your QoE.

Download the Search Fund Pre-LOI LBO (with the samples presented above via): https://fontics.com/p/sample?model=SF_LBO

You'll need a Fontics account to re-run the samples or to create and evaluate more modules. You can learn more and start your free 14-day trial at https://fontics.com

For Search Fund analysis, we recommend the Standard Plan (which supports scenario iteration across 6 assumptions). However, we also replicated the samples using the Trial Plan (i.e. Lite Plan which supports scenario iteration across 3 assumptions). Plans are backward compatible!

Fontics is super easy to install and use. But happy to chat 1:1 if you have any questions or need a custom onboarding [for Searchers or Financial Advisors]

Happy to hear your thoughts, suggestions and questions.

Fig 7: About Fontics

Note: Fontics is extremely valuable in the Post-LOI deal analysis, when you build your expanded LBO (if you need one) and can help you think through deal structures and provide levers for negotiation, but will not replace professional market-specific deal structuring advice from your financial advisor and your financial due diligence via your QoE.

Download the Search Fund Pre-LOI LBO (with the samples presented above via): https://fontics.com/p/sample?model=SF_LBO

You'll need a Fontics account to re-run the samples or to create and evaluate more modules. You can learn more and start your free 14-day trial at https://fontics.com

For Search Fund analysis, we recommend the Standard Plan (which supports scenario iteration across 6 assumptions). However, we also replicated the samples using the Trial Plan (i.e. Lite Plan which supports scenario iteration across 3 assumptions). Plans are backward compatible!

Fontics is super easy to install and use. But happy to chat 1:1 if you have any questions or need a custom onboarding [for Searchers or Financial Advisors]

Happy to hear your thoughts, suggestions and questions.

Fig 1: Pre-LOI LBO (Available for FREE) - see download link at end of post

3. Identify Main Drivers:

What are the primary drivers of risks and upside for this deal? The old way: using Excel only, this may take 1 hour+. With Fontics, you can run this in < 5 minutes using the Pareto Drivers module.

Fig 1: Pre-LOI LBO (Available for FREE) - see download link at end of post

3. Identify Main Drivers:

What are the primary drivers of risks and upside for this deal? The old way: using Excel only, this may take 1 hour+. With Fontics, you can run this in < 5 minutes using the Pareto Drivers module.

Fig 2: Fontics Pareto Drivers Module

Interpretation: in this example, 5 inputs drive 90%+ of the MOIC increase. You can focus on the top 3 to 5 in your scenario analysis, deal structuring and negotiations.

4. Run Scenarios:

Create base, upside and downside cases.

The old way: creating 3 cases for 10+ parameters and a toggle. This is limiting, prone to errors and does not make the main drivers obvious, their weights or the changes driving the cases (increase or decrease inputs). This will typically take 1 hour+.

With Fontics, you can run 10+ scenarios on the main drivers in < 5 mins using the Optimize - Scenarios module

Fig 2: Fontics Pareto Drivers Module

Interpretation: in this example, 5 inputs drive 90%+ of the MOIC increase. You can focus on the top 3 to 5 in your scenario analysis, deal structuring and negotiations.

4. Run Scenarios:

Create base, upside and downside cases.

The old way: creating 3 cases for 10+ parameters and a toggle. This is limiting, prone to errors and does not make the main drivers obvious, their weights or the changes driving the cases (increase or decrease inputs). This will typically take 1 hour+.

With Fontics, you can run 10+ scenarios on the main drivers in < 5 mins using the Optimize - Scenarios module

Fig 3: Fontics Optimize - Scenarios Module

Interpretation: you can change the value of each parameter and within 5 seconds, get a before and after chart and % change of MOIC (or IRR etc as the case may be). This truncates the scenario analysis process from hours to minutes and you'll never have to manually manage toggles again.

5. Optimize Deal Structure:

You tweak the parameters to see what you can improve and how it impacts your deal economics. E.g. seller financing structure, earn outs, bank debt, margin expansion etc. The old way: this may take you 1 hr+ to iterate on these parameters. With Fontics once you can change the parameters on your model and re-run your scenarios within seconds, enabling you to analyze as fast as you think.

The Optimize - Scenarios module works for this, and you can also backsolve to your answer using the Optimize - What-If module to answer the question: i.e. what changes can I make to my main drivers simultaneously to improve my deal economics?

Fig 3: Fontics Optimize - Scenarios Module

Interpretation: you can change the value of each parameter and within 5 seconds, get a before and after chart and % change of MOIC (or IRR etc as the case may be). This truncates the scenario analysis process from hours to minutes and you'll never have to manually manage toggles again.

5. Optimize Deal Structure:

You tweak the parameters to see what you can improve and how it impacts your deal economics. E.g. seller financing structure, earn outs, bank debt, margin expansion etc. The old way: this may take you 1 hr+ to iterate on these parameters. With Fontics once you can change the parameters on your model and re-run your scenarios within seconds, enabling you to analyze as fast as you think.

The Optimize - Scenarios module works for this, and you can also backsolve to your answer using the Optimize - What-If module to answer the question: i.e. what changes can I make to my main drivers simultaneously to improve my deal economics?

Fig 4: Fontics Optimize - What-If Module

Interpretation: simultaneous backsolve was not possible previously in Excel. Fontics makes it possible. Increasing your IRR from 26% to 30% requires less than a 5% change across your major drivers (some will increase, others will decrease) which simplifies deal structuring, risk management and negotiations.

6. Get Indicative Deal Direction:

By reducing your typical quantitative deal review time from 1 to 2 days to < 1 hour, you can iterate faster, identify the main drivers of risks and upside, evaluate what could work for your or not, and have the relevant levers to negotiate with the seller. E.g. if your deal can only work at 15% revenue growth or 60% loan to value and 10% margin expansion, it is probably a red deal.

Additional analysis

You can run What-If analysis in < 30s with automatically visualized before and after chart (see below). Unlike traditional Excel which restricts goal seek to only static cells, Fontics can use any cell in your model (including formula cells) for goal seek. E.g. could be what Year 5 EBITDA value will improve my IRR to 30% or what revenue in Year 3 will drive EBITDA of $4.5m in year 5?

Fig 4: Fontics Optimize - What-If Module

Interpretation: simultaneous backsolve was not possible previously in Excel. Fontics makes it possible. Increasing your IRR from 26% to 30% requires less than a 5% change across your major drivers (some will increase, others will decrease) which simplifies deal structuring, risk management and negotiations.

6. Get Indicative Deal Direction:

By reducing your typical quantitative deal review time from 1 to 2 days to < 1 hour, you can iterate faster, identify the main drivers of risks and upside, evaluate what could work for your or not, and have the relevant levers to negotiate with the seller. E.g. if your deal can only work at 15% revenue growth or 60% loan to value and 10% margin expansion, it is probably a red deal.

Additional analysis

You can run What-If analysis in < 30s with automatically visualized before and after chart (see below). Unlike traditional Excel which restricts goal seek to only static cells, Fontics can use any cell in your model (including formula cells) for goal seek. E.g. could be what Year 5 EBITDA value will improve my IRR to 30% or what revenue in Year 3 will drive EBITDA of $4.5m in year 5?

Fig 5: Fontics What-If Find Any Module

You can also run the classic Sensitivity Analysis (Tornado Charts) with 100+ individual input scenarios in < 2 mins.

Fig 5: Fontics What-If Find Any Module

You can also run the classic Sensitivity Analysis (Tornado Charts) with 100+ individual input scenarios in < 2 mins.

Fig 6: Fontics Sensitivity Analysis Module

CLOSING

Fontics accelerates your deal review cycle, and speeds up your Pre-LOI investment analysis by 10x,, and reduces this from days to < 1 hour. It unlocks analysis that where challenging or impossible to run in Excel, and provides levers to improve upside, protect your downside and negotiate better.

About Fontics: Fontics is an Excel plug-in to run investment analysis 10x faster in Excel. All calculations are deterministic and does not use AI. With Fontics, you can review investment models, identify the main drivers of returns / risk and optimize deal structure in minutes not days. It has 25+ modules including Scenario Analysis, Sensitivity Analysis, What-If Analysis, Visualizations, Monte Carlo Simulations and Model Audits.

Fig 6: Fontics Sensitivity Analysis Module

CLOSING

Fontics accelerates your deal review cycle, and speeds up your Pre-LOI investment analysis by 10x,, and reduces this from days to < 1 hour. It unlocks analysis that where challenging or impossible to run in Excel, and provides levers to improve upside, protect your downside and negotiate better.

About Fontics: Fontics is an Excel plug-in to run investment analysis 10x faster in Excel. All calculations are deterministic and does not use AI. With Fontics, you can review investment models, identify the main drivers of returns / risk and optimize deal structure in minutes not days. It has 25+ modules including Scenario Analysis, Sensitivity Analysis, What-If Analysis, Visualizations, Monte Carlo Simulations and Model Audits.

Fig 7: About Fontics

Note: Fontics is extremely valuable in the Post-LOI deal analysis, when you build your expanded LBO (if you need one) and can help you think through deal structures and provide levers for negotiation, but will not replace professional market-specific deal structuring advice from your financial advisor and your financial due diligence via your QoE.

Download the Search Fund Pre-LOI LBO (with the samples presented above via): https://fontics.com/p/sample?model=SF_LBO

You'll need a Fontics account to re-run the samples or to create and evaluate more modules. You can learn more and start your free 14-day trial at https://fontics.com

For Search Fund analysis, we recommend the Standard Plan (which supports scenario iteration across 6 assumptions). However, we also replicated the samples using the Trial Plan (i.e. Lite Plan which supports scenario iteration across 3 assumptions). Plans are backward compatible!

Fontics is super easy to install and use. But happy to chat 1:1 if you have any questions or need a custom onboarding [for Searchers or Financial Advisors]

Happy to hear your thoughts, suggestions and questions.

Fig 7: About Fontics

Note: Fontics is extremely valuable in the Post-LOI deal analysis, when you build your expanded LBO (if you need one) and can help you think through deal structures and provide levers for negotiation, but will not replace professional market-specific deal structuring advice from your financial advisor and your financial due diligence via your QoE.

Download the Search Fund Pre-LOI LBO (with the samples presented above via): https://fontics.com/p/sample?model=SF_LBO

You'll need a Fontics account to re-run the samples or to create and evaluate more modules. You can learn more and start your free 14-day trial at https://fontics.com

For Search Fund analysis, we recommend the Standard Plan (which supports scenario iteration across 6 assumptions). However, we also replicated the samples using the Trial Plan (i.e. Lite Plan which supports scenario iteration across 3 assumptions). Plans are backward compatible!

Fontics is super easy to install and use. But happy to chat 1:1 if you have any questions or need a custom onboarding [for Searchers or Financial Advisors]

Happy to hear your thoughts, suggestions and questions.

from University of Louisiana at Lafayette in New Orleans, LA, USA

from City University of New York, John Jay College of Criminal Justice in Manhattan, New York, NY, USA