How to Raise a Search Fund Amidst the Boom

December 08, 2016

by an investor from Wesleyan University in Dedham, MA, USA

From 2016 STANFORD SEARCH FUND STUDY: SELECTED OBSERVATIONS

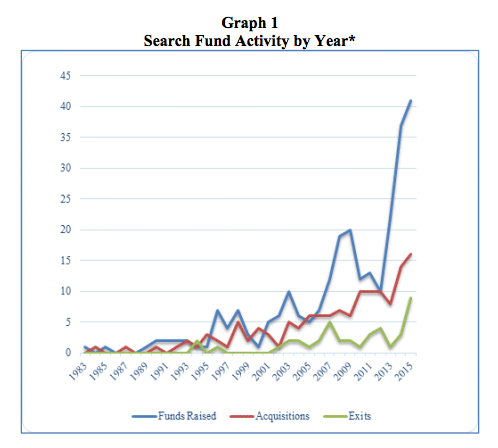

If you are thinking about raising a traditional search fund, the blue line in the graph above has to scare you. Don’t pay attention to the absolute numbers (Stanford caveats their study by saying it’s “selective observations”). After talking to friends in the search world, I would guess that the number of folks in the market looking to raise search funds in 2016 was in the ballpark of###-###-#### worldwide. And there is no sign the acceleration in the sector is going to slow. I spoke at a Harvard Business School conference this last week, and the organizers told me they had 50% more attendees than the year prior (our investor panel was moved from a classroom to an auditorium).

This boom is putting pressure on everyone in the ecosystem, but it’s particularly challenging if you are trying to raise a search fund. Certainly, fresh institutional money has come into the market, and there are new members of the “mafia”—that is, those who consistently back searchers—all the time. But the reality is that the growth in dedicated search fund capital has not kept pace with the number of potential searchers attempting to close a fund. Not even close.

So, what can you do? I do not have any silver bullets, but I do have some thoughts about what I would do if I were in your shoes to maximize my chance of success.

Take a Look in the Mirror. I was talking to one of the original search fund investors the other day, and he began pontificating about how searchers aren’t what they used to be (he didn’t say in “the good old days,” but he might as well have). “Tom, it comes down to conviction!” he said. Now, I’ve known this guy a long time. He tends to repeat himself at times. And initially, his comment struck me as cliché at best. But the more I thought about it, the more I came around to his way of thinking—not necessarily that the best searchers today are in any way inferior to the best in the past, but that at least a good chunk of prospective searchers in 2016 are missing a key ingredient. And that miss is a bi-product of the boom.

With the growth in the search fund model, particularly at the top business schools in the U.S. and Europe, being a searcher has come to be seen as a credible mainstream alternative to working in private equity (PE), as a consultant or investment banker. Too many prospective searchers come to it thinking that it’s kind of the same as those alternative career paths, only a bit more entrepreneurial. And with its rise in popularity, it’s just become the cool thing to do. I call these folks the “me-too” searchers, or “search-as-a-resume-builder.”

Let me disabuse you of these commonly held but silly notions right now.

· Doing a search fund is categorically different than any other career choice you could make. It’s not about banking pitchbooks and consulting decks or even massive PE financial modeling. It’s a roll-up-your-sleeves-and-get-shit-done process with no fancy office or private jet.

· Successful searchers don’t tend to be the smartest in their class nor the ones with the flashiest resumes. They are absolutely committed to the process of searching for a company to buy and then learning how to be a great CEO of that company (with an emphasis on learning; if you think you are already a great CEO, someone should take your arrogant ass out and put a bullet in your head, sorry).

To sum up: don’t start pitching investors on investing in your search until you have complete conviction about your ability to succeed. This is different than a consulting or banking interview, with complex “gotcha” case scenarios. The only thing a potential investor is asking himself or herself about you is: “Will this person make me money?” And that’s a gut-level decision based on looking in your eyes.

Be Realistic. You then need to build a case for why you will succeed beyond your conviction. This comes down to track record. Craft a story about what you have done in the past that is directly applicable to the search process. People who have worked in PE prior to business school generally know how to build a proprietary deal flow machine. That’s a good thing. But in the end, what investors most want to know is whether you are teachable and whether you ultimately have the ability to be a great CEO. I always tell folks who are thinking about doing a search to go have a few informational conversations with investors first. Tell them your background and ask point blank whether or not they think you have the experience to raise a fund. If they all say no, your chances are slim and you probably shouldn’t waste your time unless you are willing to go completely outside the usual sources of capital.

Go Where They Are Not. Assuming you have true conviction and your background is strong enough to make a case that you will be a successful searcher, how else can you craft your pitch to improve your odds of success against the growing mob of other qualified prospective searchers doing the exact same thing? I am a contrarian by nature, so my advice here might not be the party line. But I say think hard about defining your search in such a way that you are going after virgin soil. Very rarely can you make great investment returns by being a lemming. See where the crowd is headed and go the opposite fucking way.

In the search context, this comes down to geography and industry focus. Just as much as talking to “me-too” searchers makes me want to puke, when I hear that four or five searchers are bidding on the same company, it makes my skin crawl. The number of potential target industries and geographies suitable for a search fund acquisition is still close to infinite, despite the increasing number of searchers out there looking. Don’t do what someone else has done or stick to geographies that are swarming with searchers.

In this regard—and I know I might be in the minority—I really do think fundamental research about industry and geography, when matched up to maximize your own unique experience, talents, and network of contacts, is an important factor in building your case in the initial fundraising process. You will learn a ton once you are on the ground and may well reverse course to some extent. But have a unique investment premise on day one, and be prepared to defend it with research.

Build Your Own Book. Okay. You have conviction, you have enough relevant experience, and now you have a unique investment thesis. Let’s get specific on how to raise the search fund. Here, too, I have advice that is contrary to mainstream. But let’s start by defining what you are selling.

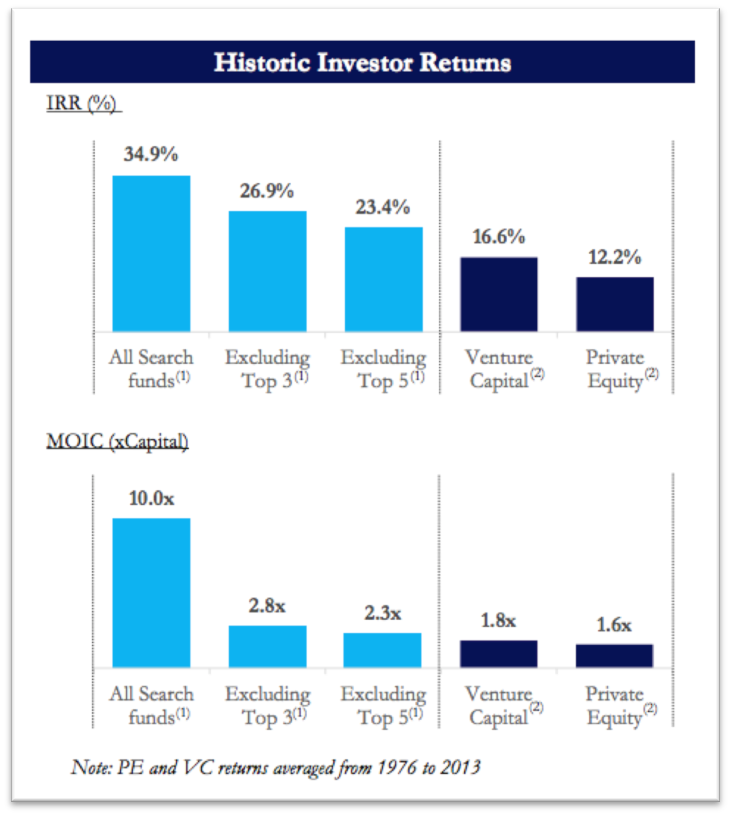

I took this slide from my searcher Joaquin Cepeda’s deck. What it shows is the performance of the search fund asset class compared to other alternative assets. Obviously, if you compared search returns to the long-term average returns of the stock and bond markets, the comparison would be even more favorable.

I include this slide to make a very simple point: search funds are a good investment. Most high-net-worth individuals are struggling to figure out how to make a return on their investment dollar. The stock market is at an all-time high, interest rates are still at historic lows, and access to top quartile alternative asset funds is hard to come by (and even if you can get in, the fees are huge and returns are not what they once were).

My advice is not to start with the search fund mafia or the institutional search fund investors unless you already have a very strong buy signal from them. Go talk to individual investors who may not have ever invested in a search fund before. The best investors will be those who can actually help you during the search process because they know the industry you are targeting, are well connected in your target geography, or have experience that is relevant to your learning how to be a great CEO. However, not all your investors are going to add value. Out of 10 or 15 units, if you have three to five folks whom you rely on to guide you through the process, you will be ahead of the game.

The great advantage of starting to build your book away from the tried-and-true search fund investors is that you will have no competition. It’s on you to successfully explain the model and your approach and to ask for help from those who are looking to put money to work and may have a non-financial interest in providing you mentorship.

Once you have a meaningful chunk of your fund raised, then go to the search fund mafia. At that point, you will have maximized your chances by clarifying your conviction, building a story around your experience, identifying a unique investment premise, and having hard dollars already committed to your fund.

Maybe the big guys bite and you’ll have a feeding frenzy, causing you to have to figure out which are the best investment partners for you. Or maybe they don’t and you have to go out and raise the rest of your fund outside the usual group of suspects.

My point is simply: if you are lazy and just go to traditional investors at the outset, your odds will be long and getting longer. If you take the onus on yourself to diversify that risk by selling the model and yourself to first time search investors you can greatly improve your chance of getting to the finish line.

from The University of Chicago in 234 James St, Barrington, IL 60010, USA

from Deakin University in Flinders St, Melbourne VIC 3000, Australia