How do you evaluate/value when TTM pops significantly?

September 19, 2025

by a searcher from New Mexico State University in Albuquerque, NM, USA

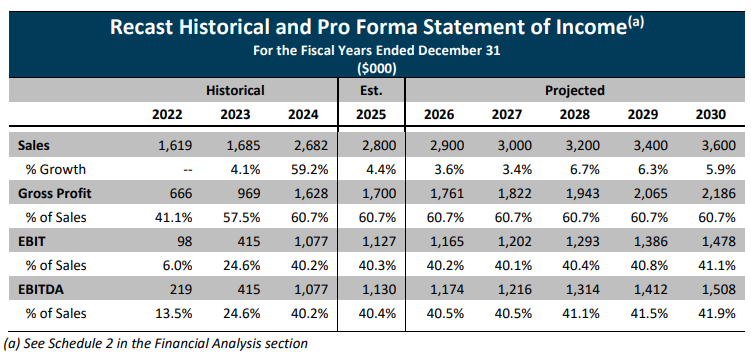

I have noticed a trend, it seems all companies see significant rises in TTM revenue, doubling EBITDA percentage, etc. Clearly they are getting ready for a sale and perhaps putting off necessary expenses, or overcommitting themselves, or playing games with rev rec, etc.

Wondering what experienced buyers do with their back of the napkin math before deeper DD? (besides the obvious: ignore the projections...40% EBITDA for the next 5 years, lol ;) )

Is it just a simple intuition on how to weight the past? (e.g. 40% TTM, 30% y-1, 20% y-2, 10% y-3)?

I have noticed a trend, it seems all companies see significant rises in TTM revenue, doubling EBITDA percentage, etc. Clearly they are getting ready for a sale and perhaps putting off necessary expenses, or overcommitting themselves, or playing games with rev rec, etc.

Wondering what experienced buyers do with their back of the napkin math before deeper DD? (besides the obvious: ignore the projections...40% EBITDA for the next 5 years, lol ;) )

Is it just a simple intuition on how to weight the past? (e.g. 40% TTM, 30% y-1, 20% y-2, 10% y-3)?

from California State University, Sacramento in Seattle, WA, USA

from University of Washington in Seattle, WA, USA