Have You Included Opportunity Zones Benefits in your Deals?

November 01, 2018

by a searcher from Northwestern University - Kellogg School of Management in Denver, CO, USA

By Kelly Bianucci, CEO, Impresa Financial & Former Managing Principal, Discover Capital

If you are in the business of investing in operating businesses, it’s worth your time to learn about Opportunity Zones.

The Opportunity Zones are one piece of the recently enacted Tax Cuts and Jobs Act. They are designed to motivate equity investments in 8,760 qualified U.S. communities, comprising 12% of U.S. census tracts and more than 35 million residents.[1]

For investors of businesses whose operating assets and property are located within these Zones, this presents an opportunity to enhance your annual returns. Most private equity cases project an increase of 3-6% in annualized returns. Newly-formed Opportunity Zone-focused private equity firm OPZ Capital projects additional return gains as high as 50%.[2]

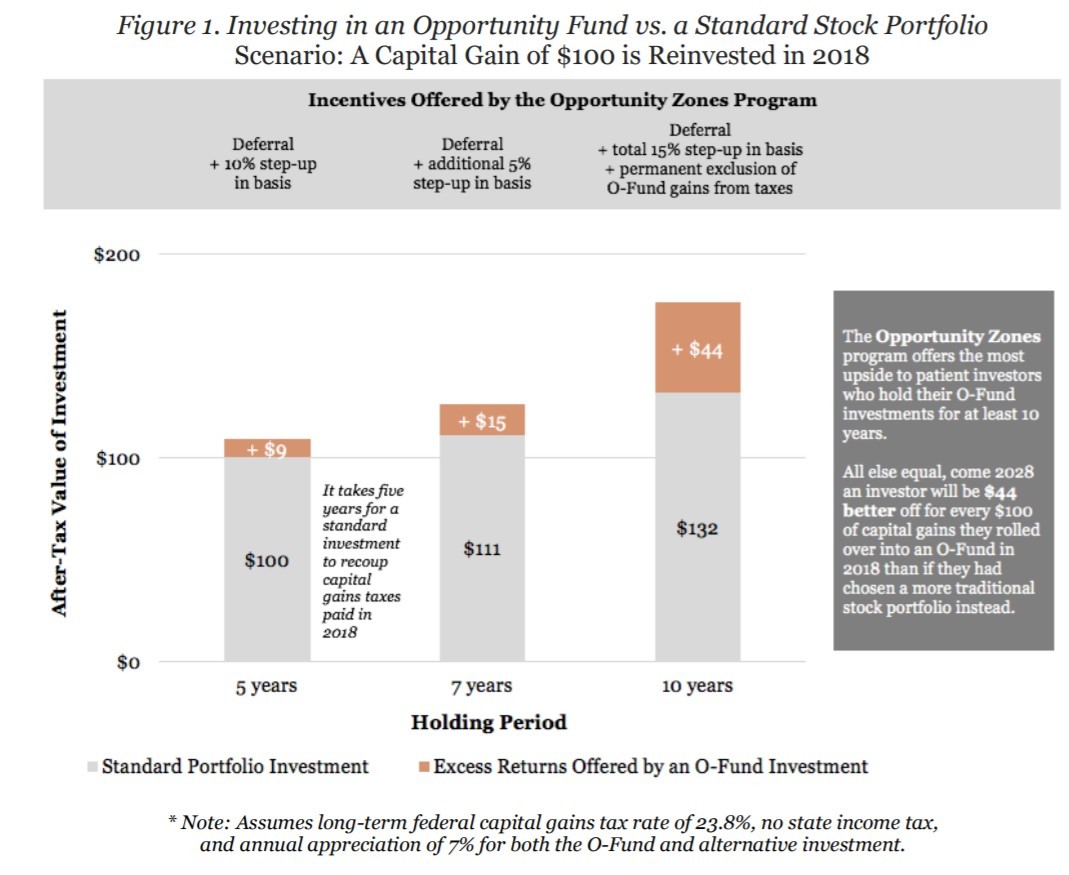

This is due to three tax incentive benefits:

- A Temporary Deferral of Capital Gain

- A Step-up in Basis for Reinvested Gains

- A Permanent Exclusion from Capital Gains Tax for Investment’s Appreciation

The temporary deferral of capital gains enables investors to defer paying capital gains tax when they deploy recently realized capital gains into an Opportunity Zone investment. The step-up in basis, which is triggered at five and seven years post-investment, reduces that initial tax liability by 10% and another 5% respectively. Finally, at year ten, all capital gains tax that would have been applied to the appreciation of one’s investment is forgiven. The net effect is paying just 85% of one’s capital gain tax for that initial investment only.

[3]

U.S. households and corporations hold an estimated $6 trillion in unrealized capital gains. The Opportunity Zones program is designed to put that capital to work. Specifically, in communities that can benefit from greater private investment while offering attractive market rate returns. U.S. Treasury Secretary Steven Mnuchin anticipates over $100 Billion in private capital will be attracted to the incentive program.[4] Furthermore, billions of institutional funds have been earmarked for deployment into Opportunity Zone investments.

How should searchers, private equity sponsors, and other acquirers take advantage of Opportunity Zones? First, consult an Opportunity Zone map to determine if any of your current deals are located within these zones. You could also target Opportunity Zones specifically and contact local economic development officials to identify investment and acquisition opportunities.

Once you identify a deal within an Opportunity Zone, work with your legal and accounting counsel to comply with Opportunity Zone requirements. While the detailed tax code is expected to be finalized by the U.S. Treasury in late October 2018, the basic action is to complete a supplemental tax form that certifies the equity investment as a Qualified Opportunity Fund.

When your legal counsel confirms that your deal qualifies as an Opportunity Zone investment, factor the tax benefits into your investor projections accordingly. While the IRR gains won’t make a bad deal good, they will serve as an attractive boost to an already-good deal. Finally, if additional fundraising is needed, there is a growing investor base with clearly defined interest in Opportunity Zone deals.

[1] https://eig.org/news/opportunity-zones-map-comes-focus

[2] https://www.bisnow.com/national/news/economic-development/investors-lining-up-to-pour-money-into-opportunity-zones-93572

[3] https://eig.org/wp-content/uploads/2018/01/Tax-Benefits-of-Investing-in-Opportunity-Zones.pdf

[4] https://www.wsj.com/articles/real-estate-developers-rush-to-capitalize-on-tax-incentive###-###-####

from Western Washington University in Key West, FL 33040, USA

from University of Pennsylvania in Cary, NC, USA