FROM SEARCH FUND TO START-UP: THE BENEFITS OF SWIMMING UPSTREAM

August 19, 2018

by a searcher from Princeton University in San Francisco, CA, USA

SEARCHFUNDER INTERVIEW OF DAVID TZE

SEARCHFUNDER INTERVIEW OF DAVID TZE

We spoke to David Tze, CEO of NovoNutrients, about his search for an aquaculture technology company and operating NovoNutrients.

How did you get the idea?

How did you get the idea?

My prior role was managing a micro-VC with a thematic focus around aquaculture – the value chain including fish farming. I realized I wanted to go back to the start-up side as an operator, but this time not in the internet sector, which was my pre-investor focus. I wanted to stay in aquaculture. I was sitting on the roof deck of the Palantir offices in New York with my friend James Weiss. I asked, “What is the term for when you have a group raising money with the prospect of acquiring a company but you don’t know what the company is yet.” Nothing came to mind at that time. A few days later James emailed me: “search fund.” That rang a bell.

I then read about it primarily on searchfund.org. I looked at some of the university and law firm documents that were linked. I noticed that there were some substantial differences between what was being described and what I wanted to do. But, I also couldn’t find any term of art in finance that was a closer match. I decided it would be good to use a common term that was somewhat applicable rather than trying to coin a new one or trying to describe it in detail without any kind of shorthand.

I had been working with venture stage companies from 2004 to 2016 and I wanted to continue. I didn’t know whether my target was going to be a technology separate from a company or an early stage company. I ended up looking at some things that were spinoffs and loose patents as well as interesting start-ups. I wasn’t sure of at what stage I was going to have to get investor commitments. I knew that, at a minimum, the search phase would be self-funded. To get a deal done, I thought I might need to raise. In practice with the target that I ultimately selected and closed with, we ended up raising money after closing. We didn’t go through a fund-raising process until I was cemented with the company, NovoNutrients.

You were able to fund the purchase yourself or through SBA loans?

It turned out not to be an acquisition. Ultimately, I ended up with more of a co-founder arrangement. The company was essentially a restart, a pivot and a recap opportunity. It had been working in biofuels and bioplastics since###-###-#### Some months before I came in contact with them, it had decided it would focus on the nutrient market, particularly fish meal replacement which is a key area in aqua feeds. It was a specific type of technology that I had become most interested in about 3 months after I started my search fund. It was a sector that I had been invested in when I was managing Aquacopia, the micro-VC. Essentially, we came to terms that would come into effect under certain circumstances. I ultimately ended up as CEO and a substantial minority shareholder, through investment and sweat equity.

What is it like being an operator?

I spent the first 8 years of my career in basically web 1.0 start-ups. This was a bit of a return, but I had never been a CEO before. It matches what I was really looking for, which was to be able to get up in the morning and focus on building one thing, rather than having my attention divided between evaluating potential investments and dealing with existing portfolio companies.

For certain personalities, it is more satisfying to be hands-on conducting business rather than listening to managers explain how they do business and perhaps advising them, which is essentially a large part of the role of an early stage investor. There are certainly the frustrations, at a small start-up company, of having to take care of building and maintaining the infrastructure, such as health insurance, real estate transactions, but it is more than made up for by the stimulation of business planning, investor pitches and potential strategic partner relationships, which are much more psychically rewarding.

When did you begin your role?

I started working with the firm full time in August. We announced my role at the SynbioBeta conference in early October 2017.

Do you have advice for anyone considering an unconventional search fund?

If you are doing an unconventional search fund of the sort I described, you must be quite confident of your capabilities and how you’re going to be perceived by the folks you will be proposing working with. If you are not bringing cash on the barrelhead, you must have intangible assets that your future team mates will see as advantageous. That in my mind is the biggest difference between a conventional search fund and what I did, if I had to narrow it down to a single distinction.

Did you learn that through trial and error in talking with potential businesses? Or, did you naturally have that confidence going in?

In my case, it was confidence borne of being a specialist in the peculiar and small overlap between finance and aquaculture. I had had some degree of press coverage, conference appearances and other profile building activities over the course of more than 10 years. I don’t think I would have embarked on this unconventional search fund without that background. I don’t think it would be possible to do unless you either have sector expertise or a much more extensive executive track record than I had at the time.

Other advice for someone thinking of this path?

It really helps to have very focused thesis for what kind of technology or business you are targeting. My initial thinking was aquaculture. Then, it evolved into the narrower aquaculture technology. Finally, that evolved into high quality bulk protein ingredients for aquaculture feeds. I spent about a year with that final level of focus and had an opportunity to talk to essentially all the companies that had promising approaches in that sub-sub-sub-sector before deciding who to make a proposal to.

How long did the process from proposal to close take?

The mutual evaluation period was rather lengthy. The first contact was in January###-###-#### I put forward a real proposal in the June/July timeframe. We had a two-stage process. In the first stage, I started working full time with the company in August. The final stage was complete when I achieved one of my main goals, which was seed round funding for the company, right before Christmas. That was when my ownership stake was actualized.

With the lengthy evaluation period, it seems like you were familiar with the company when you started. Were there any shocks afterwards?

With a company as technically complex as NovoNutrients, you’re always learning new details that you couldn’t absorb in the early months. But, no, there were no big surprises.

What are your priorities going forward for NovoNutrients?

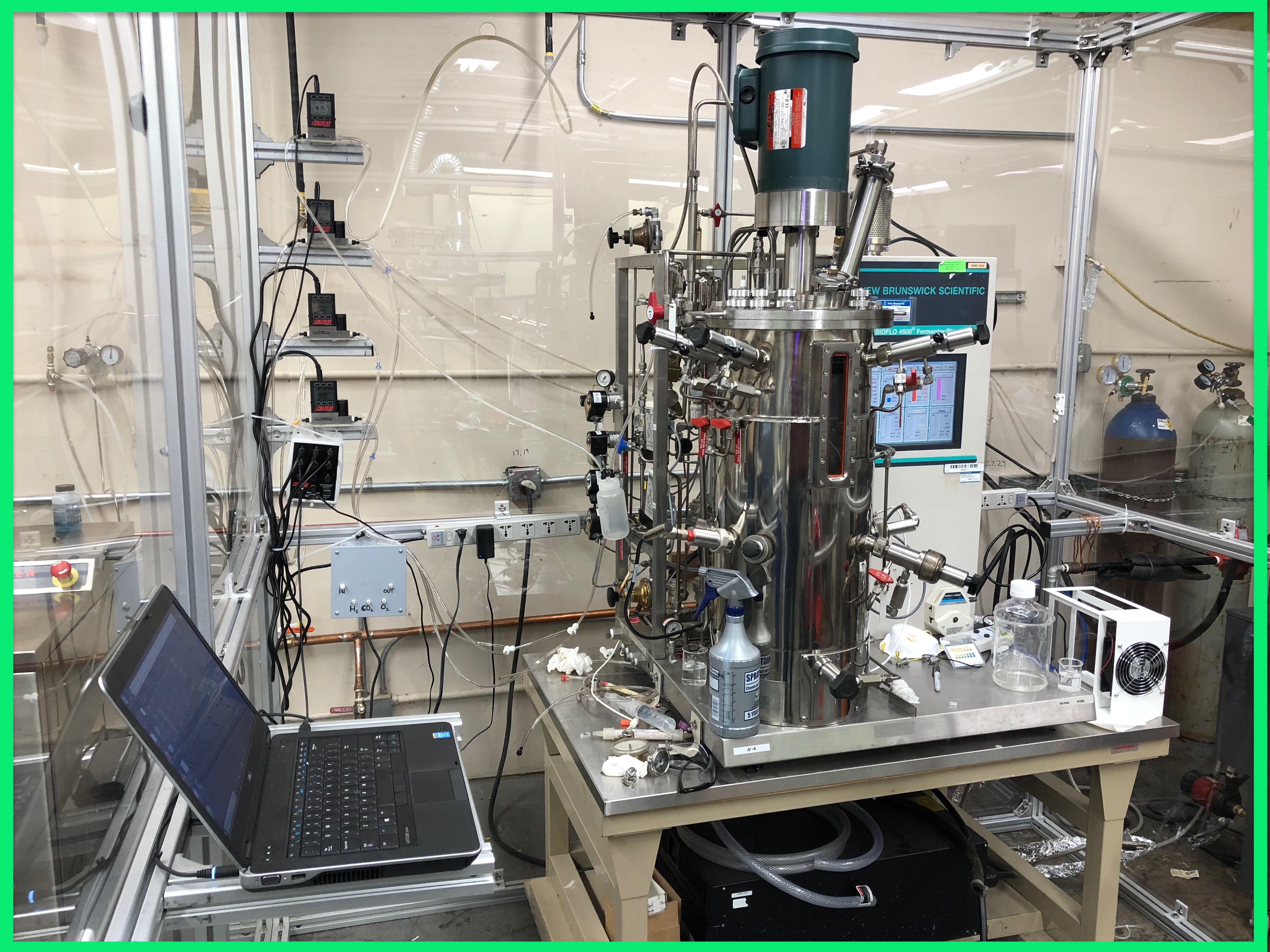

Having built up the team somewhat since our seed funding, the operational focus is in commercializing technology. That involves some development work to get the technologies ready to interface with the market. Then, fundraising is something one does relatively consistently. In our case, we had a first close on our seed and are now out looking for a larger, second portion of our seed round. Our business will be relatively capital intensive certainly compared to software businesses or the like. That means that fundraising will be an even more notable activity for us compared to some early stage start-up companies.

There’s a certain amount of information gathering, in that industrial biotech is a new field for me. It is also a dynamic one, where there are interesting things happening every day, whether there are licensing agreements, facilities, construction is starting, loan guarantees get approved, new businesses pop up or are funded. These are all indicators of what is possible, what to do, what not to do, potential partners, potential competitors. That’s an aspect that is significant.

Because it is a small team of 7, I am a direct manager of the nontechnology staff, including administration. So, part of my day is spent managing the general administration of the company. Then, helping the technologists. We have a biology team and an engineering team. I help them with the nontechnical problem-solving element in their departments, ensuring that both our R&D and commercialization are compatible with the aquaculture market, my main area of knowledge. One of my key roles is serving as liaison and customer proxy with technology teams that come from a very different background.

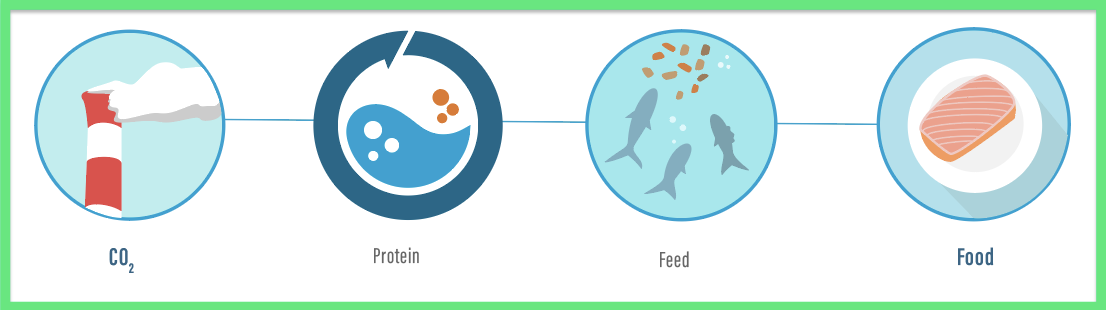

We get a lot of inquiries from existing players in feed ingredients and feed advocates. We have this unique technology, which presents pretty well in articles because our feed stock is untreated industrial emissions of carbon dioxide. We are a pollution to food company. Evaluating those potential relationships and the mutual exploration of these larger companies is a significant part of my time.

On the fundraising side, the information gathering part and other activities lead to the creation and maintenance of a database and ways to make outreach to investors who are at the right sector, knowledge, impact, focus optional, and looking at investing in the stage of company and risk that we represent. That is most of a normal day.

Also, we go through phases of recruiting and other phases where there is a stable team size and are just trying to make the best use of it. When we are in a recruiting phase, that becomes a significant activity for me in terms of advertising and networking related to the position, looking at credentials, interviewing, checking references and negotiating offers. Pretty standard entrepreneurship.

Many new search fund CEOs have remarked on the extent that they must spend time on people and culture. Are you finding the same?

It can be somewhat more organic. There were 4 of us once I came on board. We’ve hired 3 more people since then. It’s a task that will loom larger in the future as our processes take shape and our team grows in size. It is quite different from the more typical post-acquisition context for a search fund.

Anything you would like to add?

I found the materials that I read about search funds, including agendas and materials from conferences, to be very helpful in framing my thinking about my own process. Even if I were not explicitly following the steps or reaching the types of agreements, there were always enough parallels that of all of the reading I could do search funds were definitely the most helpful and relevant topic.

Thanks for your time.

Thank you.

Summary of Insights

Here are our a few of the key takeaways from our discussion with David:

- • The search fund model can be adapted for unconventional paths. Even if it’s not explicitly followed, the materials can be helpful and relevant in focusing thinking.

- • For an unconventional search fund, you should bring substantial intangible assets (such as sector expertise or an executive track record) to the table.

- • For an unconventional search fund, it particularly helps to have a very focused thesis on your target technology or business.

- • A significant diligence process reduces the risk of post-deal surprises.

from University of Pennsylvania in 中国上海市

from Dartmouth College in Richmond, VA, USA