Entrepreneurship through Acquisition Takes Off in China

June 07, 2024

by an intermediary in Hong Kong

0 Catching Fire

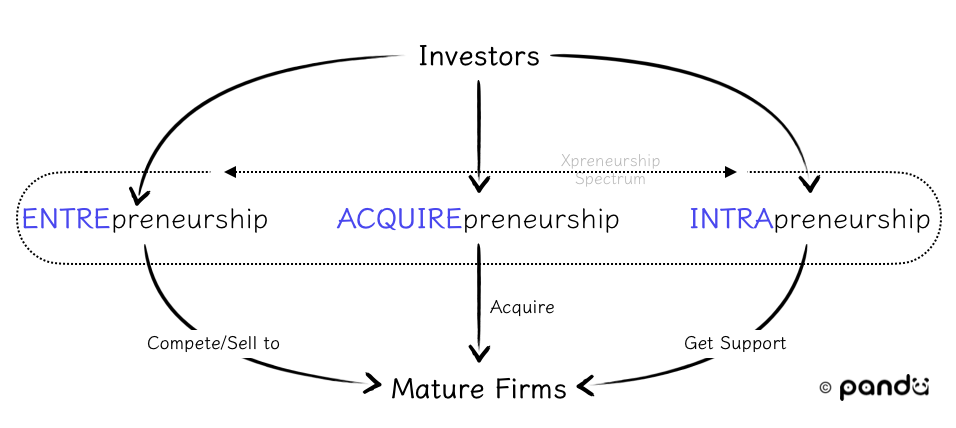

In recent years, the concept of Entrepreneurship through Acquisition (ETA) has gradually spread among Chinese domestic entrepreneurs, investors, and SME owners. By definition, it means that entrepreneurs will embark on their careers by acquiring mature companies. In the spectrum of entrepreneurship, ETA lies between starting from scratch and internal entrepreneurship. Compared to the former, it avoids the various uncertainties of starting from zero to one; compared to the latter, it maximizes the retention of entrepreneurial passion and autonomy. For investors, this provides a new choice of relatively stable investment with remarkable returns. For entrepreneurs, it represents a new pathway for succession, transformation, and exit.

Search funds are the most common model of ETA. Recently, Xue Lin (Prospect Search Capital) established China's first search fund with the support of 14 leading investors at home and abroad as well as the support from the Search Panda™ community, making her one of China's first pioneers in the ETA arena. Some well-known startup incubators and investment institutions are also exploring the Chinese model of ETA.

Source: Search Panda™

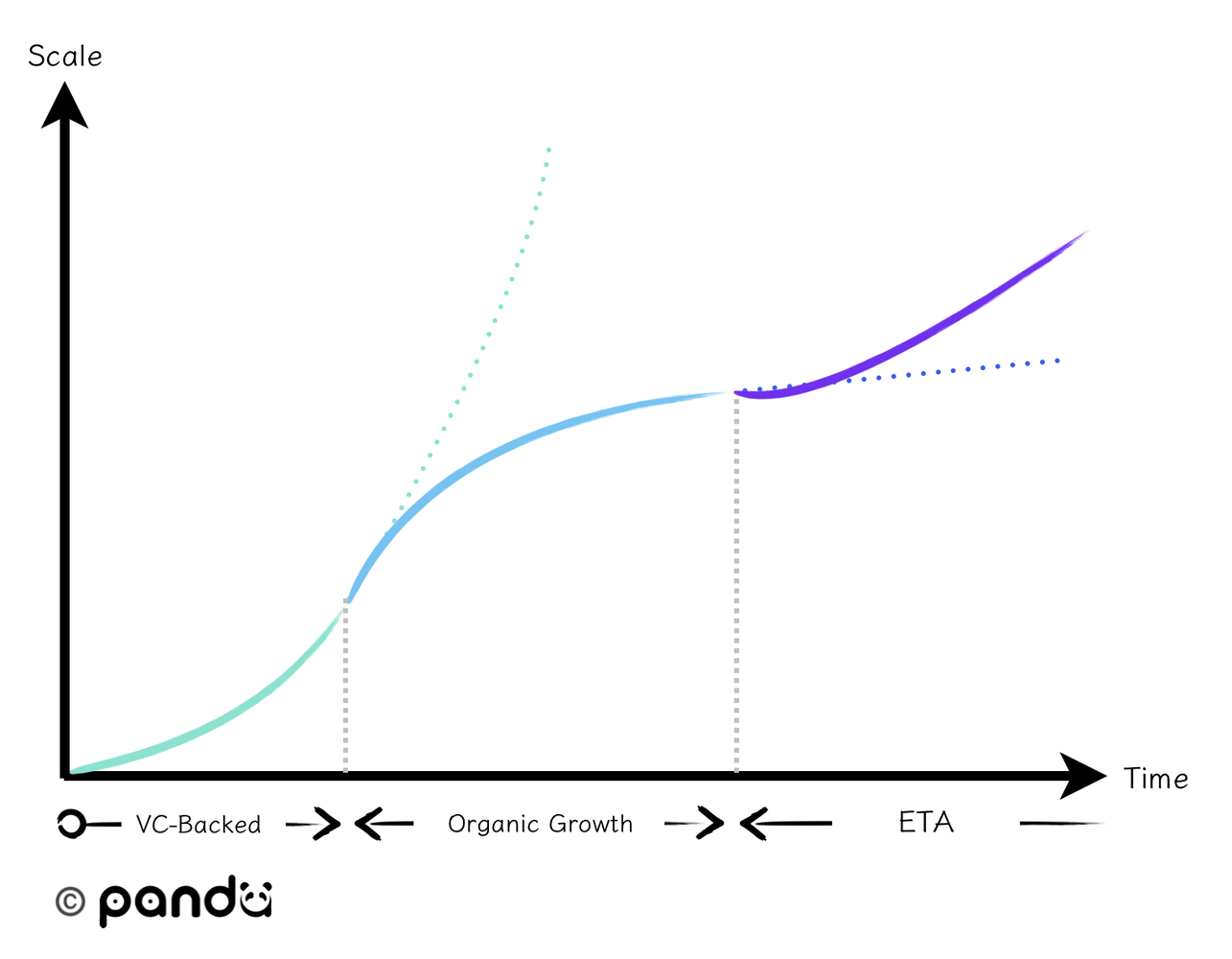

In China, as the classic VC-backed entrepreneurial path narrows, PE/VC capital markets take a hit, and SME owners’ desire to exit increases, ETA offers a new path for all three parties, bringing fresh ideas for the “high-quality development” of China's small and medium-sized private enterprises.

1 Persistent Returns

ETA originated in the 1980s when Irving Grousbeck, then a professor at Harvard Business School, first proposed the model. He guided his student, Jim Southern, in raising a search fund to acquire Uniform Printing, with Jim becoming its CEO and initiating value creations. Over the next decade, Uniform Printing's business grew continuously, and Jim and his investors eventually exited with a 24-fold return on investment (ROI).

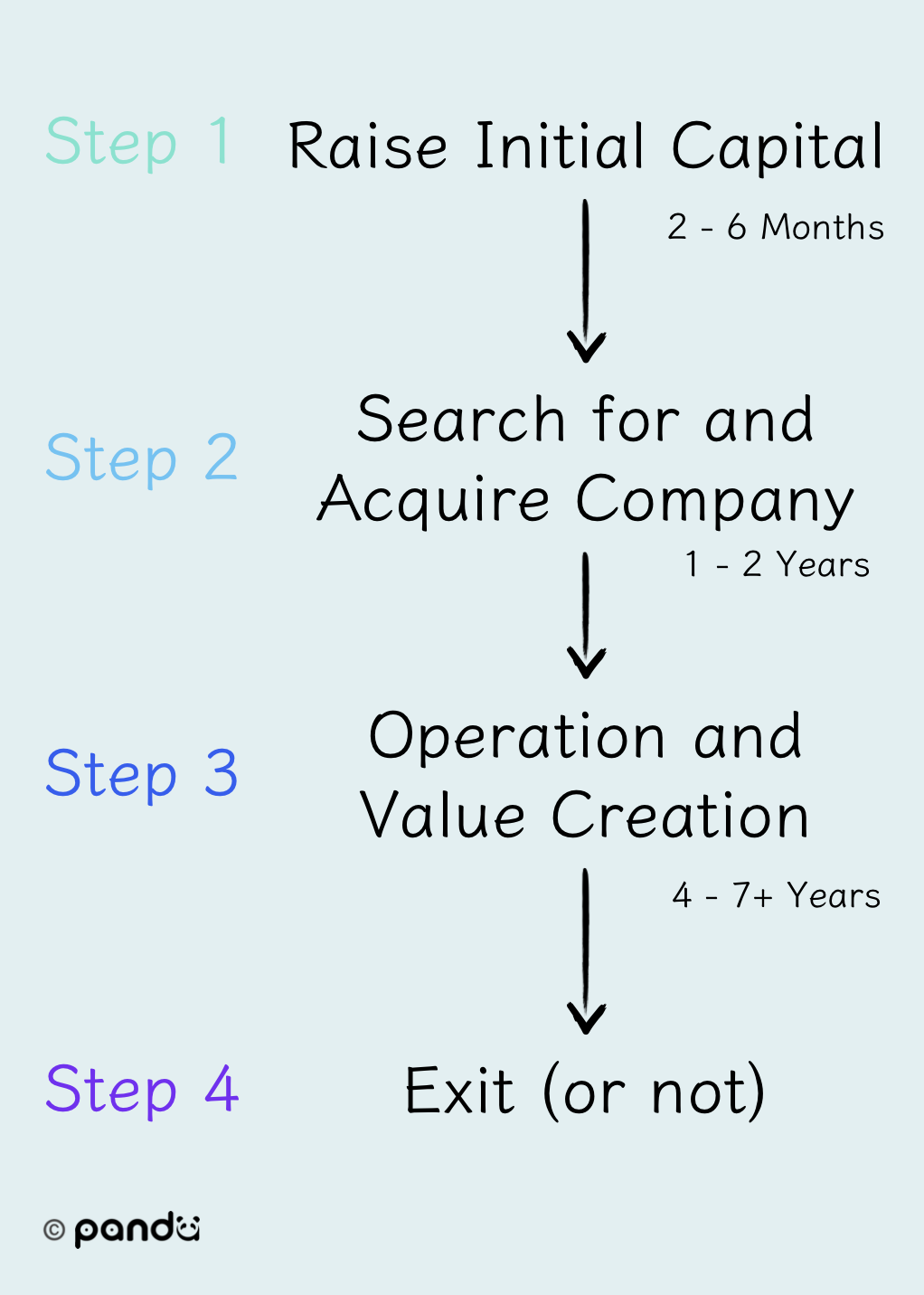

Today, more MBAs and professional managers are engaging in ETA. Its specific models have gradually extended from search funds to self-funded searches, accelerators, SPACs, and holding companies, spreading from Europe to the rest of the world. Research by Stanford University and IESE Business School in 2022 shows that there are over 700 search fund cases globally, half of which were established after###-###-#### The average internal rate of return (IRR) for North American search funds has consistently been over 30%, with an average ROI of over 5 times. International search fund exit data is less, currently between 20% and 30% IRR.

Source: Stanford Search Fund Report 2022

Industry insiders note that while venture capital generally follows a power law distribution, making its standard deviation large, the statistical data of ETA more accurately reflects the general situation and demonstrates its adaptability and robust stability in changing external environments.

2 Perfect Timing

At a critical time of economic restructuring and industrial upgrading, many small and medium-sized family businesses face the dual challenges of succession and transformation in China. The introduction of the concept of ETA provides these businesses with a pathway for continuous operation and transformational upgrading.

Reports indicate that nearly 3 million family businesses in China are entering a stage of intergenerational succession. Family businesses, predominantly private enterprises, account for over 90% of all business activities in China, contributing more than 60% of the GDP, over half of tax revenue, more than 70% of technological innovation and research, and over 80% of urban employment. Experts say that the largest succession wave in Chinese history is bringing profound changes to the domestic industrial landscape and having a far-reaching impact on the global supply chain.

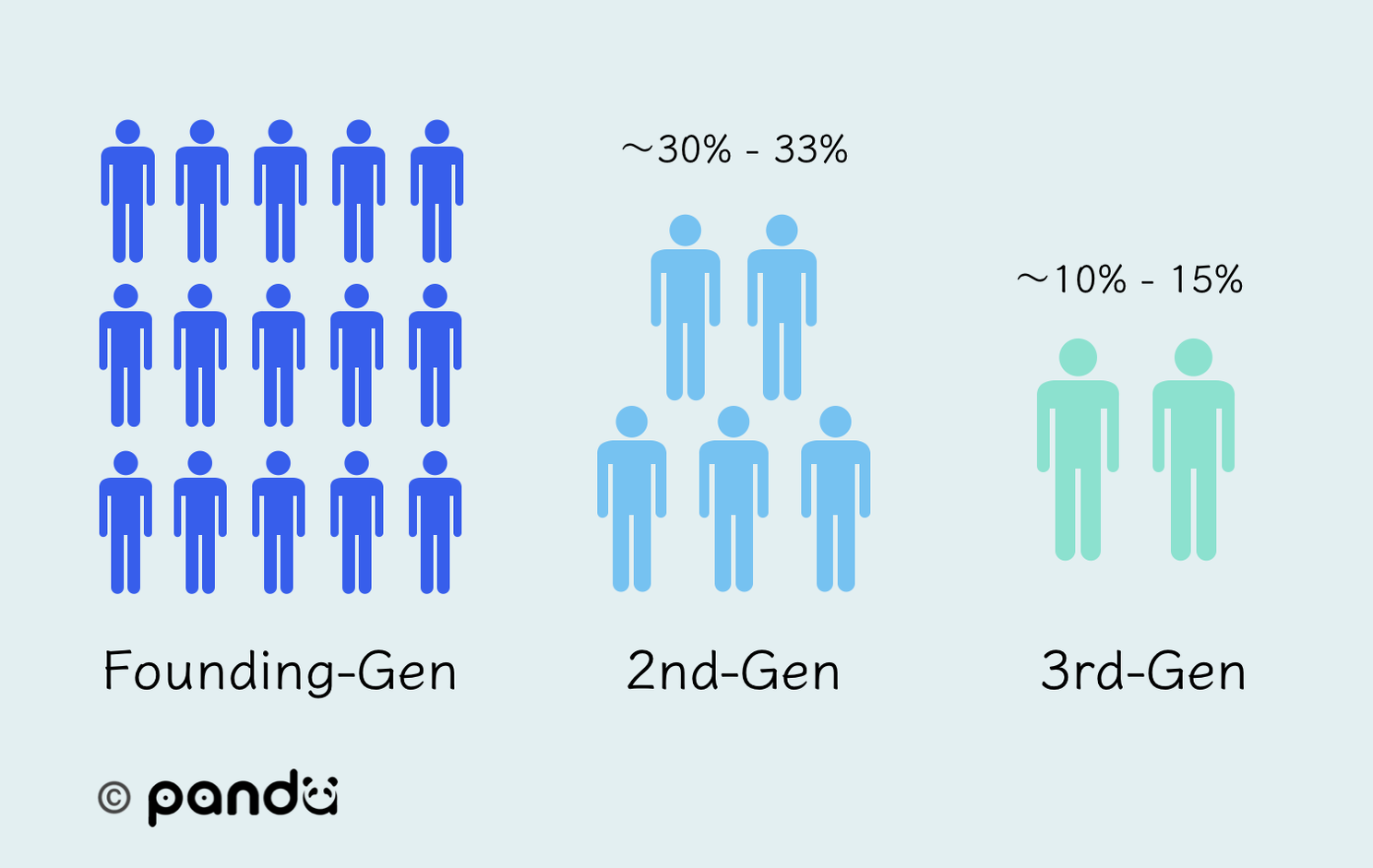

Succession issues further diminish these businesses' determination to invest in digital transformation and upgrading. Even some progressive "second generations” willing to succeed face stark differences in management philosophy with the "first generations “, impeding transformation efforts. Currently, only 10% of the next generation in traditional manufacturing family businesses in China continue to develop their inherited industries, compared to 30% internationally as reported (including other industries).

Source: McKinsey

From past search fund examples, a significant portion of acquiring entrepreneurs took over businesses as successors. After taking over the controlling stake and properly incentivizing the existing management team, the transformation and transition can be shorter and face less resistance than traditional family succession plans.

3 Localization Solutions

Besides solving succession and transformation issues, ETA is widely applicable and flexible in emerging industries. In the U.S. software services industry, more business owners are willing to sell companies that generate stable cash flows to embark on new ventures or retire early. In China, with its vast and diverse market environment and rapidly evolving industry landscape, ETA offers various solutions to different problems.

For example, some quality SMEs may have already been on the radar of Corporate Venture Capital (CVC) of industry leaders. However, these CVCs remain on the sidelines due to a lack of post-investment transformation plans, manpower, or when the transformation cost exceeds the synergistic effect. Entrepreneurial acquirers can first acquire targets with search funds, immediately start on value creation and transformational upgrading, and sell to industry leaders at a pre-agreed price after a few years.

Moreover, ETA models with distinct industry characteristics are also emerging. In synthetic biology, some organizations are funding entrepreneurial acquirers to discover and acquire excellent projects, with the entrepreneurs owning the business line and being responsible for commercializing the technology. Furthermore, with the significant potential of AI enablement in various industries, the search fund model allows entrepreneurial acquirers to partner with AI experts, helping VCs to invest early in AI.

Source: Search Panda™

Additionally, a recently successful entrepreneurial acquirer pointed out that a category of projects is gradually gaining attention from new acquirers. Some businesses that have received at least one round of financing and are experiencing healthy growth, although steadily gaining market share, are no longer favored by venture capital funds due to their lack of exponential growth or rapid scalability potential. These businesses are referred to as “VC Orphans.” On the other hand, in the relatively mature private equity market, IPO exits account for less than 10%. Previously, 90% of China's VC market exits relied on IPOs. Under the influence of fund maturity and various factors, VC/PE investors seek to transfer project equity or fund shares, willing to lower valuations and sacrifice some returns for liquidity. Quality "yesterday's stars" also become potential targets for ETA.

Acquiring a quality company that generates stable cash flows in a thriving industry at a reasonable price is not easy, and it is just the beginning of ETA. For domestic pioneers, how to explore while cautiously advancing is a challenge that must be faced.

4 Building Ecosystems

Jan Simon, Director of the International Search Fund Center, mentioned in his book "Search Funds and Entrepreneurial Acquisitions" that the enduring high return capability of search funds is attributed to their highly collaborative community culture. Each potential entrepreneur and investor benefits greatly from the generous information sharing and collaboration of their predecessors, and when they succeed, they become investors in the field to give back to the community, continuing this collaborative culture.

Search Panda™ is China's first community for ETA and search funds, committed to connecting entrepreneurs, investors, and business owners. It provides a new direction for the succession and development of small and medium enterprises and a new perspective for entrepreneurial investment. Since 2022, Search Panda™ has successfully helped numerous Chinese search funds and institutional investors through various means.

Leo, founder of Search Panda™, points out that medium, small, and micro businesses are the "capillaries" of China's economy. ETA can further create value for mature enterprises — including transformational upgrading, going global, etc.— and can promote the continuous transition of new and old drivers of the Chinese economy, helping more domestic small and medium enterprises become "little giants”, and injecting robust momentum into China's “high-quality development”.

(Translate from Chinese with the help of GPT-4)

References:

Jan Simon, Search Funds and Entrepreneurial Acquisitions

Frasier, Abraham, Business Wealth Without Risk

Harvard Business Review, Buying Your Way into Entrepreneurship

Stanford Business School, Stanford Search Fund Study 2022

IESE, IESE 2022 Search Fund Study

Chicago Booth, The Evolution of ETA

People's Daily, Accelerating the Optimization and Upgrading of Industrial Structure to Promote the Continuous Transition of New and Old Drivers

Xinhua News, Opinions of the CPC Central Committee and the State Council on Promoting the Development and Growth of the Private Economy

Economic Daily, Caring for the 'Capillaries' of China's Economy

NBER, How High are VC Returns?

McKinsey, How Chinese Family Businesses Break the Generational Succession Curse?

CAIXINGlobal, China's Family-run Businesses Face Succession Challenges

Tencent Prism, Wenzhou's Second Generations Reluctant to Take Over

Undercurrent Waves, Beyond Equity Investment: A Pathway in the Primary Market

Steve Divitkos, Venture Capital 'Orphans'

Family Office Wisdoms, Deep Unveiling: What is the Core Driver of Family Business Succession?

iSynBio, Search Fund: A New Model for Innovation in the Synthetic Biology Industry