Deal Analysis: The "Stable" Dental Practice (Insolvent)

February 17, 2026

by a lender from Florida Atlantic University - College of Business in Boca Raton, FL, USA

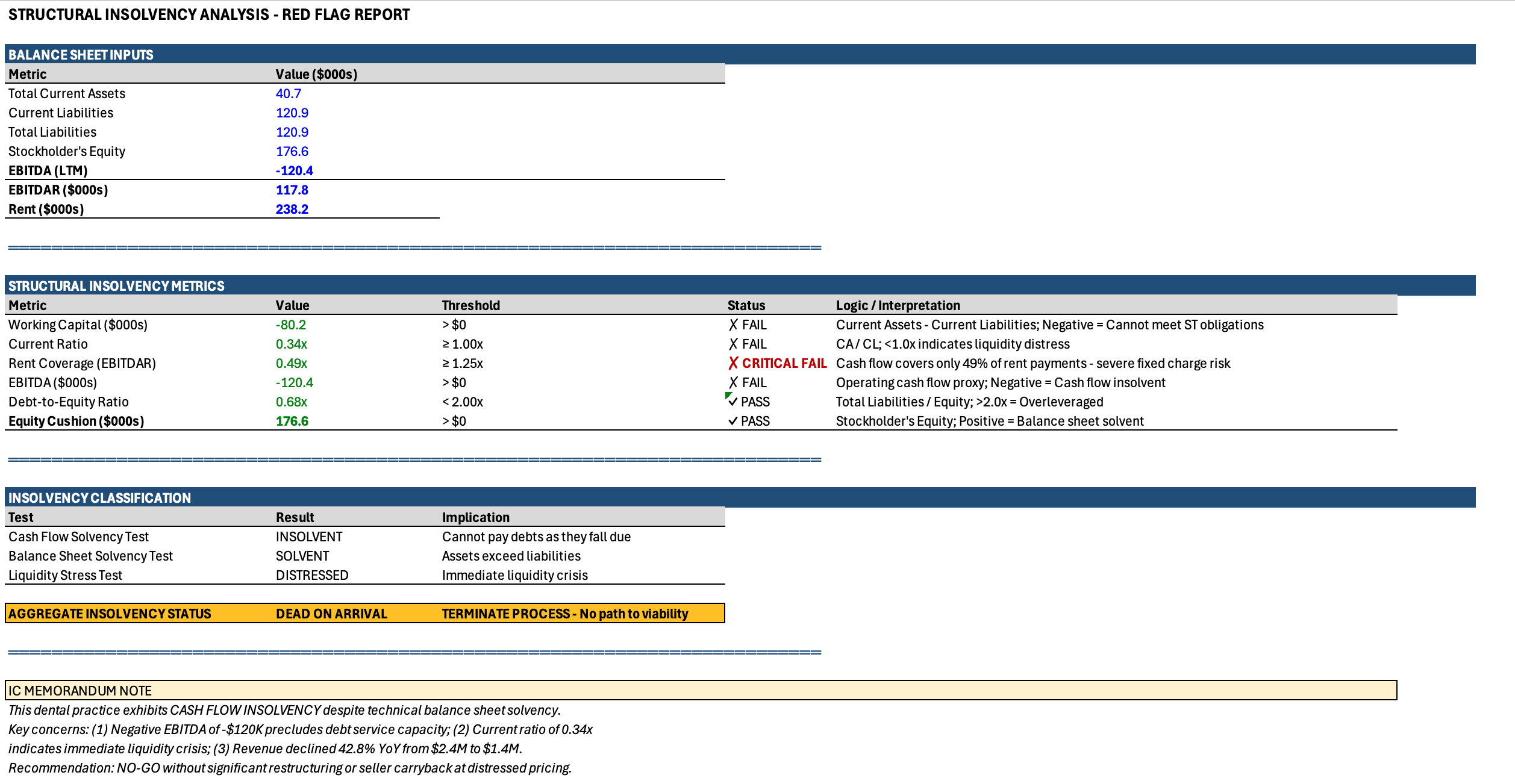

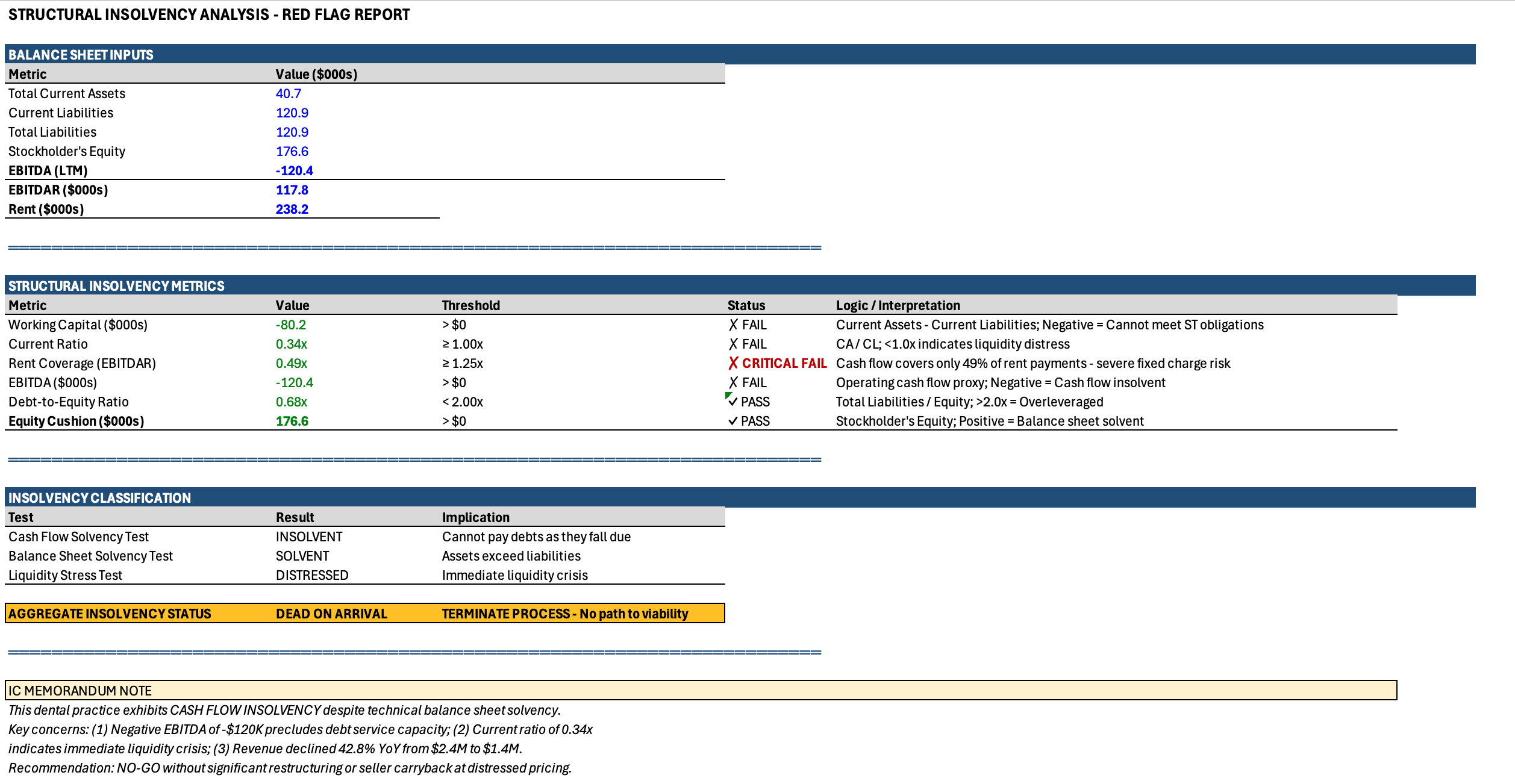

Analyzed a General Practice teaser this morning.

Ask: $836k (4x SDE).

Narrative: Stable cash flow / safe asset class.

Reality (Triage Results):

Revenue: -42.7% YoY ($2.4M → $1.3M).

Liquidity: Current Ratio 0.34.

Solvency: EBITDAR ($117k) covers only 49% of Rent ($238k).

The business is structurally insolvent. The broker manipulated the add-backs (adding back owner comp) to mask that the business cannot physically pay its lease.

This isn't a turnaround; it's a bankruptcy.

Stop modeling upside cases on distressed assets. Kill the deal at the rent line. DM me if you want the Triage Model I used to catch this.

DM me if you want the Triage Model I used to catch this.

DM me if you want the Triage Model I used to catch this.

DM me if you want the Triage Model I used to catch this.

in Raleigh, NC, USA

from Massachusetts Institute of Technology in Portland, OR, USA