De-risking deals amidst strong recessionary indicators

May 17, 2023

by an intermediary in Nashville, TN, USA

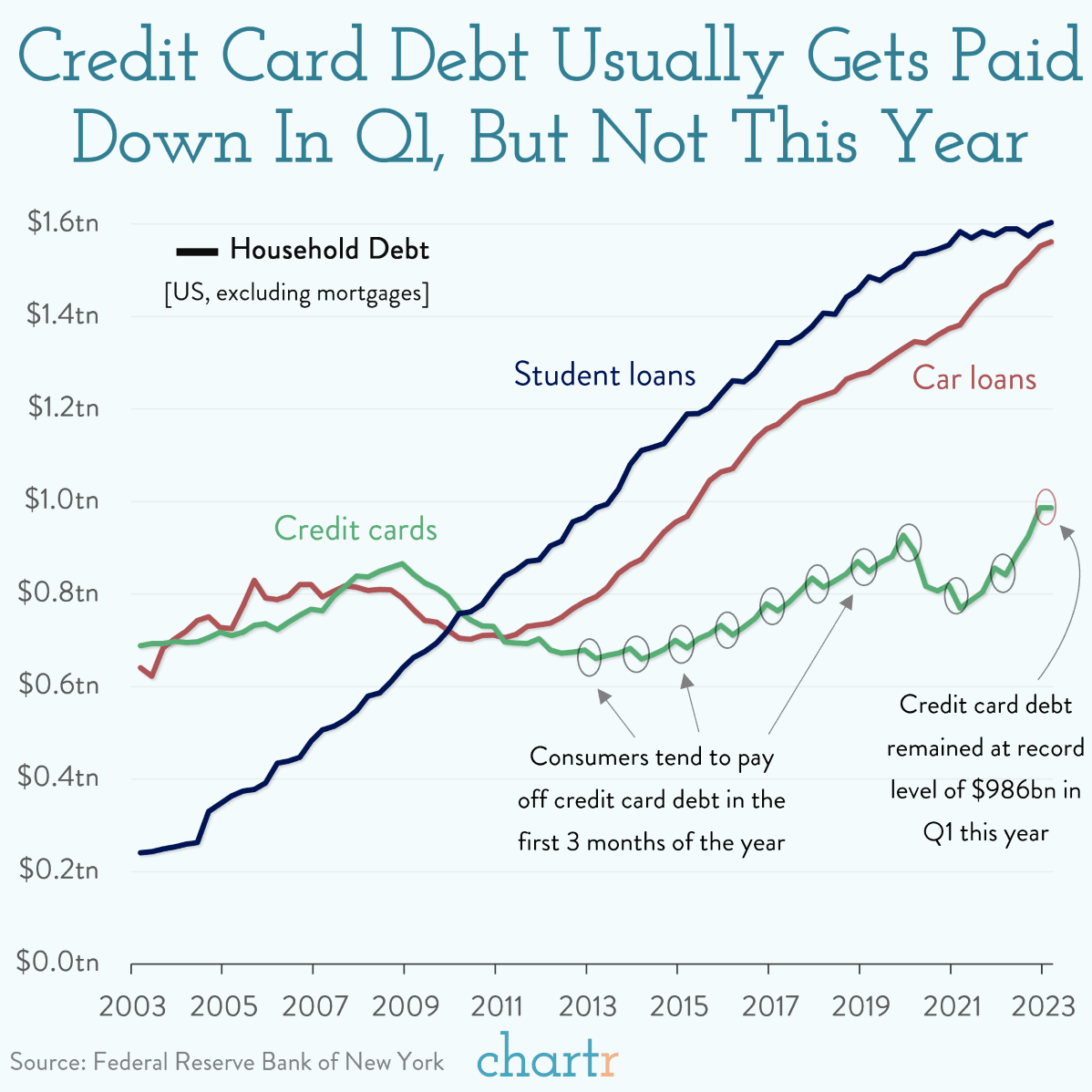

Aggregate consumer debt, especially credit card debt, can be an early indicator to economic retraction, and it's currently at an all-time high. Additionally, 95% of CEOs expect to spend part of 2023 in a recession. Not to mention, Congress / Biden have yet to negotiate the debt ceiling. How are searchers and acquirers thinking about these conditions and what terms are they negotiating to de-risk deals?

From my deal facilitation standpoint, I'm seeing much more delayed consideration in the form of earn-outs and seller financing than I saw a year ago. One of my clients negotiated forbearance on his seller note if earnings dropped below a pre-determined amount (hasn't been needed though). Generally speaking, I'd love to hear other creative measures for managing economic risk?