Confused about EBITDA calculation

January 12, 2021

by a searcher from Full Sail University in Milwaukee, WI, USA

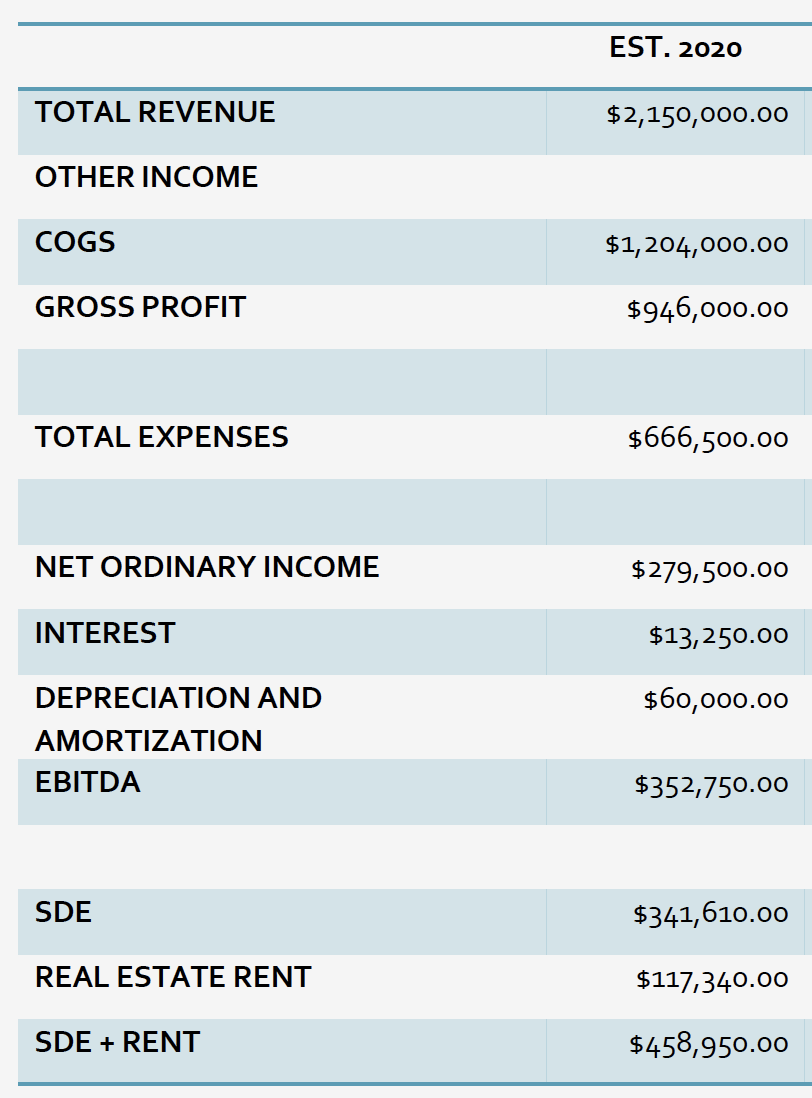

This is from an offering memorandum provided by the broker. It appears he's calculating EBITDA by adding interest, depreciation and amortization to the 'ordinary income' line. Am I misunderstanding something? By definition, that seems to be very much not the EBITDA.

from Washington University in St. Louis in Denver, CO, USA

Total Operating Expenses Shown $666,500

Less: SDE (assuming all hitting OpEx) $(341,610)

Less: Rent (assuming all hitting OpEx) $(117,340)

Less: Interest (Added Back) $(13,250)

Less: D&A (Added Back) $(60,000)

Other Operating Expenses (Incl. Headcount) $134,300

I'm probably missing something but it seems very low to me as it should include all other expenses (any other opex headcount/business insurance/IT costs/marketing/etc.) and for any business you are going to try to grow it doesn't seem like there is much there for you to start with

(again may be right depending on business you are looking at).

from University of Western Ontario in Toronto, ON, Canada