Anatomy of a Dumb Deal - By Business Buyers

January 16, 2026

by a professional from University of Southern California - Marshall School of Business in North Palm Beach, FL, USA

Here’s how to buy the wrong business or the right business the wrong way.

I’ve seen, this month (and for 30+ years) so much nonsense 🤣, being foisted upon nice people wanting to buy SMBs, which is taking advantage of their limited knowledge, that I’m forced – I SAY FORCED – again, to post this in case anyone is looking on a Friday afternoon 1/16/26:

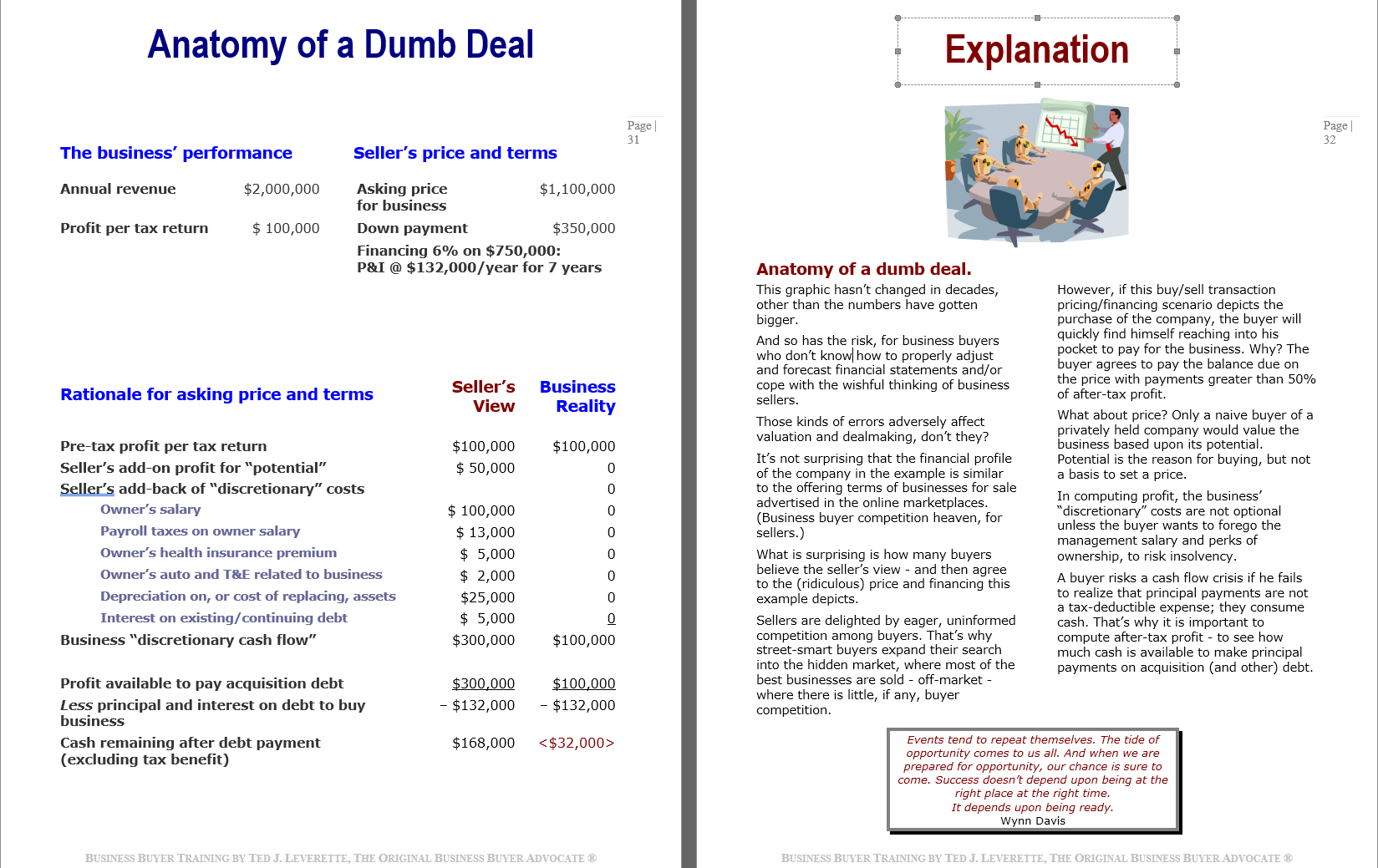

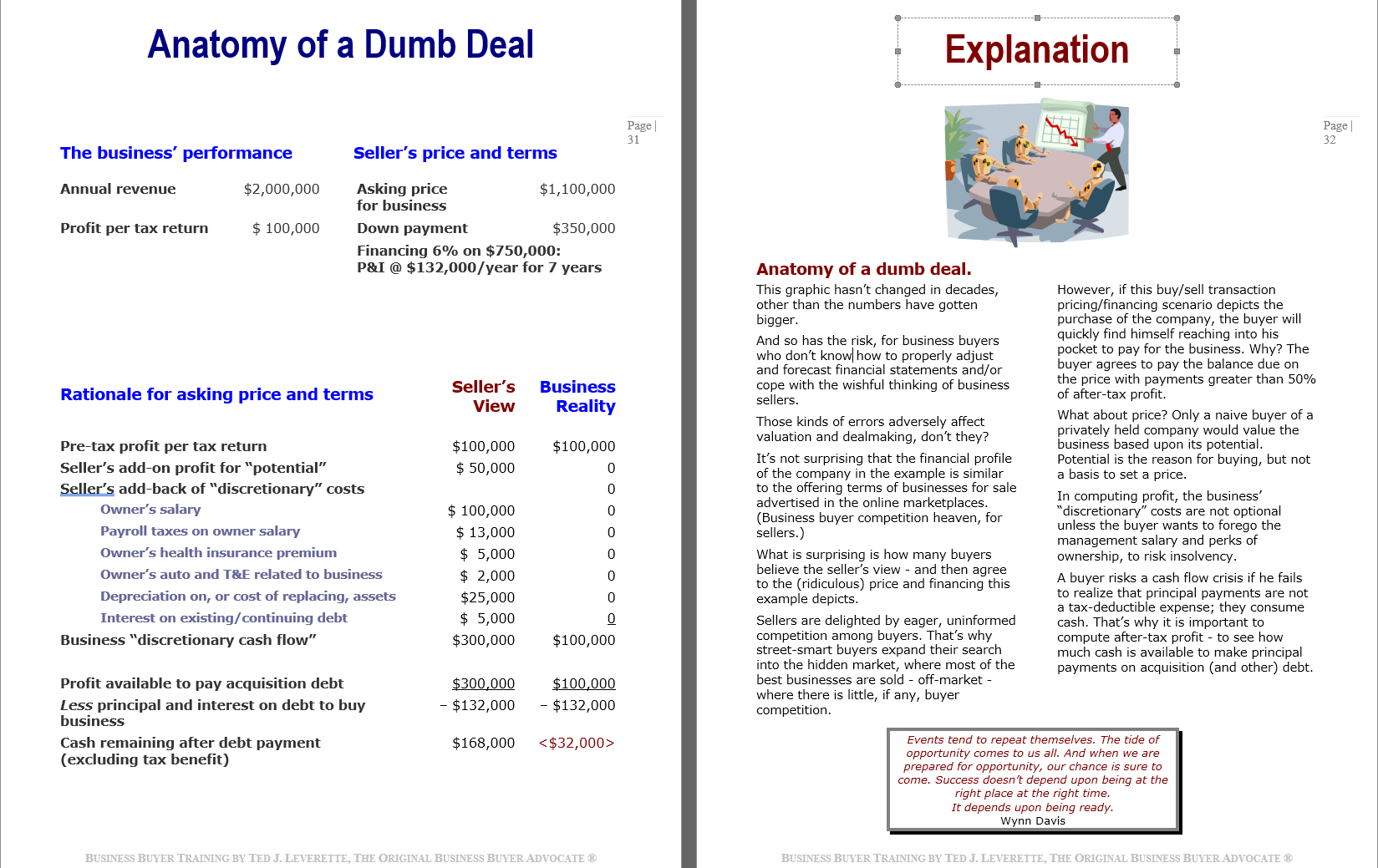

This graphic (from an early edition of the syllabus I give to people attending my Zoom Business Buyer Trainings) hasn’t changed in decades, other than the numbers have gotten bigger.

And so has the risk, for business buyers who don’t know how to properly adjust and forecast financial statements and/or cope with the wishful thinking of business sellers.

Any comments?

Complaints?

Praise? 😍

from University of North Texas in Dallas, TX, USA

from Frankfurt School of Finance & Management gGmbH in Frankfurt am Main, Deutschland