Anatomy of a dumb deal - 497 views, so far. Maybe helpful for you, too?

August 10, 2022

by a professional from University of Southern California - Marshall School of Business in North Palm Beach, FL, USA

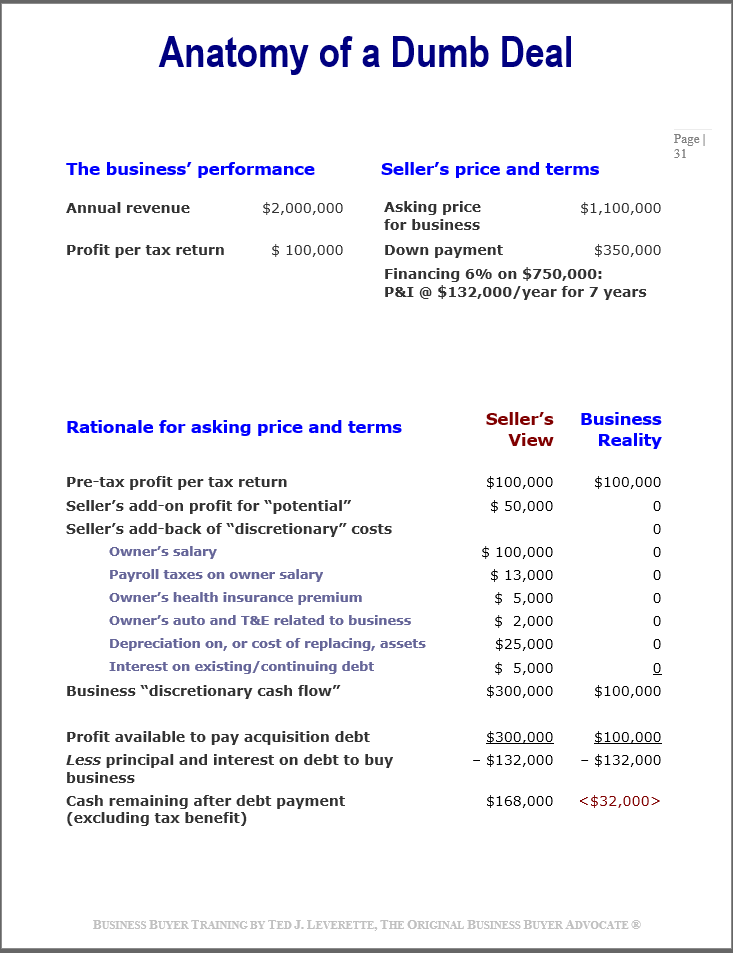

This graphic (from an early edition of the syllabus I give to people attending my Zoom Business Buyer Trainings) hasn’t changed in decades, other than the numbers have gotten bigger.

And so has the risk, for business buyers who don’t know how to properly adjust and forecast financial statements and/or cope with the wishful thinking of business sellers.

Those kinds of errors adversely affect valuation and dealmaking, don’t they?

It’s not surprising that the financial profile of the company in the example is similar to the offering terms of businesses for sale advertised in the online marketplaces.

Business buyer competition heaven, for sellers.

What is surprising is how many buyers believe the seller’s view - and then agree to the (ridiculous) price and financing this example depicts.

Sellers are delighted by eager, uninformed competition among buyers. That’s why street-smart buyers expand their search into the hidden market, where most of the best businesses are sold - off-market - where there is little, if any, buyer competition.

The company in the example is worth buying. It earns a profit in addition to paying the owner a fair management salary and perquisites.

However, if this buy/sell transaction pricing/financing scenario depicts the purchase of the company, the buyer will quickly find himself reaching into his pocket to pay for the business. Why?

The buyer foolishly agrees to pay the balance due on the price with payments greater than 50% of after-tax profit.

What about price? Only a naive buyer of a privately held company would value the business based upon its potential. Potential is the reason for buying, but not a basis to set a price.

In computing profit, the business’ “discretionary” costs are not optional unless the buyer wants to forego the management salary and perks of ownership, to risk insolvency.

A buyer risks a cash flow crisis if he fails to realize that principal payments are not a tax-deductible expense; they consume cash. That’s why it is important to compute after-tax profit - to see how much cash is available to make principal payments on acquisition (and other) debt.

497 viewers, first day, LinkedIn.

from Texas Tech University in 2400 Aviation Dr, DFW Airport, TX 75261, USA

This is also why it is one of the first things my team looks at.

Thank you for the post.

from La Sierra University in Destin, FL 32541, USA