A New Idea on How to Calculate Search Fund Performance Equity

June 08, 2017

by an investor from Wesleyan University in Dedham, MA, USA

Founder equity in the search fund model has traditionally been allocated into three equal buckets: deal completion, time vested, and performance vested.

The performance part has always been the most controversial. Traditionally, it is earned based on the percentage return generated by investors with a minimum threshold of 20% and maxed out at 35% IRR.

For some time now, there has been a growing conversation around the appropriateness of this metric since it does not consider the length of hold time. Most search fund investors are extremely patient and long term in their orientation. Generating a 35% return for one year and then selling the business will max out the performance equity but hardly satisfy investors. Generating a 35% IRR (or perhaps even a significantly lower return number) for ten years will thrill investors. Yet these outcomes are treated the same.

The existing rubric does not distinguish high IRRs for short periods and from those that can compound untaxed for longer periods. In fact, one could argue that the longer the hold time, the harder it is to maintain such a high IRR. So, the metric, in fact, incentivizes search CEOs to look for a quick exit (to max out their performance equity), even though that is exactly the opposite of what everyone involved would prefer.

This perverse incentive has caused several searchers and search investors to replace IRR with multiple of cash-on-cash return performance thresholds. For example, you must return 2.5 times the investor capital to begin to earn performance equity and 5.0 times the investor capital to max out that portion of your equity.

This is perhaps a better mousetrap in that at least it does not incentivize short-term thinking. Everyone is aligned in looking for a long-term hold period and generating substantial total capital gains. But here, too, there is a problem with the time period. Generating five times your money over five years is very different from generating that same dollar amount of gain over twenty-five years. In the vernacular, five times in five years is awesome, while five times over a quarter century is dog shit when considering illiquidity, risk, et al. in our ecosystem. The former is a 38% IRR, and the latter, 6.65%.

The problem with the cash-on-cash metric is that it flips the incentive the other way. The search CEO now has the incentive to hold the company forever to maximize his or her performance equity. And there is no penalty if it takes an eternity to get there.

How to solve this quagmire? Just one more issue here is that the best search fund investments tend to have the longest hold periods. And the best investments also are the ones that may have more than one round of equity investment. Certainly, some have used third-party valuations after five years to establish the performance over that first period of time, even if the company has not exited. And others have found ways for the board and founder to negotiate reasonable solutions to particular circumstances along the way.

But is there a better standard performance metric for us as a search fund community to use? One that combines both IRR and cash-on-cash multiple in a way that acknowledges the investors’ long-term orientation but also accounts for the time value of money? Ideally such a framework would prevent the need to have boards adjust for the shortcomings of existing frameworks midstream. Set it up at initial acquisitition and let it run to exit, however long that turns out to be in the future.

I was talking about this problem with my searcher Paulo Landim in São Paulo, and we came up with a new approach. I personally think it’s a good idea. But I am curious to hear other investors’ and searchers’ reactions. Let us know if you think this is an improvement—or not.

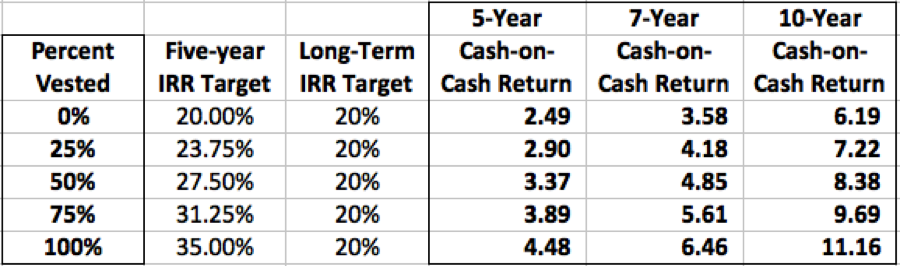

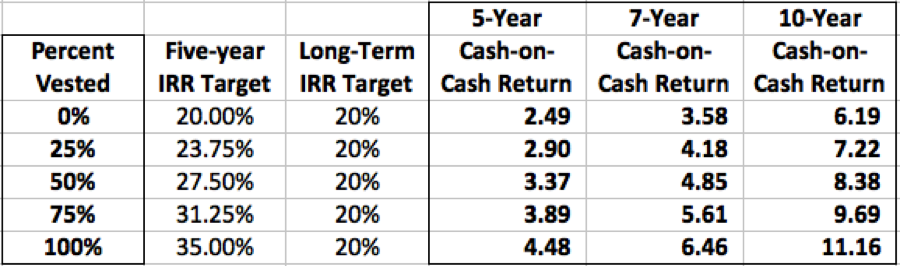

The basic idea is to use a relatively standard cash-on-cash multiple for the first five years, utilizing the 20% to 35% IRR range, assuming a hold for that full period. A five-year hold at 20% IRR gets you to a 2.49 times return. A five-year hold at 35% IRR produces a 4.48 times cash-on-cash return.

The first part of the new formulation is for any exit within the first five years after the acquisition investors need to receive 2.49 times their capital back for the search CEO to start to get performance equity. To reach all their performance equity for an exit in the first five years, investors need to receive 4.48 times their capital back, with a linear interpolation between those two points. This means you certainly can exit early but you have to have a compelling reason to do so which will generate substantial capital gains for everyone, not just a quick IRR.

After the fifth anniversary, the cash-on-cash goal posts do not remain static. They continue to compound until the eventual exit, whenever that is, at an annual rate that no longer requires the 35% pace to max out. We suggest reverting to the minimum of 20% per annum as the standard not just for the bottom of the range after the fifth anniversary but across the board. This recognizes the fact that a business that has grown shareholder for value for 35% per year for five years and then continues to compound that capital gain at 20% per year thereafter is still going to be a home run by any standard.

So, for a business sold on the seventh anniversary, for example, investors would need to receive 3.58 times their capital back for the search CEO to get into the money and 6.46 times their money to max out the performance equity.

At the ten-year mark, the range would be 6.19x to###-###-#### times.

Whatever the actual hold period for a given investment, the calculation would be to take that period beyond the five-year threshold and grow the endpoints of the performance equity earn out by 20% on an annualized basis, doing the math for partial years and straight-line interpolation for the actual result inside the measurement range.

See the table below for a summary of what I am talking about here. My hope is that this formulation might provide a solution to a persistent issue in our ecosystem. Or perhaps be a first step towards that solution if others like the framework but want to further refine the particulars.

from Harvard University in Los Angeles, CA, USA

from Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM) in Río Amazonas 57, Col. Renacimiento, Cuauhtémoc, 06500 Ciudad de México, CDMX, Mexico